Pi Network Tumbles 19% as DEX Launch News Fails to Spark Rally

Market Pulse

- Pi’s 19% slump over a week is a bit odd, given recent DEX and AMM news.

- A 47.1 RSI suggests weakening momentum, but without oversold conditions.

- $0.193 support held for the second time, after a December drop.

The price of PI hit an all-time high of $0.73 on June 14th, but since then it’s been a long march south as the altcoin suffered grueling 84.4% losses. Nonetheless, a localized uptrend throughout November moved the pump and dump token within touching distance of a bullish breakout before prices collapsed again. The price action is now confined within a downwards channel that has repelled all attempts of a sustained recovery, though bulls remain focused on holding $0.193 resistance turned support. A close below this barrier would position PI to retest the all-time low of $0.121 for the first time since mid-July.

| Metric | Value |

|---|---|

| Asset | PI (PI) |

| Current Price | $0.20 |

| Weekly Performance | -2.27% |

| Monthly Performance | -19.06% |

| RSI (Relative Strength Index) | 39.4 |

| ADX (Average Directional Index) | 18.7 |

| MACD (MACD Level) | -0.01 |

| CCI (Commodity Channel Index, 20-period) | -57.18 |

Momentum Exhaustion at 47.1 Without Capitulation Signal

The relative strength index is at 47.1 on the daily chart, per Bloomberg data. That represents a quick retreat from last week’s reading near 60 but still comfortably above the level of 30 that is often used to define oversold conditions. This mid zone signals that sellers have grabbed the wheel in recent days but haven’t yet led to the panicked washout that often acts as a precursor to bottoms in lousy markets. Same RSI setups in October were followed by another 15% drop before real demand emerged.

What is interesting to note is that despite all the positive DEX and AMM related developments, which in normal circumstances would at least trigger a momentum spike over 50, RSI has not really moved. For swing traders, this low oscillator response suggests that the market is not convinced about Pi’s transition to Open Mainnet timeline and hence any rallies can be quickly reversed until RSI can hold levels above 55.

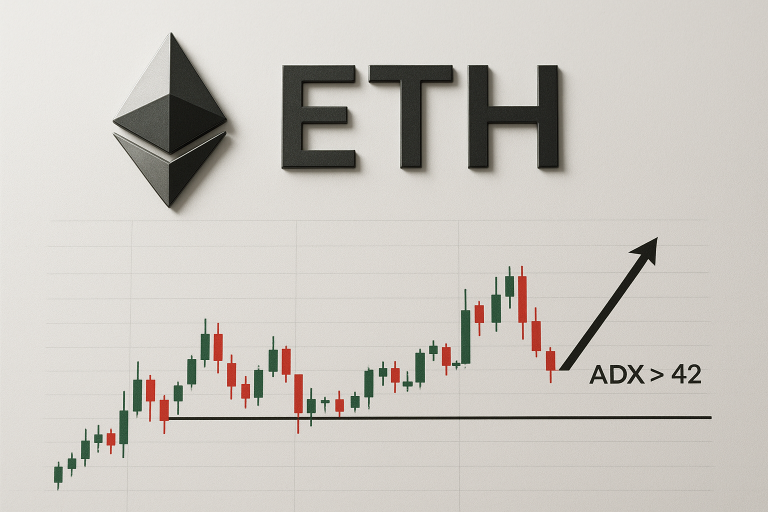

ADX at 18.7 Keeps Range Traders in Control

When ADX is trending above 25, a trading idea is often to wait for a pullback as with any strong trend readers can expect it to head to higher levels in due course. The Standing buy zone is seen at 50.82, 49.95 and 48.45. The Standing sell zone would be at 53.33, 54.44 and 55.93. The correlation of closing price to the 20-day simple moving average is 0.5%.

To put it simply, the low ADX is indicating day traders to not try trends trading and instead concentrate on range trading. This is because the market is not inclined either upwards or downwards, making it a situation where trades quickly made between support at $0.193 and resistance at $0.24 are at less risk compared to directional bets. As long as the ADX does not go over 25, we can expect to stay within the range and bounce back and forth.

