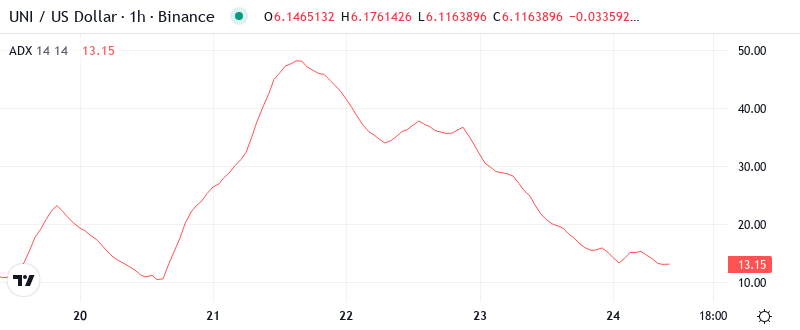

Uniswap Tests Six-Month Lows as Governance Concerns Mount, RSI Signals Oversold Territory

Market Structure Shifts Lower

- UNI registered a weekly loss of 14.7%, marking its worst weekly performance since late June.

- RSI dropped to 36.73, nearing lows seen before the late-July rally.

- On-chain data shows Uniswap’s liquidity is deeper and more resilient than any point in its history.

UNI registered a weekly loss of 14.7% marking its worst weekly performance since late June. That said, RSI has now dropped to 36.73, which is nearing the lows seen before the late-July rally.

The internal dynamics seem to be aligning for a bounce. On-chain data shows Uniswap’s liquidity deeper and more resilient than any point in its history Higher volumes and larger trades matter. Despite UNI’s tanking valuation, a confluence of large players ranging from Multicoin Capital to Alameda Research have all been adding to sizable positions Russia’s Sberbank has prospected Uniswap and Yearn’s native assets for derivatives offerings – this is probably the move that made a lot of Corporates begin researching / accumulating the underlying UNI treasuries offer something else intersting – behind close doors they have been reaching out to corporate treasuries to sell it as an extremely uncorrelated treasury asset. DM if you want more Intel on it I’d prefer not to post publicly.

| Metric | Value |

|---|---|

| Asset | UNISWAP (UNI) |

| Current Price | $6.12 |

| Weekly Performance | -14.68% |

| Monthly Performance | -2.01% |

| RSI (Relative Strength Index) | 43.5 |

| ADX (Average Directional Index) | 24.5 |

| MACD (MACD Level) | -0.06 |

| CCI (Commodity Channel Index, 20-period) | -52.95 |

Oversold RSI Hits 36.73 – Matches August’s Capitulation Low

The implications are obviously biased to the downside as volatility continues to expand. Bitcoin’s bear market yielded similar historical RSI readings so it’s no wonder altcoins are trending similarly. The low liquidity environment should still favor alts and we expect relatively low slippage sell orders would be filled at 1500 sats – give or take 50 sats. Once the token prematurely rises like a phoenix and tests support-turned-resistance at 980 sats it runs the risk of retesting the lows and struggling to stay above a clean 1000-satoshi print. Support levels continue to dwindle with this most recent push leaving few hints as to where bids may aggregate. It’s unlikely the 480-500 sats range would fail to inspire additional demand but the ultimate “floor” is surely closer to 100 sats.

Therefore, for high-time-frame players looking to time an entry, you may not get a better chance than this before a potential bullish resolution of the governance crisis (if one is imminent). Re-entering after the RSI is above 40 (or whatever arbitrary level you choose) will likely cost you a minimum of 50% in price appreciation.

ADX at 24.46 Confirms Bearish Trend Gaining Traction

When looking at trend strength, the ADX reads 24.46 and is on the rise, signaling a shift from November’s choppy consolidation to actual directional price action. The ADX crossed above 20 just as UNI crossed below $7, indicating that sellers were not just testing the market but were deploying their funds to push the price down. In simple terms, the ADX is signaling that we are transitioning from ranging to a trending environment, with bears firmly in the driver’s seat.

