PI Network Plunges 39% as AI KYC Overhaul Meets Legal Headwinds

Market Structure Shifts Lower

- PI drops 39% monthly amid $10 million lawsuit concerns and KYC system upheaval

- Technical breakdown accelerates below $0.23 support with ADX confirming trend strength

- Bears target $0.17 as momentum indicators flash capitulation signals

PI Network’s price action tells a story of mounting pressure, with the token shedding 39.22% over the past month to trade at $0.21 – a devastating drop that accelerated after news of AI KYC implementation challenges collided with a $10 million lawsuit risk. The weekly chart shows an even grimmer picture, with PI down 70% year-to-date, erasing months of gains as the project faces scrutiny over unrecognized price claims by its core team. The main question for traders is: has this washout created a bounce opportunity, or are we witnessing the early stages of a deeper unwind?

| Metric | Value |

|---|---|

| Asset | PI (PI) |

| Current Price | $0.21 |

| Weekly Performance | -10.14% |

| Monthly Performance | -9.83% |

| RSI (Relative Strength Index) | 36.6 |

| ADX (Average Directional Index) | 16.5 |

| MACD (MACD Level) | -0.01 |

| CCI (Commodity Channel Index, 20-period) | -142.45 |

Momentum Exhaustion Signals Capitulation Phase at 36.61

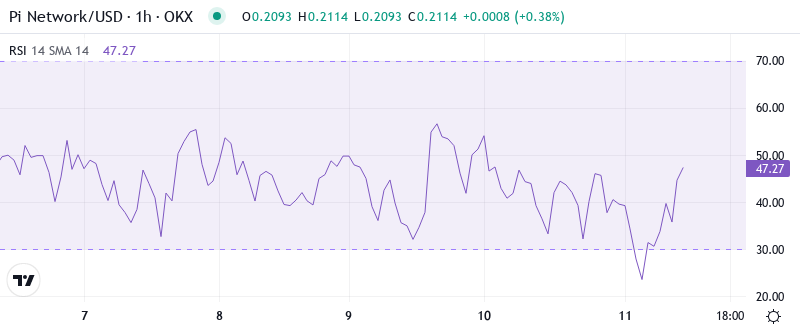

RSI sits at 36.61 on the daily timeframe, marking the first venture into oversold territory since the project’s earlier controversies. This reading reflects the intensity of selling pressure that followed the AI KYC overhaul announcement – a development that spooked holders already nervous about the pending lawsuit. What’s revealing is how quickly momentum collapsed from neutral readings above 50 just weeks ago, suggesting panic selling rather than orderly distribution.

Similar RSI configurations in crypto projects facing regulatory uncertainty often mark short-term bottoms, but the bounce quality depends entirely on news flow. So for swing traders, this oversold RSI presents a knife-catching opportunity with clear invalidation: any daily close below 30 would signal continuation lower toward $0.17. The wildcard remains whether the Fast Track KYC AI system implementation can restore confidence or becomes another source of FUD.

ADX at 16.50 Keeps Range Traders in Control Despite Volatility

Looking at trend strength, the ADX reading of 16.50 indicates we’re still in choppy, non-trending conditions despite the sharp decline. Basically, being in this zone means the recent drop represents more of a liquidity flush than an established downtrend – at least according to this indicator. The lawsuit news triggered the initial cascade, but sellers haven’t maintained directional conviction.

To clarify, the ADX is indicating that we haven’t switched to full trending conditions yet, which leaves room for mean reversion trades. Therefore, day traders should adjust their strategies for range-bound action between $0.204 (monthly low) and $0.23 (broken support turned resistance). Only an ADX climb above 25 would confirm a genuine trending environment, either for recovery or further breakdown.

Former Support at $0.23 Now Caps Recovery Attempts

Price action through the EMA ribbons paints a bearish picture. PI trades below the entire moving average stack, with the 10-day EMA at $0.222 already acting as dynamic resistance during yesterday’s relief bounce. More concerning is the gap to the 50-day EMA at $0.239 – a level that rejected advances twice this week as traders digested the core team’s stance on price recognition.

What’s significant is the compression between the 20-day ($0.228) and 30-day ($0.236) EMAs, creating a resistance cluster that coincides with the psychological $0.23 level. This confluence zone changed from being a support floor to a resistance ceiling after the KYC system overhaul news broke. Bulls must reclaim and hold above this entire EMA cloud to shift the narrative from breakdown to recovery.

$0.204 Monthly Low Becomes Line in Sand for Bulls

Resistance stacks heavy between $0.23 and $0.244, where broken support meets the 50-day EMA. This zone has transformed into a formidable barrier, especially with the lawsuit overhang creating selling pressure on any bounce attempts. The monthly pivot at $0.241 adds another layer of resistance, making it clear that bulls face an uphill battle even for modest recovery.

Bulls defend the monthly low at $0.204 as the last line of defense before deeper support at $0.161. This level has held through multiple tests despite the negative news flow, suggesting some buyers view current prices as attractive given the project’s user base. The repeated bounces from $0.204 indicate accumulation, though volume remains light – a sign that institutional interest hasn’t materialized.

Crucially, the market structure shows a series of lower highs and lower lows since the AI KYC implementation challenges surfaced. This bearish architecture remains intact until PI can reclaim $0.23 on volume and hold it through a daily close. Without that structural repair, the path of least resistance points toward testing yearly support at $0.161.

Bulls Need Decisive Close Above $0.23 to Shift Momentum

Should price reclaim the $0.23 resistance cluster with conviction, the technical picture brightens considerably. Bulls would then target $0.244 (50-day EMA) followed by $0.283 (monthly high), especially if the Fast Track KYC system proves successful in onboarding users. The lawsuit resolution timeline becomes the key catalyst for any sustained recovery.

The bearish scenario triggers if $0.204 support fails on volume – this would trap recent bottom-fishers and likely cascade toward $0.161 or even $0.08 (yearly support). Given the core team’s non-recognition of current trading venues, any additional regulatory scrutiny could accelerate this breakdown. Watch for daily closes below $0.20 as the first warning sign.

Taking into account the oversold bounce potential against the negative fundamental backdrop, the most probable near-term path is consolidation between $0.204-$0.23 while the market digests KYC implementation progress. Without clear lawsuit resolution or positive KYC adoption metrics, PI likely grinds sideways in this range before choosing direction. Risk-conscious traders should wait for either support to hold definitively or resistance to break before taking positions.