Shiba Inu Futures Launch Fails to Halt 21.8% Monthly Slide as Bears Test Critical Support

Market Structure Shifts Lower

- SHIB tumbles 21.8% this month despite Coinbase and Gemini futures launches

- Bears eye $0.0000075 support after rejection at 20-day EMA resistance

- ADX surge past 38 signals genuine downtrend strength building

Shiba Inu has shed 21.8% over the past month, with price action telling a stark story of bearish dominance even as major exchanges rolled out regulated futures trading. The meme coin currently trades at $0.00000791, down from November’s $0.0000101 peak, as institutional product launches from Coinbase and Gemini failed to stem the selling pressure. What’s particularly revealing is how SHIB rejected advances at the 20-day EMA three times this week – a textbook sign of sellers defending overhead resistance. The main question for traders is: will the much-tested $0.00000754 monthly low hold, or are bears positioning for a deeper flush toward the psychological $0.0000070 level?

| Metric | Value |

|---|---|

| Asset | SHIBA INU (SHIB) |

| Current Price | $0.00 |

| Weekly Performance | -12.50% |

| Monthly Performance | -21.84% |

| RSI (Relative Strength Index) | 31.8 |

| ADX (Average Directional Index) | 38.4 |

| MACD (MACD Level) | 0.00 |

| CCI (Commodity Channel Index, 20-period) | -135.83 |

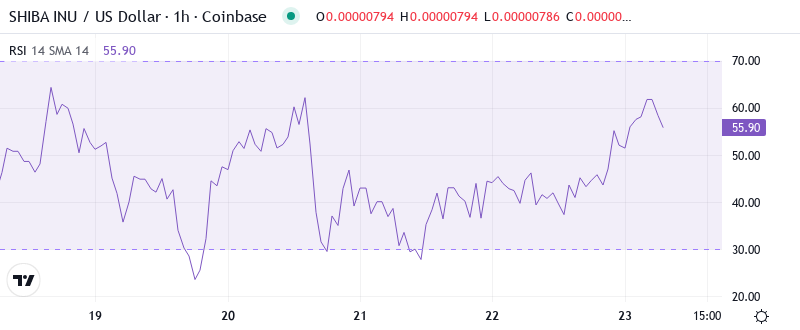

RSI at 31.8 Approaches Oversold Territory Last Seen in August

Reading the oscillator at 31.8, traders see momentum approaching levels that historically marked significant bottoms for SHIB. The daily RSI hasn’t touched these depths since the August washout that preceded a 40% relief rally – though crucially, that bounce came with broader crypto market support that’s absent today. Similar RSI configurations in early 2024 saw the token establish multi-month bases before trending higher.

So for swing traders, this near-oversold reading presents a double-edged setup. While the indicator suggests seller exhaustion approaches, the lack of bullish divergence means catching this particular falling knife requires exceptional timing. The futures launches theoretically provide more liquidity for bounces, but as this week demonstrated, new derivatives products can amplify moves in both directions.

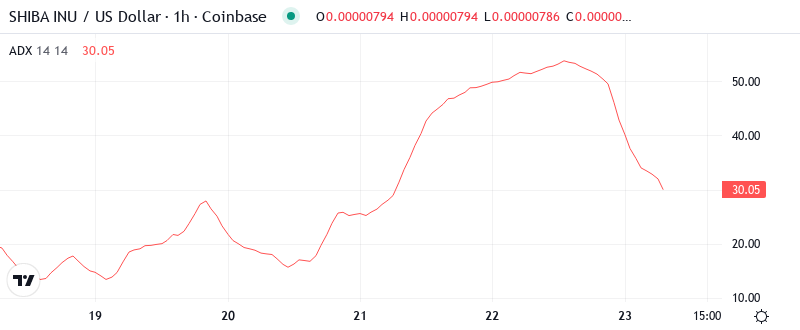

ADX Climbs to 38.4 – Highest Trend Strength Since Summer Collapse

Trend strength readings paint an unambiguous picture, with ADX surging to 38.4 – its highest print since July’s devastating unwind. At this level, the indicator confirms we’ve shifted decisively from November’s choppy consolidation into a mature downtrend. Basically, when ADX pushes above 35 while price bleeds lower, it signals conviction behind the selling rather than a mere correction.

Therefore, day traders should adjust strategies for trending conditions rather than mean reversion plays. The combination of high ADX and declining price typically sees continuation moves rather than sharp reversals. To clarify, the regulated futures that launched December 5th appear to have attracted shorts as much as longs, with the enhanced leverage accelerating SHIB’s descent through multiple support levels.

20-Day EMA at $0.00000889 Transforms Into Bearish Ceiling

Looking at the moving average structure, SHIB trades decisively below the entire EMA ribbon – with the 10-day at $0.00000842 and the 20-day at $0.00000889 both acting as dynamic resistance. Price attempted three separate rallies into these averages over the past week, each rejection coming on increased volume. The 50-day EMA looms far overhead at $0.00000984, roughly 24% above current levels.

More telling is the compression between the 10 and 20-day EMAs, which typically precedes explosive moves. Given price sits below both, probability favors that explosion to the downside. The 100-day EMA at $0.00001082 now represents distant resistance, while the 200-day at $0.00001209 marks the ultimate line for any bullish recovery thesis. Until SHIB reclaims at least the 20-day EMA on a daily close, sellers maintain complete technical control.

Monthly Low at $0.00000754 Becomes Final Support Before Psychological Levels

Resistance stacks up formidably in the $0.00000840 to $0.00000890 zone, where the 10 and 20-day EMAs converge with recent rejection points. Above that, the psychological $0.00001000 level that capped November’s rally would likely attract heavy selling if retested. The December high at $0.0000107 feels impossibly distant given current momentum.

Bulls desperately need the $0.00000754 monthly low to hold on any retest. This level has provided bounces twice already this month, but each rally proved weaker than the last. Below that, the chart shows an air pocket down to summer 2023 levels around $0.0000070, where the last major accumulation phase began.

The market structure reveals how the Coinbase and Gemini derivatives launches created a news-driven spike to $0.0000095 before reality set in. Rather than attracting new institutional capital as bulls hoped, the futures products seemingly enabled more sophisticated shorting strategies. With scam warnings from the SHIB team adding to negative sentiment, the technical picture aligns with fundamental headwinds.

Bears Target $0.0000070 Unless Bulls Reclaim 20-Day EMA Quickly

Bulls require a decisive close above the 20-day EMA at $0.00000889 to even begin repairing the technical damage. Such a move would need to come with ADX rolling over from extreme levels and RSI pushing above 40 to confirm momentum shifting. The regulated futures could theoretically provide the liquidity for a sharp squeeze if shorts get overextended.

The bearish scenario accelerates if $0.00000754 breaks on volume. That would likely trigger stop-losses from recent futures buyers banking on the derivative launches, opening a quick path to $0.0000070 or lower. At current ADX readings above 38, any breakdown would probably see follow-through rather than an immediate reversal.

Given the failed catalyst of institutional derivatives, persistent technical weakness, and absence of broader crypto market support, the most probable near-term path sees SHIB grinding between $0.00000750 and $0.00000850 while sellers reload. Unless Bitcoin stages a surprise Santa rally that lifts all boats, SHIB’s chart suggests lower prices ahead before any sustainable recovery takes hold.