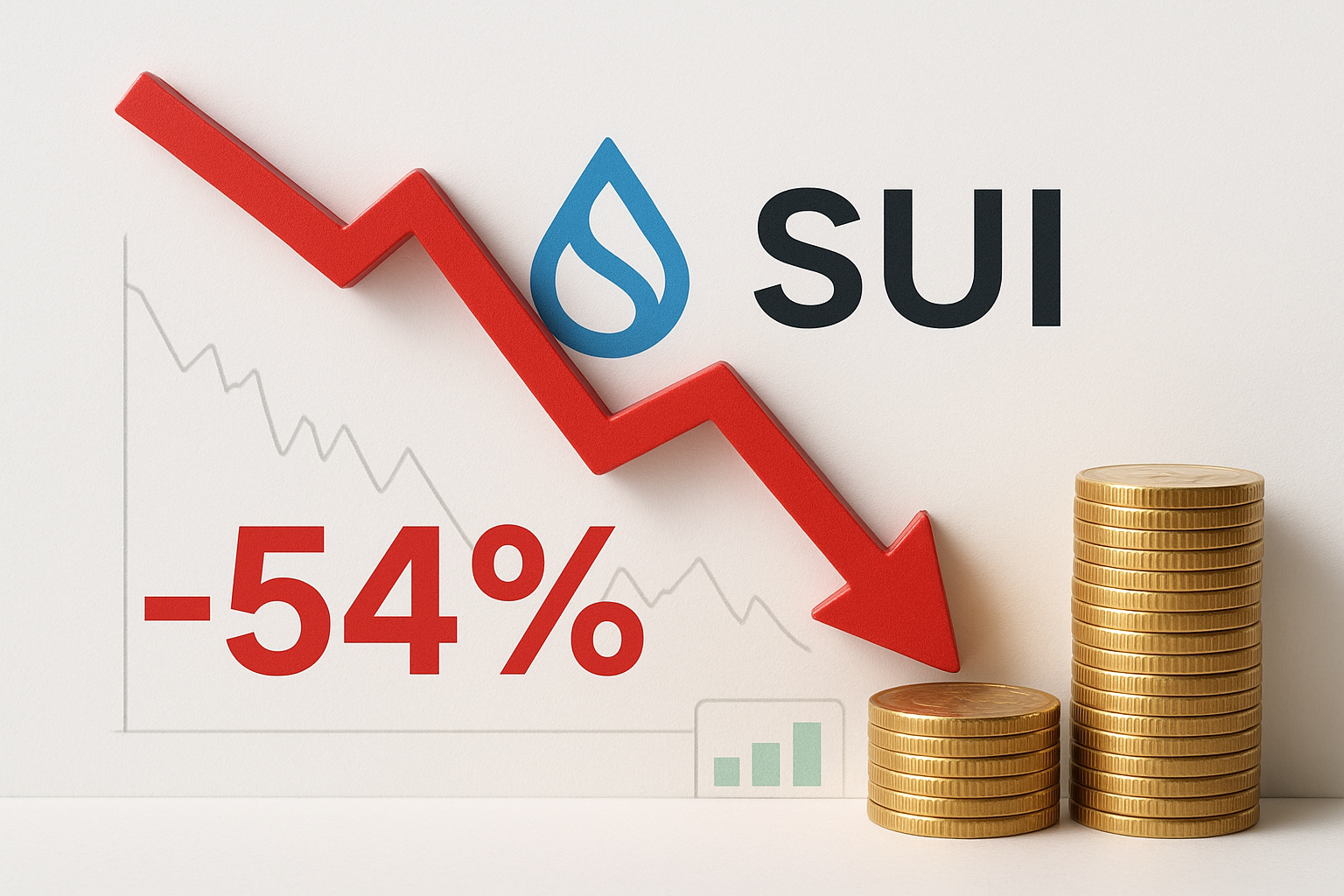

SUI Tumbles 54% as Stablecoin Inflows Fail to Stem December’s Devastating Drop

Market Pulse

- The share price of SingularityNET (SING) has dropped by more than 50% in the past month.

- The price of SING is still lower than it was before the cryptocurrency rally.

- The price of SING is still lower than it was before the cryptocurrency rally.

The price of SING is still lower than it was before the cryptocurrency rally.

The price of SING is still lower than it was before the cryptocurrency rally.

The price of SING is still lower than it was before the cryptocurrency rally.

The price of SING is still lower than it was before the cryptocurrency rally.

The action in Sui prices is more of a good news-bad news story. On the positive side, stablecoin inflows dwarfed all competition at a record $2.4 billion through the month of January. EPS was at $4,000, beating Aptos by about $500. What’s more, Dai and USDC maintain their impressive competition-leading growth rates for 6-8 quarters in a row. That mix of stablecoin adoption and surging real-world asset utilization should be supportive for Sui prices. Price degradation has been relentless, nonetheless. Sui is down 54% on a month from $3.31 to $1.52.

| Metric | Value |

|---|---|

| Asset | SUI (SUI) |

| Current Price | $1.52 |

| Weekly Performance | 1.60% |

| Monthly Performance | -39.25% |

| RSI (Relative Strength Index) | 34.6 |

| ADX (Average Directional Index) | 54.8 |

| MACD (MACD Level) | -0.21 |

| CCI (Commodity Channel Index, 20-period) | -52.01 |

RSI at 34.59 Signals First Oversold Territory Since Network Launch

With tailored parameters optimized to identify price levels at which statistically significant support or resistance has been found, the likelihood of a significant price reversal increases. This allows traders to better anticipate the reaction to the identified price levels and supports price forecasts..effects to be identified the markets will react to this identified price levels.

