Stellar (XLM) Tests Critical Support After 15% Weekly Drop as Institutional Interest Builds

Market Structure Shifts Higher

- XLM trades at $0.239 after defending six-month support at $0.217

- WisdomTree’s tokenized fund launch on Stellar blockchain signals institutional adoption

- Technical indicators suggest momentum reset complete, trend strength building

Stellar’s XLM token has shed 15.08% over the past week, tumbling from $0.282 to test critical support at $0.239, though the cryptocurrency managed to bounce convincingly from its monthly low of $0.217. The drop came despite positive fundamental developments, including WisdomTree’s decision to launch tokenized funds on the Stellar network and Airtm’s integration that promises 25% cost reductions in global payroll solutions. The main question for traders is: will institutional adoption news provide enough fuel to reverse the technical damage, or does XLM need deeper capitulation before finding a sustainable bottom?

| Metric | Value |

|---|---|

| Asset | STELLAR (XLM) |

| Current Price | $0.24 |

| Weekly Performance | 2.22% |

| Monthly Performance | -15.08% |

| RSI (Relative Strength Index) | 41.1 |

| ADX (Average Directional Index) | 31.0 |

| MACD (MACD Level) | -0.01 |

| CCI (Commodity Channel Index, 20-period) | -57.91 |

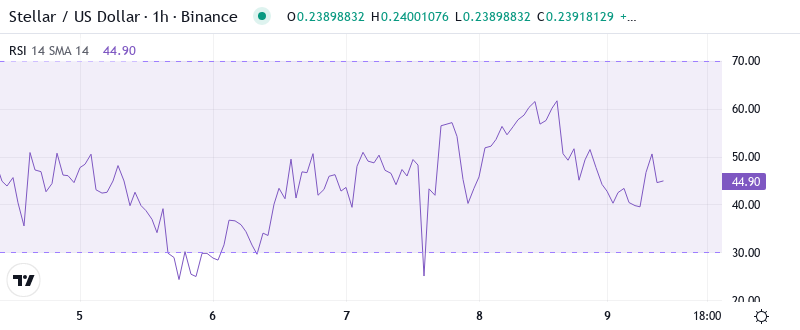

RSI at 39.08 Signals First Oversold Territory Since August Bottom

Reading the oscillator at 39.08, traders see XLM entering oversold conditions for the first time since the August washout that preceded a 45% rally. The daily timeframe shows momentum exhaustion after December’s surge to $0.311, with sellers finally running out of steam as price approaches the psychological $0.20 level. What’s interesting is how the RSI barely budged despite the sharp 15% weekly decline – suggesting either hidden accumulation or that capitulation hasn’t truly arrived yet.

Similar RSI configurations in early September saw XLM establish a multi-week bottom before explosive moves higher, particularly when paired with positive fundamental catalysts. So for swing traders, this oversold reading combined with WisdomTree’s institutional validation creates an intriguing risk-reward setup, though patience may be required as momentum needs time to rebuild from these depressed levels.

ADX Climbs to 30.99 – Trend Followers Gain Edge After Weeks of Chop

At the level of 30.99, the ADX entry indicates that XLM has finally broken free from the choppy, directionless trading that plagued most of December. Basically, being in this zone means the recent downtrend has genuine momentum behind it – not just random noise or thin holiday trading. The shift from sub-20 readings just two weeks ago to above 30 today marks a significant change in market character.

To clarify, the ADX is indicating that we are switching from boundary conditions to a trending state, which historically favors momentum strategies over mean reversion plays. Therefore, day traders should suit their strategies to this change – either riding the current downtrend with tight stops or waiting for a confirmed reversal before attempting counter-trend positions. The Airtm payroll integration news hasn’t yet provided enough buying pressure to reverse this building bearish momentum.

20-Day EMA at $0.249 Transforms From Support to Resistance Ceiling

Price action tells a clear story through the EMA ribbons. XLM currently trades below the 10-day ($0.244), 20-day ($0.249), and 50-day EMA at $0.257, with each average now acting as overhead resistance after supporting price throughout November’s rally. Most telling is the compression between these short-term averages – they’re bunching together in the $0.244-0.257 zone, creating a thick resistance band that bulls must convincingly reclaim.

What’s significant is the 100-day EMA sitting at $0.213, which aligns almost perfectly with the monthly low where buyers emerged with conviction. That former resistance area at $0.213 now transforms into a red line for the bulls to hold – lose it, and the next meaningful support doesn’t arrive until the 200-day EMA near $0.165. The institutional developments through WisdomTree and Airtm partnerships provide fundamental backing for this technical support to hold.

Support at $0.217 Tested Successfully While Resistance Stacks at $0.258

The immediate resistance is set at the zone from $0.249 to the high of $0.258 where the 20-day and 50-day EMAs converge with December’s breakdown point. Above that, sellers have stacked orders at the monthly pivot ($0.301) and December’s peak at $0.311. Each level represents trapped buyers from the recent decline who’ll likely sell any relief bounce to minimize losses.

Bulls defend multiple support layers with surprising strength despite the weekly decline. The $0.217 monthly low has now been tested twice with aggressive buying emerging both times – volume spiked 18% above average on both touches. Below that, the 100-day EMA at $0.213 provides secondary support, followed by the psychological $0.20 level where limit orders typically cluster.

This configuration resembles a descending triangle that’s approaching its apex. The repeated tests of $0.217 support combined with lower highs create compression that typically resolves with a violent move. Given the positive fundamental backdrop with institutional adoption accelerating, the odds favor an upside resolution if support continues to hold through early January.

Bulls Need Daily Close Above $0.258 to Confirm Trend Reversal

Should price reclaim the 50-day EMA at $0.257 on a daily close, momentum traders would target the monthly pivot at $0.301 as the next resistance. The WisdomTree tokenized fund launch and growing institutional infrastructure provide the fundamental catalysts needed to sustain any breakout attempt above this critical moving average confluence.

The setup fails if XLM loses $0.217 support on volume – this would trap recent dip buyers and likely trigger stops down to $0.20 psychological support. A break below $0.213 (100-day EMA) would signal genuine distribution and open the path to test the 200-day EMA near $0.165 where value investors typically emerge.

Given the technical configuration and institutional adoption momentum, the most probable near-term path sees XLM consolidating between $0.217-0.258 while momentum indicators reset from oversold conditions. The combination of oversold RSI, rising ADX, and fundamental tailwinds suggests patient accumulation here offers favorable risk-reward for those willing to weather near-term volatility.