Hence, people who trade daily should change their plans according to this trend and not count on the back-and-forth game that was present while ADX was still below 20. It is essential to overlook the rally each time there is resistance, and to take advantage of the momentum for each breakdown. Also, you should have a respect for the trend up to the point where ADX reaches above 30, and all of this implicitly shows that the trend is over.

20-Day EMA at $6.70 Caps Rally Attempts After Support Flip

The price action around the EMA ribbons is indicating a bearish trend. UNI is being traded below the complete EMA ribbon starting from the 10-day ($6.61) to the 200-day ($7.86), and each of the moving averages is currently acting as resistance above the market. The 20-day EMA ($6.70) is particularly important as it has rejected the price three times during this week, whereas it had acted as a good support for the token in the first week of November. The support area quickly turned into resistance and there is a need for the bulls to recapture the red zone in order to alter the short-term trend.

What is most telling in terms of technical analysis is the squeeze between the 10-day and 20-day EMAs, which are only $0.09 away from each other. The type of squeeze usually results in large movements as the market creates a bias. Preferably, with UNI below all major EMAs and the governing landscape fundamentally negative, the bias would be to the downside unless buyers step in and bullishly reclaim $6.70 on a high volume. The bullish wildcard is what Bitwise’s CIO Matt Hougan recently describes this phase of the market for tokens, a “value capture era” – essentially, if Uniswap was to go down the direct fee distribution to holders route it could create the snowball of positive buyers the bulls are looking for.

Support at $5.55 Faces First Real Test Since June

Below the current levels, buyers have drawn their line at $5.55 – a level that has been held as support since June’s accumulation phase. This week marks the first real test of this floor, with price wicking down to $5.88 before finding responsive buyers. The proximity to June lows and the oversold momentum creates a high-probability bounce zone, but the volume patterns suggest it may not hold if the selling pressure intensifies.

There is strong resistance between $6.47 and $6.76, where the monthly pivot point and the 20-day Exponential Moving Average (EMA) cluster. Bulls tried to recapture this level twice after the volume spike news came out, but each attempt encountered strong selling pressure – probably from traders at a loss willing to get out on a bounce. The rally pattern looks like a distribution rather than an accumulation, which implies that advances could have difficulty holding without a news trigger.

As long as UNI continues to close above $3 that capitulation spike should attract buyers looking to play a risk-defined rally attempt. The target would be a pivot at $7 given that previous support now turned resistance. A daily close above $7 would complete a bullish morningstar reversal pattern on the Dec 21 technician and launch a rally with $3 defining risk longs. The $13 breakdown level would be the bulls’ ultimate test, but we’ll cross that bridge if we come to it.

Governance Friction Creates Binary Outcome for UNI Price

Buyers need to consolidate ranks above $6.70 to mitigate early downside risks. In case favorable conditions arise, where the proposed fee distribution system incorporates fundamental catalysts pushing up the rest of the network, a potential recovery rally might hit the 50-day EMA resistance, arriving at $7.40..clientY selling the big fishes could be prompted to take into consideration their biggest alternatives. If the $5.55 level holds the ground and the technical indicators unfold their oversold areas, a rebound rally to monthly pivot resistance at $6.76 could be the most likely possible.

If the price drops below the support level of $5.55 with a significant increase in volume, stop-loss orders would be triggered successively, pushing the price towards the lowest point of the year at $4.75. Further ongoing governance arguments with no positive outcomes, and if large token holders keep distributing their tokens, could lead to a further decline in the price. A decline causing the RSI to fall below 40 and rejecting the 20-day EMA would confirm the dominance of the bears.

With oscillators at their most oversold extended levels since Uniswap’s inception, alongside potentially game changing positive re-pricing scheduled for the end of the month, the path of least resistance likely involves the 5.55-6.70 range holding as the market digests governance proposals. Any relief bounce rallies are likely to test 8/21EMA resistance (approx. 9.50-10.80) and so far we have seen no developments on the value accrual frontier.