VeChain Tests Critical Support as Staking Surge Meets Exchange Disruption

Market Structure Shifts Lower

- VET has fallen 21.9% in September, eliminating the recovery of three previous months

- The suspension resulted in a lack of liquidity at an important time from a technical point of view

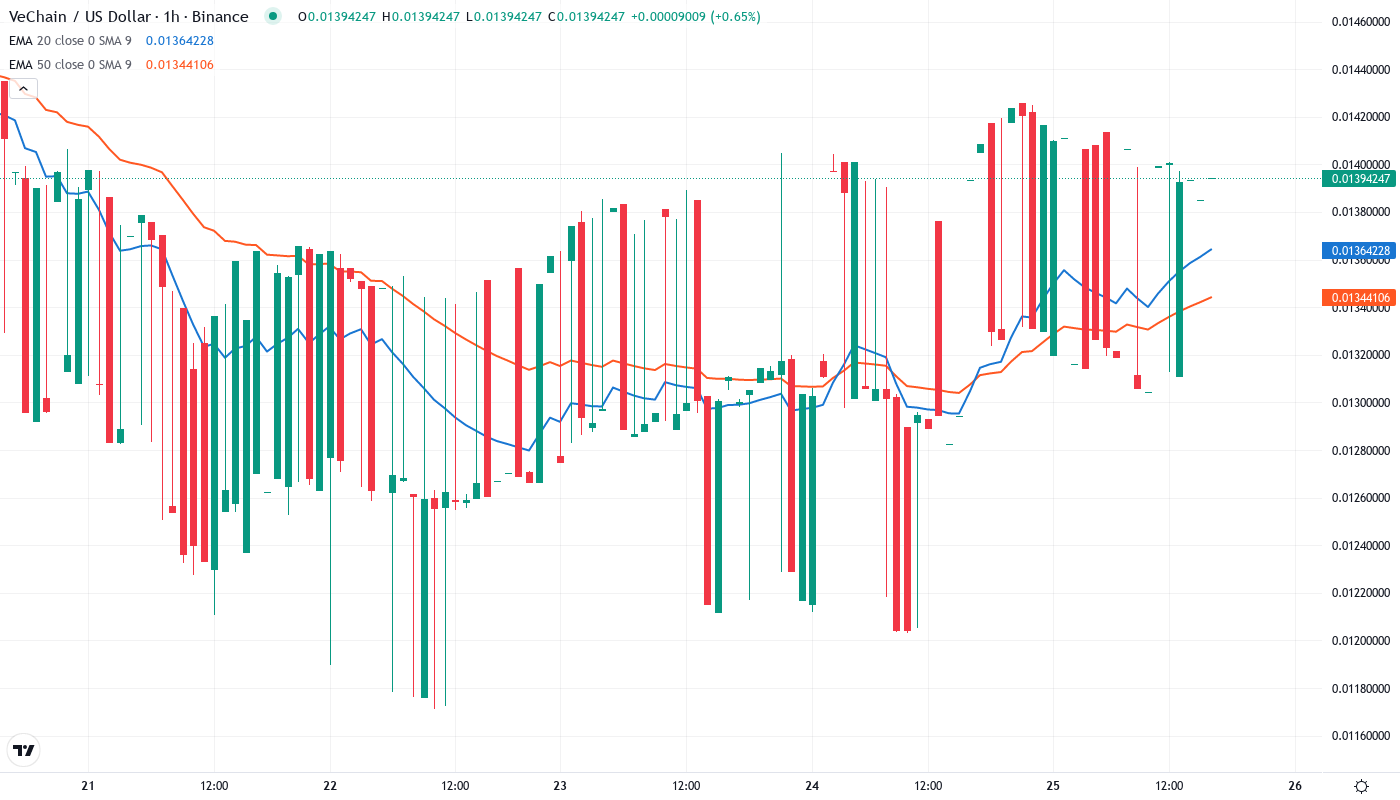

- The price now tests the support level of $0.0139 after being unable to stay above the 50-day EMA

The Bithumb panic and subsequent announcement of a tokenomics upgrade taking effect June 22 are largely the culprit behind the 25% weekly drop and 29% monthly drop. Both of those factors combined has bears expecting the previous lows of $0.0063 in December 2018. Surprisingly, the identities of the 101 new nodes also reveals addition to the staking model. Interestingly, VeChain is ahead of schedule and onboarding mainstream giants already.