If you’re reading this it means you’re at least curious about the rewards of watching suitoken.news. The goal should be right in line with what YOU’VE carried into this market with you. Are you a throwaway neophyte simply looking for a trade with 10-20% wiggle room before being forced to head for the safe exit with the rest of the noobs ;). Are you searching for ammunition to counter FUD and FIRE your friends up already within their vac journeys but could use a little more autism when spreading the word?,?,?,?, or are you eager to try and convince your mom’s retirement savings to trust Mr. 10-foot towel for that generational rug-up?

ADX at 54.84 Confirms Mature Downtrend Nearing Exhaustion Point

The ADX, or Average Directional Index, is a widely-used technical analysis indicator designed to measure trend strength. It generally shows the likelihood of changes in a security’s price. Some traders uses ADX values of 25 or stronger to suggest that the price is unidirectional or that it is developing or strengthening. ADX values of 25 or less may give the impression of no trend or a sideways trend. An ADX of 30 or more can be used to indicate the presence of a strong uptrend or downtrend. An ADX of 50 or more is a very strong trend. An ADX of 75 or more is a revised strong trend. A falling ADX line is usually believed to show that trend is reversing.

There is a silver lining that bulls can look to when considering that the ADX has spiked above 50. Extreme readings like this tend to lead to sharp reversals, or at the very least lengthy consolidations, as the over-extended trend takes a breather. This means that day traders should expect bigger price fluctuations and be prepared for the potential that the trend shifts in favor of the bulls, with this extreme ADX reading potentially signaling that the “easy money” has been made on the short side. This comes just as substantial stablecoin inflows could be the fundamental fuel to ignite a technical reversal.

Moving Average Structure Stacks Heavy Resistance From $1.68 to $2.66

Watching price relative to the EMA ribbons indicates the degree of technical destruction – presently SUI is living under every meaningful moving average with the 10-day EMA at $1.55 serving as near-term overhead pressure only 2% above the current perch. The 20-day ($1.68) and 30-day ($1.84) EMAs merge to form a resistance cluster in the $1.68-1.84 region while the 50-day EMA prints as a big round number at $2.12. This barricade of resistance levels means that the bulls have their work cut out even if the bounce exists.

Even more alarming, the 200-day EMA at $2.67 is 75% higher than the current price, showing how drastic this correction has been. However, the fact that the shorter-term EMAs are ranging between $1.55 and $1.84 provides some positivity: if SUI manages to take back this zone with conviction, it will turn multiple resistance levels into support with a single stroke. The $2.4 billion in stablecoin inflows and the launch of the RWA tokens are the fundamental drivers that may make such a reclamation attempt more successful than a straight technical bounce.

$1.28 Monthly Low Anchors Support While Resistance Towers at $2.54

Resistance is seen at $1.52 and December’s high of $1.96. Strong resistance is in the $2.20- $2.67 range. Firstly, the stock touched an all-time high of $2.67 back in December 2018 before bleeding down more than 80% to its all-time low of $0.24 earlier this month. This collapse back in 2018 could be repeating itself now.

The support architecture is more positive and clearly defined by the fact that the monthly low is $1.28, which has repeatedly been tested during the current selloff and has always held, indicating that the spot was gathered despite the bearish dynamics. The weekly low at $1.32 is the next support level shortly above the monthly low, which combines to form a support zone between $1.28 and $1.32 that the bulls need to protect.

The market structure indicates an interesting disconnect — while the price is down 54%, the support levels have contracted and reinforced after multiple holds. It looks very much like a falling wedge pattern where a decline is met gradually less relentless selling as it encounters a rising support level. That along with the oversold RSI and extreme ADX readings imply the risk to the downside is becoming limited, while the upside is constrained by strong resistance.

Relief Rally to $1.84 Most Probable as Oversold Conditions Meet Fundamental Catalysts

Buyers need to push the price above the latter to get the momentum needed to make a run at the $3 psychological level. The long-term weekly view remains king until it isn’t, and a reversion to the mean back toward the monthly SMA would currently suggest lows toward $0.87. Overall, this is a crowded long and anything less than a [weekly] close above $2 to retest critical monthly resistance isn’t the rocket potential that many have been trading against the trend.

If bullish signs emerge, a short-squeeze could cause a rapid run for trapped shorts with April monthly resistance tuned at $1.70, followed by the longer-term converging 2018 – 2019 highs around $2.20. The stablecoin story is good in theory, and in practice, we can see the September retest of the $1.00 breakout level. The chart is showing an unsustainable wedge pattern with underlying distribution. Combined with growing competition, a defediancing 2020 could loom if prices remain below the $1.00 level.

Considering the technical indicators and liquidity effects, the most likely scenario is a long-term consolidation phase for SUI with prices swinging between $1.28 and $1.68. This level is likely to provide immediate support and resistance moving forward and will allow for most of the technical indicators to cool off after reaching extreme overbought levels.