20-Day EMA at $0.212 Becomes First Resistance After Support Failure

The price movement throughout the EMA ribbons indicates bearish dominance. PI is presently positioned beneath all the vital moving averages including the 10-day ($0.205), 20-day ($0.212), and most importantly, the 50-day EMA found at $0.22. Such a decisive breakdown of moving average support was exacerbated as the ecosystem updates failed to fuel the expected fundamental uptrend. A significant sustained volume increase and close above it might kickstart technical traders’ buyers back into gear. On the flip side, XLM could easily retest last week’s lows around $0.184 on a daily close underneath support at $0.197. The RSI has swung back into the bullish range just below 50, after rejecting from 40. Buyers would like to see it back above 60. The series of lower highs remain intact on the daily MACD and the Stoch, hinting at more consolidation.

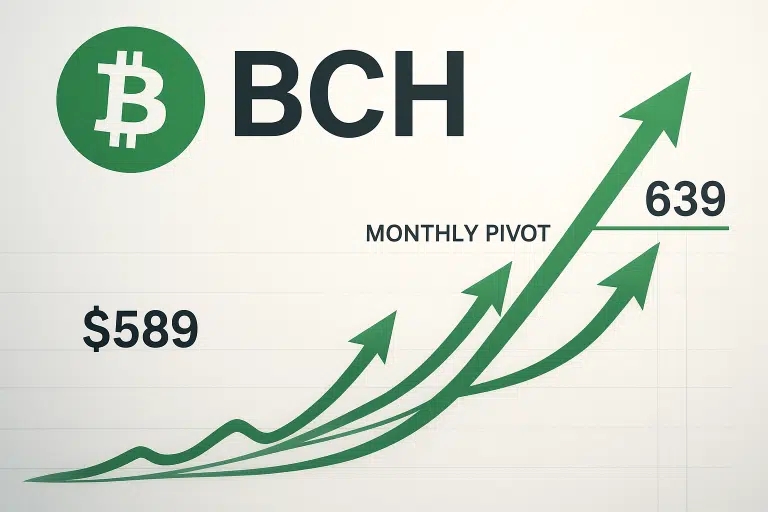

Double Bottom at $0.193 Meets Monthly Pivot – Critical Support Zone

There are multiple resistance levels that have prevented the price from a sustainable breakout in the last couple of weeks. The 20-day EMA at $0.212 has been the first hurdle and above this level, the psychological $0.24 has also played a significant role as it capped the last rally attempt in December. The monthly pivot at $0.196 is another resistance level. Buyers aggressively stepped in at the $0.193 low in early December, resulting in a strong pushback – if they are once again defending the same level there are compelling reasons to suggest that they will eventually wear down sellers and gravitate to resistance overhead.

Buyers taken out with a close below $0.193 could be trapped, fueling the decline. The project’s latest ETH value at $0.128 is a month and 2020 low near $0.120. An initial test of March’s monthly low could be in play. Note that 8-day protection rejected the latest decline. This may not hold on a retest.

Bulls Need Decisive Close Above $0.212 to Revive Rally Hopes

If the price recovers the 20-day EMA at $0.212 with force, the bulls will again attempt to push the price to the 50-day SMA at $0.22. The Open Mainnet transition schedule is the unknown factor that could act as a tailwind to push the price into a sustained recovery to the $0.24 overhead resistance. If the $0.193 support fails to hold on a daily closing basis, longs may exit en masse leading to a quick slide to $0.161, which is the monthly S2 pivot. This will mark the beginning of a new downtrend. To sum up, bears will be in the driving seat at levels not seen since this time in 2020.

The weak ADX, neutral RSI, and price stuck below all major EMAs suggest that the path of least resistance is sideways, bouncing between the 20-EMA and $0.198. Again, a break above $0.198 could trigger a rally to $0.212 or higher, while a break below the 20-EMA could result in a decline to $0.193.