| Metric | Value |

|---|---|

| Asset | VECHAIN (VET) |

| Current Price | $0.01 |

| Weekly Performance | -5.58% |

| Monthly Performance | -21.94% |

| RSI (Relative Strength Index) | 41.1 |

| ADX (Average Directional Index) | 35.5 |

| MACD (MACD Level) | 0.00 |

| CCI (Commodity Channel Index, 20-period) | -79.46 |

RSI at 41.09 Signals Oversold Bounce Territory Without Capitulation

The oscillator read is 41.09 on daily timeframe and increasingly close to oversold conditions, yet not at extreme washed-out levels. Late September’s RSI retested 30 before price bounced 15-20%, but that recovery didn’t face the Bailey exchange issue. New staking benefits may possibly push that momentum flag back up should buying respond to these levels.

What is particularly informative about RSI is that in the aftermath of the Bithumb announcement it declined from 52 to its current level in just three trading days, indicating that sellers will likely outweigh any positive exchange-related sentiment. Hence for swing traders, this balanced-to-oversold RSI implies that further knife-catching attempts are not encouraged until the Bithumb situation is clear, but for patient bulls, the waning momentum below 40 will present an adequate opening.

ADX at 35.46 Confirms Sellers Control the Trend

The stock’s recent decline put it back below its 200-day moving average, which is currently in the $127.50 region. This could bring actual or anticipated resistance into play in the short term. Schaeffer’s Volatility Index (SVI) of 28% sits in the 13th percentile of its annual range, revealing relatively low volatility expectations priced into near-term contracts.

As ADX has risen from the mid-20s to its current levels, the market has transitioned from the sideways grind of November to this month’s clearly defined uptrend. As such, day traders will want to adjust strategies to capitalize on this type of environment—buying breakouts rather than selling breakdowns until ADX returns below 25 or the price loses support. Thus far, the rampant buying interest hasn’t produced the necessary momentum to overturn this trend.

20-Day EMA at $0.0149 Becomes First Resistance After Support Failure

The price is now in very worrying territory for bulls. VET broke below the previous three daily lower highs, capturing liquidity resting below $0.0144 and $0.0142. Price isn’t done and $0.01313 on May 9 remains exposed. Buyers will be waiting to see if the May 23 low of $0.010452 is hit next.

From a broader perspective, that previous support zone around the 20-day EMA at $0.0149 now turns resistance that bulls will have to overcome. The 50-day EMA at $0.0168 is an even stronger obstacle that has rejected price three times over the past two weeks before the breakdown. The technicals are firmly on the bears’ side as long as VET does not capture these levels on strong volume, despite the positive new tokenomics.

Support at $0.0139 Faces Sixth Test as Bulls Make Their Stand

Bulls are running out of steam and time but while 6HRS close above $0.0139 it keeps hope alive for the almost impossible 743% rally to mid-2019 levels.

There is strong resistance between the 20-day EMA at $0.0149 and the 50-day at $0.0168. These averaged resistance kept advancing in late December but the trading outage eliminated demand right when bulls tried to regain them. The next weekly pivot at $0.0145 also contributes to this clustering resistance.

The market infrastructure continues to look fragile with no staking-related demand in place, leaving IOST exposed to merchant selling if the price does turn heavy. The only nearby active resistance is $0.0140 up to $0.0144, which should be easily absorbed by the downside breakout players.

Bulls Need Immediate Reclaim of $0.0149 to Avoid Deeper Correction

If the price of REPHR goes below the 200-day EMA and the 20-day EMA at $0.0116 and $0.0149 respectively, the next level to watch is the $0.0126 support. If sellers continue to dominate and violate this barrier, the 50-day SMA at $0.00868 is likely to be visited. Support should be in effect as the pair starts to transition.

If the $0.0139 level, the lowest point printed by the June 22 daily candle, gives way, Polkadot will likely be heading to the Liquid Zone (purple). This would quickly flush any stress-testing bids at $0.0131 and tag the 2018 low at $0.0117, creating a liquidity cascade that would likely test the 2021 address re-accumulation bids between $0.007 and $0.009.

Based on the present technicals and the short exchange hiatus, the most likely short-term scenario would be further testing of the $0.0139 level until Bithumb trading is back online. If support is maintained following the exchange restoration, staking inflows might push up a relief rally to $0.0149-$0.0155.