Sonic Darts to Monthly Low as Strategic Pivot Tests Market Patience

Market Structure Shifts Lower

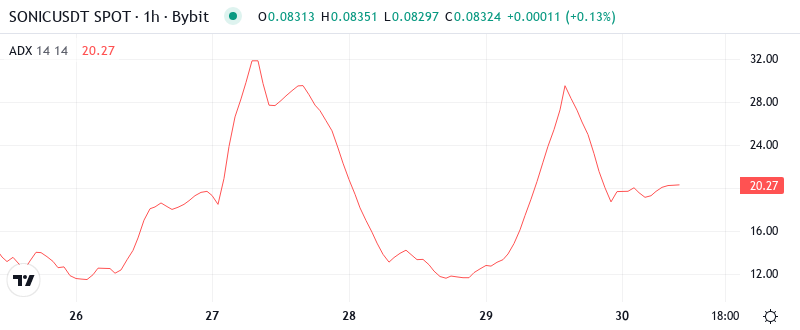

- The S token has dropped by 33.4% this month, reaching $0.0833, the lowest level since last month’s rally.

- The strategic pivot from prioritizing speed to focusing on business sustainability has resulted in short-term sales pressure.

- The RSI at 48.89 indicates balanced momentum despite the noticeable decline in price.

The S token has lost a third of its value since late February, slipping from $0.1254 to around $0.0833 as Sonic continues to work through its transformative blueprint. The broader ﹘ and undeniable ﹘ trend within the blockchain space favors higher-quality, less-centralized networks, and these players could gain from the new Sonic strategy as a potential competitor falls out. That said, the clear shift from transaction processing to revenue-generating opportunities could finally lead to a more secure place for a frantic and time-pressed crypto trader. What’s the risk/reward, timing, and technical outlook for using this S token situation to draw out a profitable long entry?

| Metric | Value |

|---|---|

| Asset | SONIC (S) |

| Current Price | $0.08 |

| Weekly Performance | -8.09% |

| Monthly Performance | -33.40% |

| RSI (Relative Strength Index) | 27.5 |

| ADX (Average Directional Index) | 44.9 |

| MACD (MACD Level) | -0.01 |

| CCI (Commodity Channel Index, 20-period) | -90.39 |

Momentum Holds Neutral Ground Despite Month-Long Selloff

With the price of the token at $0.17188, 24-hour $1 million spot trading volume and $6 million futures volume, it’s unclear if this is an intermediate buy-in level or a pause before the next leg down. Buyers won’t get too excited until the token gets back over its old support level of $0.225 and sellers won’t push too hard until l/s ratios return to neutral after a short covering rally.

What is interesting to note is the reaction of RSI to previous strategic changes of Sonic. Comparable momentum set up from the end of the summer until mid-September of the past two years shows RSI temporarily levels off in the lower half of its range. This signals that the downtrend has lost its harshest steepness. For a swing trader, this tends to be a healthy phase of stabilization where price tries to establish a floor before initiating a rebound.

ADX at 44.90 Confirms Strong Trending Conditions Remain Active

With an ADX of 44.90, we have trend strength that’s often associated with significant market action about to occur. In other words, being above 40 in this indicator means that the current downtrend is pretty powerful – this isn’t the kind of up and down ranging movement which might not necessarily result in a clear trend, but this is the kind of movement that any sort of system trying to identify trends would currently be hopping on for the downward direction.

So, in summary, critical levels lower for Demeter include the $31,000-35,000 zone; losing to here likely sees a fast drop to $20,0000. Above and beyond the ADX suggests acceleration in the trend to the upside. ADX represents 100% with a high in place or at $80,000ish and a low back in the Demeter coin at $23,000-30,000.

20-Day EMA at $0.0956 Becomes First Major Resistance Overhead

The 20-day EMA still bulls crosses the 50-day EMA, potentially causing the spread between the two to widen. This would likely lead to lower lows, with the next significant support area lying from $0.076 to $0.0846. As blue-green as this all sounds, the momentum oscillators actually suggest a potential relief bounce for the oversold share price.

When you look at the moving average confluence, it becomes apparent how little was able to hold during this recent downturn. The 50-day EMA flipped from support to resistance in early December, and that previous support level at $0.1027 now becomes a red line for bears to defend. Bulls would need at least the 20-day EMA to signal a switch of trend dynamics.

Support Tests Critical $0.0803 Low While Resistance Stacks Heavy Above

Initial resistance is 0.085, which held XRP back last week. The next one is around $0.087, followed by the weekly high at $0.089 which is the level to reclaim to turn short-term bullish. Above, resistance is expected at $0.0925 and $0.095.

There are several resistance levels tightly packed above, kicking off with the 20-day EMA at $0.0956 and extending through $0.10. The monthly pivot at $0.1158 is a more solid barrier, with the 100-day EMA at $0.1164 closely matching up to it, the confluence forming a strong resistance zone that would take significant demand to breach.

The configuration resonates with a compressed spring, with price pinched between the monthly low and the first resistance level. The recent corporate rebrand under Demeter’s guidance introduces more organic ambiguity to these technical levels, as the market reevaluates if the new focus on institutional networks and US contingents supports market price or calls for additional revaluation.

Bulls Need Sustained Break Above $0.0956 to Shift Momentum

The bulls need to push the price above the 20-day EMA, which is currently at $0.0956. If that happens, it will suggest that selling pressure has reduced. The recovery is likely to face resistance at the 50-day SMA at $0.109 and then at the downtrend line.

If it hasn’t, then price will eventually gravitate back towards the recent lows, tracking the structurally bearish path.catalog The resultant pooling of a new wave of extreme bearish sentiment would resolve the current adverse long/short positioning tussle. A sell-stop below $0.079 emerged after the Doji fireworks display rejected the strategic pivot.

Considering the high ADX reading and the moving average breakdown, the contraction should extend in the short term, with $0.0803 containing lows while $0.0956 puts a cap on advances. The expected stalling doesn’t alter the bearish technical structure, which paints a rather dark broader picture. A close beneath $0.0803 would ignite the next sell-off with the potential to slice 6 cents and reach long-term trendline support at $0.0498.