VET Plunges 33% as Hayabusa Mainnet Shift Tests Critical Support

Market Structure Shifts Lower

- VET shed 33.4% this month, erasing gains from the October accumulation phase

- Hayabusa mainnet overhaul disrupted passive rewards, triggering sell pressure from former yield farmers

- Price tests make-or-break support at $0.01078 while momentum indicators reset to oversold extremes

VeChain’s native token VET collapsed 33.4% over the past month, marking its steepest decline since the summer washout. The devastating drop coincided with the Hayabusa mainnet launch, which fundamentally altered VeChain’s economic model by eliminating passive VTHO generation. What started as a technical upgrade morphed into a liquidity crisis as yield-focused holders rushed for exits. The main question for traders is: can bulls defend the critical $0.01078 support that has held through multiple bear markets, or will the structural shift in tokenomics trigger another leg lower?

| Metric | Value |

|---|---|

| Asset | VECHAIN (VET) |

| Current Price | $0.01 |

| Weekly Performance | -14.71% |

| Monthly Performance | -33.42% |

| RSI (Relative Strength Index) | 31.6 |

| ADX (Average Directional Index) | 39.8 |

| MACD (MACD Level) | 0.00 |

| CCI (Commodity Channel Index, 20-period) | -158.22 |

RSI Hits 31.57 – Deepest Oversold Since Summer Capitulation

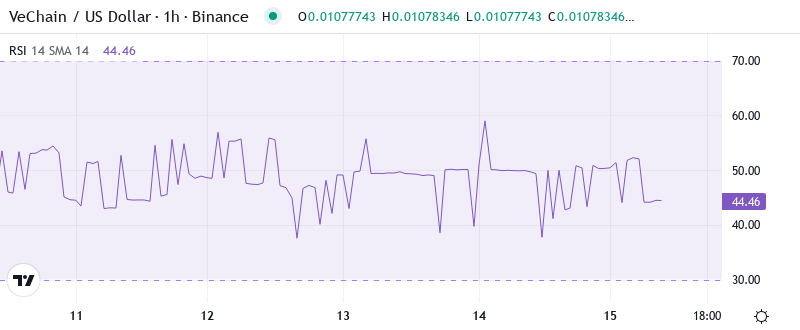

Reading the oscillator at 31.57, traders see momentum exhaustion matching levels last witnessed during August’s marketwide flush. The daily RSI hasn’t touched these depths since VET traded below a penny, suggesting either capitulation is nearly complete or the selling has further to run. Similar oversold extremes in September preceded a 40% relief bounce within two weeks.

Crucially, the Hayabusa transition created a perfect storm for momentum collapse. Former passive stakers who relied on automatic VTHO generation suddenly faced a staking-only rewards model, prompting many to liquidate positions rather than adapt. So for swing traders, this extreme RSI reading combined with fundamental restructuring creates a high-risk, high-reward setup where bounces could be explosive but support failures devastating.

ADX Climbs to 39.84 – Sellers Control With Conviction

Trend strength indicators flash warning signals with ADX surging to 39.84, its highest reading since the March 2024 unwind. At this level, the ADX confirms we’ve transitioned from the autumn consolidation into a full-blown trending state – and that trend points decisively lower. The shift from sub-20 readings in November to nearly 40 today marks one of the most aggressive trend accelerations in VET’s recent history.

What’s particularly revealing is how the Hayabusa upgrade acted as the catalyst for this trend explosion. The mainnet changes didn’t just adjust tokenomics – they fundamentally altered holder behavior, converting a range-bound market into a directional avalanche. Therefore, day traders should abandon mean-reversion strategies and embrace trend-following approaches until ADX drops back below 25.

All EMAs Turn Resistance as Price Trades Below Entire Ribbon

Price action tells a grim story through the moving average structure. VET currently trades at $0.01078, trapped beneath the entire EMA stack – from the 10-day ($0.01169) through the 200-day ($0.02798). Most damaging is the loss of the 50-day EMA at $0.01440, which had supported price through three separate tests in Q3 before finally cracking under Hayabusa-induced selling pressure.

The 20-day EMA at $0.01248 now acts as immediate resistance, having rejected two relief attempts since the mainnet transition began. This level transformed from reliable support during the October-November accumulation phase to a ceiling that bulls can’t crack. That former support area around $0.01248 becomes the first hurdle for any recovery attempt, while the 50-day at $0.01440 looms as major resistance that would signal trend reversal if reclaimed.

Support Hangs by Thread at $0.01078 While Resistance Stacks Heavy

Above current levels, sellers have fortified multiple resistance zones. The immediate barrier sits at $0.01248 (20-day EMA), followed by psychological resistance at $0.015 where December’s pre-Hayabusa highs peaked. The monthly pivot at $0.01892 creates another ceiling, though reaching it would require a 75% surge from current levels.

Bulls defend their final fortress at $0.01078, a level that has witnessed six touches since June without breaking. This support gains extra significance as it marks the pre-Hayabusa accumulation base where institutions loaded positions before the upgrade announcement. Below this critical floor, the next meaningful support doesn’t emerge until the 2023 lows near $0.0075.

Market structure reveals a knife-edge moment. The compression between $0.01078 support and $0.01248 resistance creates a 15% range that must resolve soon. Given the fundamental shift from passive to active staking requirements, the path of least resistance appears lower unless bulls can quickly adapt to the new tokenomics reality.

Hayabusa Aftermath: Bulls Need Volume Surge Above $0.01248

Bulls require a decisive close above $0.01248 on heavy volume to neutralize the Hayabusa-driven selloff. Such a move would flip the 20-day EMA back to support and open a path toward $0.015, where trapped longs from the mainnet announcement await breakeven exits. The new staking model could eventually attract committed holders, but that transition needs time.

The bearish scenario triggers if $0.01078 support crumbles on volume. That breakdown would likely cascade toward $0.0075 as stop-losses from six months of accumulation positions activate. More concerning, the elimination of passive rewards removes a key price floor that historically cushioned VET during market downturns.

Given the technical damage and ongoing tokenomics adjustment, the most probable near-term path sees VET grinding between $0.01078-$0.01248 while the market digests Hayabusa’s implications. Only after holders adapt to the new staking requirements can sustainable recovery begin.