RENDER Tests Critical $1.37 Support After Devastating 84% Annual Decline

Market Structure Shifts Lower

- RENDER trades at $1.37, matching both its weekly and monthly closing prices in a rare triple confluence

- The token has shed 84.5% from yearly highs, making it one of 2024’s worst-performing major altcoins

- Support at $1.35 has held six times since June, but momentum indicators suggest bulls are exhausted

RENDER’s price action tells a brutal story of decline, with the token trading at $1.37 after dropping 19.4% this week and 31.7% over the past month. The recent Upbit security breach that saw $36 million in Solana-based assets stolen, including RENDER tokens, added fresh selling pressure to an already devastated chart. What’s particularly striking is how the current price matches exactly with both the weekly and monthly closes – a technical oddity that often precedes decisive moves. The main question for traders is: can the $1.35 support that has held six times since June survive another test, or will this security breach become the catalyst that finally breaks the dam?

| Metric | Value |

|---|---|

| Asset | RENDER (RENDER) |

| Current Price | $1.37 |

| Weekly Performance | -19.42% |

| Monthly Performance | -31.74% |

| RSI (Relative Strength Index) | 30.2 |

| ADX (Average Directional Index) | 24.9 |

| MACD (MACD Level) | -0.14 |

| CCI (Commodity Channel Index, 20-period) | -169.54 |

RSI Plunges to 30.18 – Matching Historical Capitulation Zones

RSI sits at 30.18 on the daily timeframe, marking the first genuine oversold reading since the August washout that preceded a 45% relief rally. This momentum exhaustion comes after RENDER spent most of December grinding lower without any meaningful bounces, suggesting sellers have completely dominated the tape. The security breach news accelerated what was already a weak technical setup, pushing the oscillator into territory that historically marks short-term bottoms.

So for swing traders, this oversold RSI presents a classic mean-reversion opportunity – but with a major caveat. Previous drops to the 30 level in RENDER’s history have produced violent snapback rallies averaging 25-40%, yet each bounce ultimately failed at lower highs. The difference this time is the fundamental headwind from the Upbit hack, which could keep buyers sidelined longer than usual despite the attractive risk-reward from these bombed-out levels.

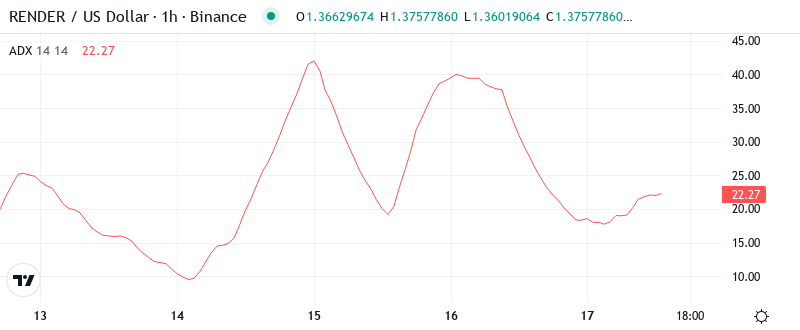

ADX at 24.94 Confirms Downtrend Gaining Fresh Momentum

Looking at trend strength, the ADX reads 24.94 and climbing, signaling that what started as choppy consolidation in early December has morphed into a directional move lower. The indicator crossed above 20 just three days ago, right as news of the security breach hit the wires – essentially pouring gasoline on an already bearish fire. To clarify, when ADX rises while price falls, it indicates the downtrend is gaining conviction rather than exhausting.

Day traders should adapt their strategies to this trending environment by avoiding bottom-fishing attempts until ADX peaks and rolls over. Historically, RENDER’s ADX readings above 30 have marked trend exhaustion points, so there’s still room for this move to extend before mean reversion becomes the higher probability play. The last time ADX hit current levels during a downtrend was October’s flush to $3.20, which then bounced 35% once the indicator peaked at 31.

All Moving Averages Stack as Resistance – 200-Day EMA at $3.49 Now Distant Memory

Price trades below the entire EMA ribbon, with even the shortest-term 10-day EMA at $1.50 acting as overhead resistance – roughly 9% above current levels. More concerning is how the 20-day ($1.61) and 50-day ($1.92) EMAs have compressed together, creating a thick resistance band between $1.60-$1.95 that would require significant buying power to reclaim. The 200-day EMA sits all the way up at $3.49, a staggering 154% above current price, highlighting just how severely this uptrend has broken down.

What’s particularly revealing is the speed at which these moving averages flipped from support to resistance. The 50-day EMA supported price through September and October before failing dramatically in November. Since then, every attempt to reclaim even the 20-day EMA has been aggressively sold, with the most recent rejection coming just before the Upbit hack news broke. This systematic failure at progressively lower moving averages paints a picture of distribution, not accumulation.

Support at $1.35 Faces Seventh Test as Resistance Towers Overhead

Below current price, the $1.35 level has emerged as the final line in the sand for bulls, having been tested six times since June’s correction. Each bounce has been weaker than the last, and with the psychological impact of the security breach fresh in traders’ minds, this seventh test carries extra weight. The monthly low at $1.35 provides exact confluence with horizontal support, but the lack of volume on recent bounces suggests buyers are exhausted.

Resistance stacks up formidably overhead, starting with the psychological $1.50 level that aligns with the 10-day EMA. Above that, the zone between $1.90-$2.15 represents massive overhead supply from October’s breakdown, coinciding with both the 50-day EMA and the monthly pivot points. For perspective, RENDER would need to rally 40% just to reach the first major resistance cluster – a tall order given current momentum readings.

The market structure resembles a descending triangle with a flat bottom at $1.35 and a series of lower highs since October. This pattern typically resolves to the downside, especially when fundamental catalysts like security breaches provide the push. Volume patterns support this bearish view, with each bounce attempt accompanied by progressively lighter turnover while selloffs see expanding participation.

Bears Target $0.75 if $1.35 Support Breaks on Volume

Should RENDER lose the $1.35 support on a daily close with above-average volume, the technical vacuum below points to the $1.00 psychological level as the next stopping point. The bearish scenario accelerates if the security breach fallout spreads beyond just price action to impact RENDER’s ecosystem partnerships or developer activity – factors that would transform a technical breakdown into a fundamental one.

Bulls require a decisive close above $1.50 to even begin repairing the technical damage, and realistically need to reclaim the 20-day EMA at $1.61 to shift near-term momentum. Even then, the overhead resistance clusters and the reputational damage from being included in a major hack would likely cap any relief rally around the $1.90-$2.00 zone where the 50-day EMA lurks.

Given the oversold RSI, the seventh test of major support, and the tendency for hack-related selling to exhaust within 72 hours, the highest probability scenario sees RENDER attempting a relief bounce from the $1.35 area toward $1.50-$1.55 before sellers re-emerge. However, if $1.35 fails to hold through the weekly close, the next significant support doesn’t appear until the psychological $1.00 level, implying another 27% downside.