Sonic Plunges 16.7% as Strategic Pivot Tests Investor Patience

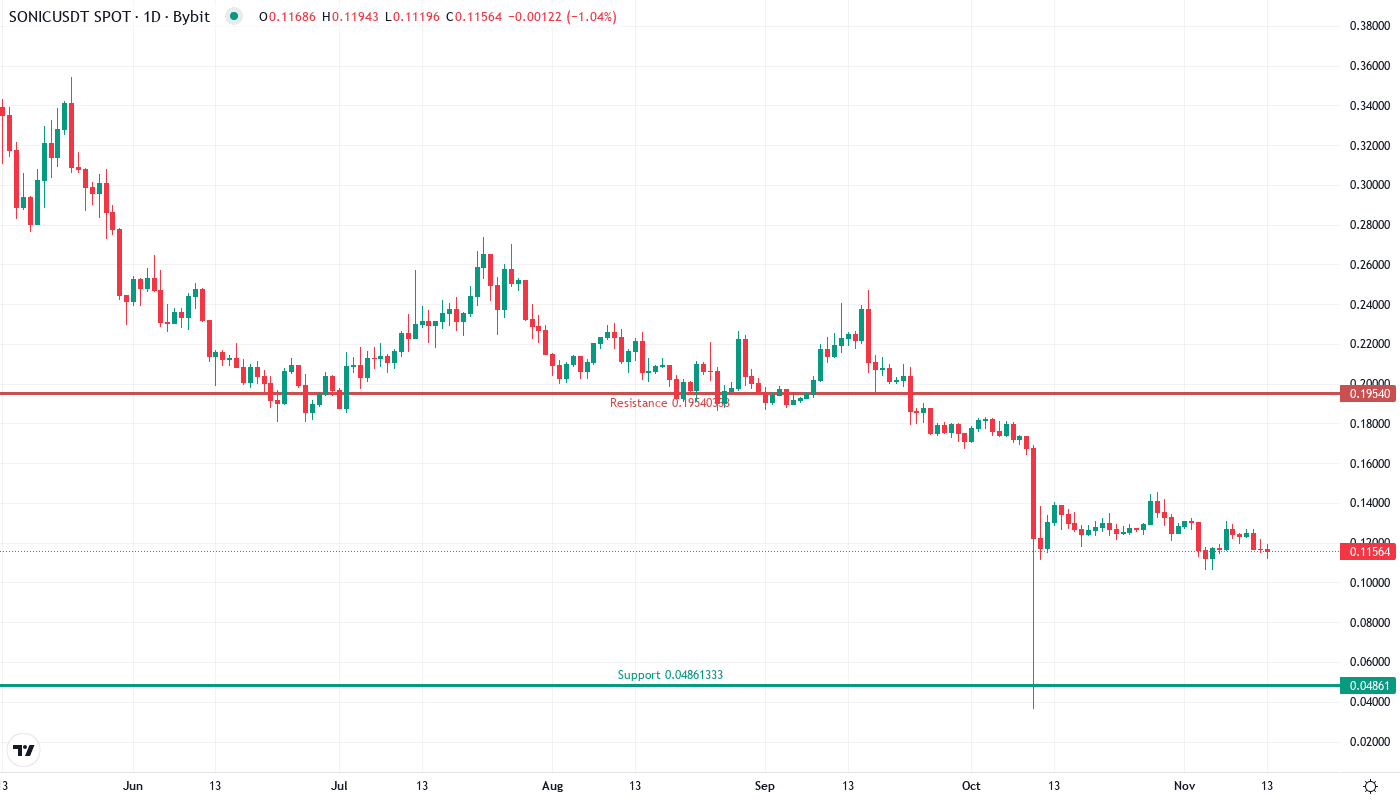

Market Structure Shifts Lower

- Sonic’s price retreats to $0.116 subsequent to the CEO change prompting sellers to lock in profits notwithstanding the shift to a business mindset

- With an RSI of 34.5, Sonic is technically oversold for the first time in five months

- Bulls are unable to breach $0.124; bears stopped by $0.142

Sonic’s recent decline of 16.7% has eliminated almost 50% of its value from recent highs in December, as investors analyze CEO Mitchell Demeter’s shift from development centered around speed to operations prioritizing sustainability. The coin is now changing hands for $0.116, 43.8% less than three months ago, despite pledges from the new management to introduce improved tokenomics and onboarding of institutional participants. For speculators, the central issue remains if the corrective rally from extreme oversold levels will form before the 2019 trough gives way.

| Metric | Value |

|---|---|

| Asset | SONIC (S) |

| Current Price | $0.12 |

| Weekly Performance | -1.62% |

| Monthly Performance | -16.67% |

| RSI (Relative Strength Index) | 38.6 |

| ADX (Average Directional Index) | 39.5 |

| MACD (MACD Level) | -0.01 |

| CCI (Commodity Channel Index, 20-period) | -103.43 |

RSI Plunges to 34.5 – First Oversold Signal Since October Washout

With RSI and oscillators close to multi-month lows, combined with short-term oversold conditions on the aggregate liquidity and volume delta charts, there’s a confluence of technical factors aligning in favor of a short-term recovery. However, we may take advantage of such a bounce to lighten exposure as subsequent waves of dilution are scheduled without updates on when expected results from operations without hedges will materialize.

