Solana Tumbles to $121 as Bears Defend Key EMAs Despite Network Expansion News

Market Structure Shifts Lower

- SOL price down 35.8% from yearly high, bears in control.

- 50-day EMA at $141.41 transformed to resistance; $120 support critical.

- RSI, ADX and MACD readings suggest bearish momentum persists.

The price of Shiba Inu has dropped substantially by 35.8% from its yearly high of $0.00004788 on November 4, as sellers appear to be in full control of the market. This bull trap adds to the overhead pressure SOL has been facing since late November 7, with bears prevailing in the battle ever since.

Solana had a tough week, losing 6.68% to end at $121.84 despite several upbeat events like the Base network being integrated by Coinbase and the launch of Ondo Finance’s tokenized stocks. It is now down 35.8% from the yearly high, selling the 50-day EMA at $141.41 and converting the previous strong support to the stiff resistance. The pressing issue for traders is: will the bulls uphold the critical $120 level or the prevailing technical downtrend downslide towards the 200-day EMA?

| Metric | Value |

|---|---|

| Asset | SOLANA (SOL) |

| Current Price | $121.84 |

| Weekly Performance | -5.63% |

| Monthly Performance | -6.68% |

| RSI (Relative Strength Index) | 37.3 |

| ADX (Average Directional Index) | 25.5 |

| MACD (MACD Level) | -4.76 |

| CCI (Commodity Channel Index, 20-period) | -112.88 |

RSI at 45.54 Signals Neutral Territory After December’s Overbought Extreme

With over $6 billion in liquidation, a loss of over $8 billion in collateral, and the total value locked plunging by approximately 50%, DeFi is now under threat. The 3 largest liquidations in history occurred in December 2020 and February 2021 which resulted from almost zero price shock. The near 50% peak-to-trough instability across DeFi this cycle is already inflicting damage with further declines likely.

For swing traders, this neutral RSI indicates that rather than bottom-fishing, it may be preferable to wait for more defined signals. Previous data indicates that in order to form true capitulation bottoms, Solana’s RSI must fall to 35 or below, and we are still a long way from that. In essence, the momentum picture suggests that both bulls and bears still have something left in the tank, while neither has had the strong enough conviction to push the oscillator to the overbought or oversold zone.

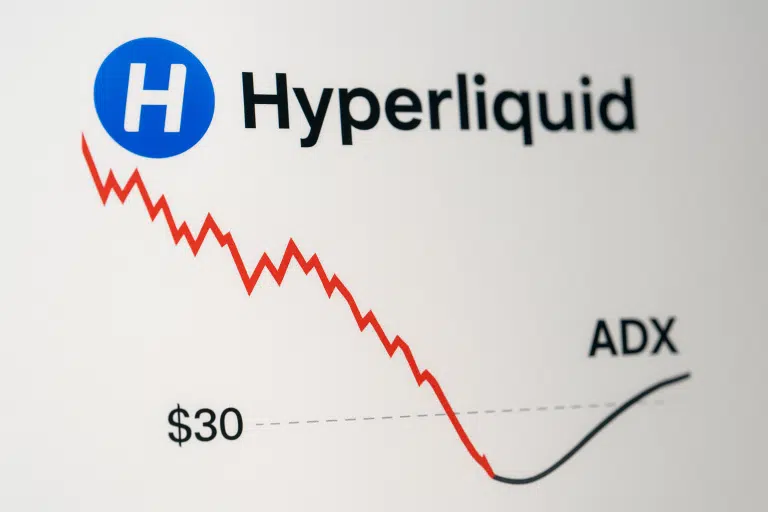

ADX at 25.47 Confirms Trend Strength Building as Bears Take Control

When you take trend strength into account, the ADX reading of 25.47 shows an important turn away from the choppy, somewhat directionless action that was prevalent at the start of January. A rise above the 25 level here shows that we are shifting from a range to a trending market and as price is under all major EMAs, that is a bear trend. The acceleration in the ADX is similar to what we saw in the lead up to November’s breakdown, with these readings coming before SOL began to drop from $160.

In simple terms, the ADX suggests we’re moving from ranging to trending, with momentum trading more likely to work than mean reversion trading. For day traders, that means a subtle tweak – the more ADX confirms the direction, the more dangerous fading (i.e. taking the other side) becomes. With ADX rising and price turning back right at the 50-day EMA, it’s about as good a setup for continuing the downtrend as you’re likely to find – especially given the news backdrop failed to shift the technical stance.

50-Day EMA at $141.41 Transforms From Support to Resistance Ceiling

The MACD line and signal line remain in bearish territory, while the RSI is extremely oversold with a reading below 30. The daily outlook for SOL continues to look dismal at best. Support is currently seen around $113 (the July high) and then $108, which was a jumping point for the rally in late November.

The 200-day EMA is not only the last line of defense for remaining longer-term bulls but also marks the theoretical realization of the expectation that a full retrace would bring prices back to the bullish breakout in July at around $117.

Resistance Stacks Heavy Between $132 and $141 Despite Network Growth

There are several resistance levels above the current price that have been reinforced by sellers, meeting technical levels and psychological levels of resistance. The 100-day EMA is currently at $131.78, while the 50-day EMA is at $141.41, forming the first resistance zone. The monthly pivot at $148.13 forms the upper level of the resistance zone that bulls will need to push the price above to restore their hopes of recovery. So far, every rally into this zone has been promptly rejected. This type of behavior typically signals institutional selling, so it’s likely that somewhere along the way, they accumulated a large position.

The support structure between $107.18 (monthly S3) and $115.19 (200-day EMA) is currently the bulls’ last line in the sand. The monthly pivot support level at $107.18 is the line in the sand to keep the multi-year parabolic trend intact. A weekly close or 40% decline from the all-time high will activate stop-loss orders.

Importantly, the price structure is showing lower highs and lower lows since the peak in December, with failed bounce attempts occurring at increasingly lower levels. This bearish structure persists, despite Solana’s solid fundamentals. The range between $107-$141 most closely resembles a descending triangle, which favours a continuation to the downside unless bullish breakout confirmation comes with an increase in volume above the 50-day EMA.

Bulls Need Decisive Close Above $141 to Invalidate Bearish Structure

If the price recaptures the 50-day EMA at $141.41 (most likely in response to a BTC-driven breakout), the bulls will see a rally to the monthly pivot at $148.13. This will be facilitated by the significant improvements implemented in the Base network and their integration of tokenized assets. To confirm the aforementioned level as support, a weekly close is needed above $141.

Things will start to get really ugly below the 21SMA and EMA50 confluence around $120. We might see better levels over the coming weeks.

Considering the technical setup and the fact that positive news cannot change the course of the market, it is most likely that SOL will reach the 200-day EMA of $115.19 in the coming week before trying to recover. To find the next direction, the market would either have to experience a true capitulation below $107 or reclaim $131 on high volume.