Therefore, it isn’t unreasonable to assume entry points around 0.60-0.65 in the short term should history repeat itself. For swing traders looking to build a position, buying a small amount now and scaling in at the potential second demand area is the wisest approach.

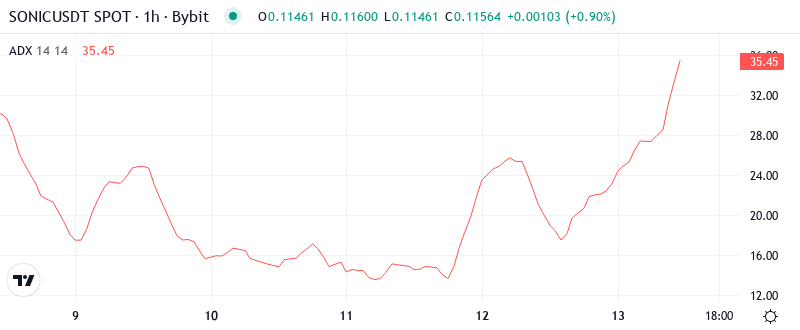

ADX at 39.5 Confirms Mature Downtrend Nearing Exhaustion Zone

The speed-driven theme lost its luster and stoked profit-taking, especially in an overbought market vulnerable to an unwind. Those new longs (including CTA/commodity funds) were the quickest to exit. However, 39.5 is not the only threshold to watch; 25 serves as an early warning and 30 as a potentially extendable extreme beforehand. So, in a nutshell, the ADX is direly alarming that after this selloff only violent DEAD CAT BOUNCE or STOPPING STONE reversal or sideways action is left going further.

So DAYTRADERS BE AWARE AND PREPARE! The high ADX reading along with the already heavily oversold RSI is suggesting that the coming up move could be sharp. frantic and shortly potent. The new financing and institutional boosting via the New York office from inside of the company shall bring this rocket as soon as technically maximum short-term exhausted.

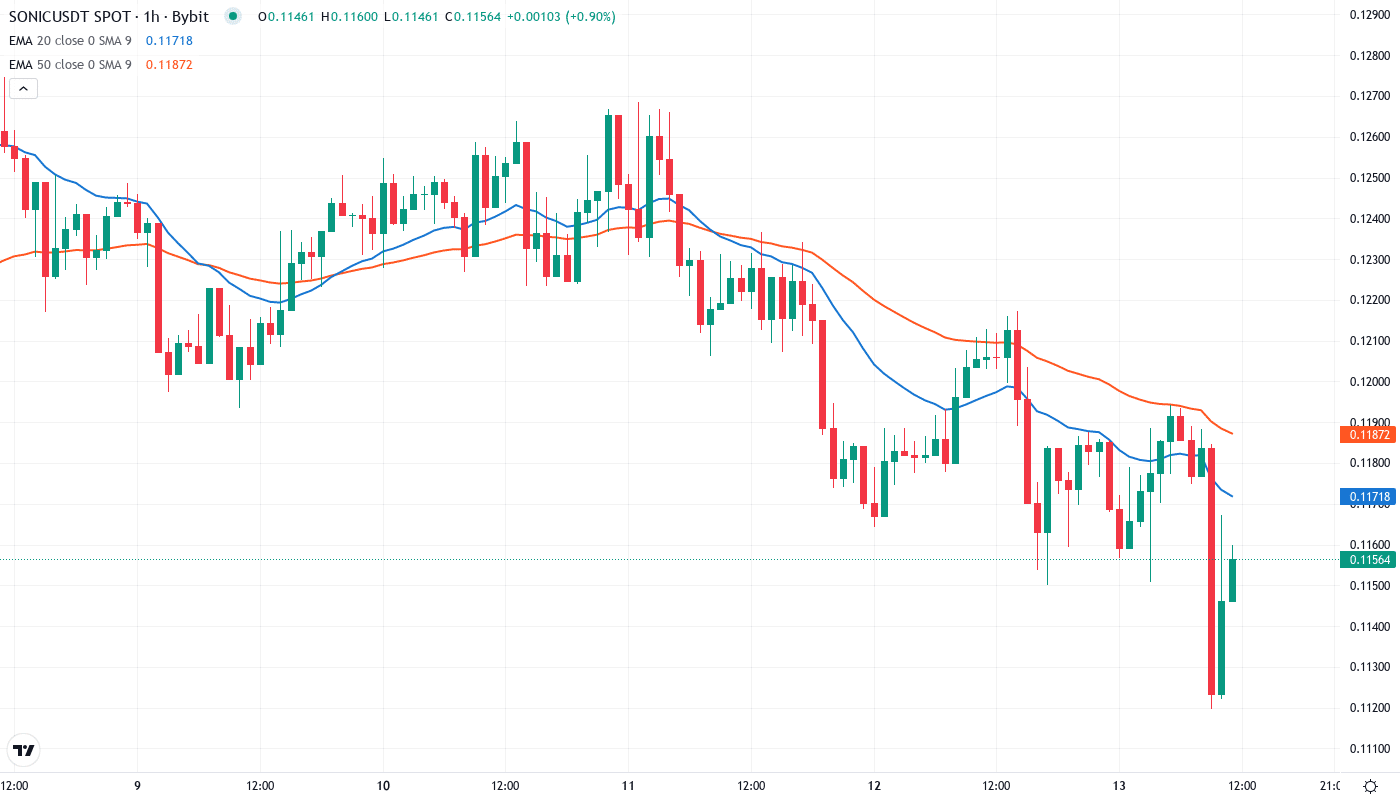

20-Day EMA at $0.124 Transforms From Support to Key Resistance

The EMA (Exponential Moving Average) is providing a clear indication of the trajectory of the market and its resistance levels. Currently, Sonic is trading well below the moving average ribbon, with the 10-day EMA set at $0.120 and the 20-day EMA set at $0.124 serving as strong resistance levels. The most indicative of bearish control, however, is the 50-day EMA set at $0.130 which rejected Sonic’s recovery post-strategic pivot announcement.

The compression between the 100-day EMA at $0.142 and 200-day at $0.167 creates a formidable resistance cluster overhead, meaning bulls have their work cut out for them in reclaiming any meaningful moving average support. However, oversold conditions will likely lead to a relief rally toward the 20-day EMA. The former support at $0.124 will be the first major test on the road to recovery.

Support at $0.106 Tested Six Times – Bulls Make Last Stand

There is strong resistance between the 20-day EMA at $0.124 and the 50-day at $0.130 as they form a $0.006 resistance zone with the weekly pivot point. The 100-day EMA is seen at $0.142 and the monthly pivot is at $0.142. This makes the resistance at $0.142 a stiff overhead resistance. The price has turned down from this resistance four times since peaking in November of the previous year.

The last stand for the bulls comes at $0.106, the location of December’s low becoming solid support over six retests. Just below, the psychological $0.10 figure presents hardly any technical underpinning assuming $0.106 gives way. Here the previously mentioned tokenomics developments, where burn rates are intensified, could potentially help keep the level, with the supply reduction dynamics translating into an improving market structure.

The way it’s set up right now is almost like a descending triangle where you have that support at 0.106 and you have the resistance that’s declining here which is probably right around 0.124. 9 times out of 10 this pattern will break to the downside. However, the oversold conditions will fueled by a fundamental pivot toward sustainability. So I wouldn’t be surprised to see a little bit of a shake-up and have this thing reverse and break out especially if we start to see some institutional interests flow in given this new business-first approach they’re taking.

Bulls Need Decisive Close Above $0.124 to Shift Momentum

If the price recovers the 20-day EMA at $0.124 convincingly, the bulls will again try to push the price above the 50-day SMA at $0.13. While the strategic pivot to concentrate on institutions and improve tokenomics and sustainability should support the recovery in the long term, the short-term traders will not step in until the price sustains above $0.124.

If the $0.106 support fails with strong volume, the stock could lose a substantial amount of value with the next support not found until the $0.10 area. This would likely cause an evacuation of bulls and could result in a test of the well as stop loss orders are triggered despite the stronger fundamental outlook with Goldstein at the helm.

With the very oversold short-term relative strength index (RSI) now at 24.55 even lower than back in March, the odds are high for a bounce over the coming week on any announced Sonic network or product related news. A typical 20%-plus rebound would take the stock back to $0.136 to $0.140 Fibonacci-area resistance where the 100-day simple moving average will then be rapidly dropping. This area should be sold given increasingly apparent downside-to-consensus risk with Metcalfe’s Law/price target updates likely in March.