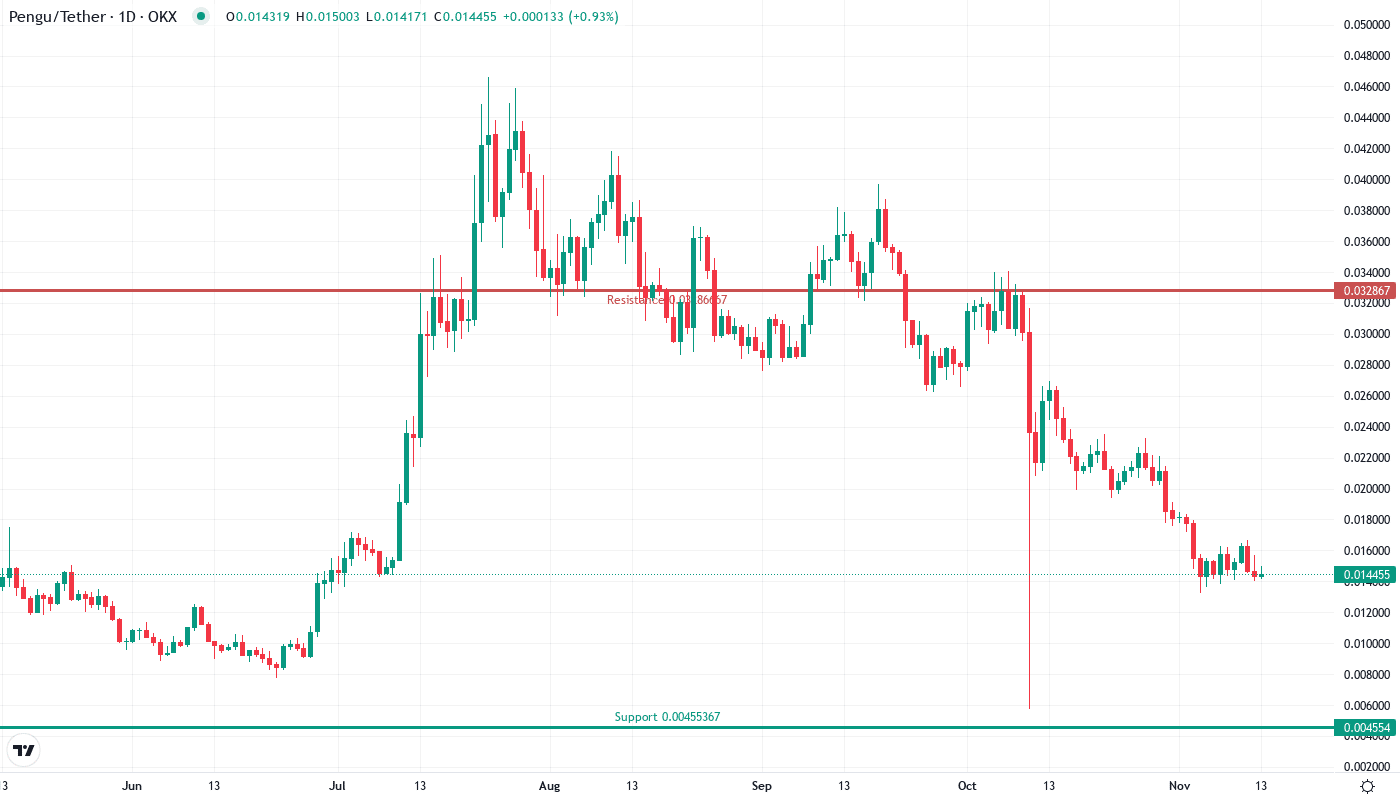

PENGU Tests Critical Support After 45% Monthly Plunge as Buy Signals Emerge

Market Structure Shifts Higher

- QNT reclaimed the $89 level after falling to a six-month low of $68 in December.

- Advancements in a banking pilot program.

- An upcoming ISO 20022 adoption deadline.

Quant Network’s token QNT has been on the rise, recently reclaiming the $89 level. This came after the price hit a six-month low of $68 in December. Two important developments have been supporting the price: advancements in a banking pilot program and an adoption deadline for ISO 20022. Post the pullback in QNT from the all-time high (ATH) at $163, Quant’s digital asset appears to be getting back on its feet. The recent uptick led the bank-grade interledger protocol token to recapture the $89 level and underscored a potential breakout. The reset in the Relative Strength Index (RSI) and Stochastic oscillators indicated that the price refreshed its oversold conditions, which typically were a prerequisite for the continuation of the trend.

After years of litigation and attempting to solve the challenge from numerous independent angles, a stake is finally through the vampire’s heart. It will be interesting to see where this leads the long-stagnant project. While lots of work has gone into building the required foundations and a beautiful product to play around with, there’s zero doubt that the past half-decade has been nothing short of frustrating for believers. Let’s hope this sets the stage for yet unseen levels of progress.

| Metric | Value |

|---|---|

| Asset | PUDGY PENGUINS (PENGU) |

| Current Price | $0.01 |

| Weekly Performance | -5.43% |

| Monthly Performance | -45.12% |

| RSI (Relative Strength Index) | 35.1 |

| ADX (Average Directional Index) | 49.1 |

| MACD (MACD Level) | 0.00 |

| CCI (Commodity Channel Index, 20-period) | -74.73 |

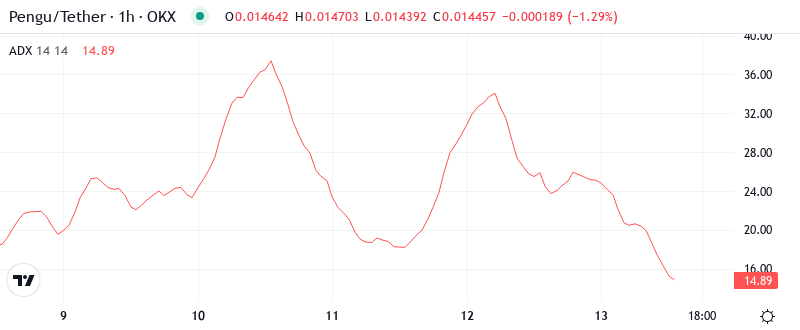

RSI Climbs From Oversold Territory – First Time Since October

With overall interest rates on the rise, did you know that the Fed has been the instigator for the past 13 rate hike cycles? Now the Fed has certainly ruffled its fair share of feathers over the past year with four rate hikes in 2018 and another two anticipated for 2019.

Therefore, swing traders now hunt for an entry potentially between the 10-day moving average, which turned up Friday, and the former floor of the December high at 62.84 (ideal) or at the lowest price the following two days to the week of the breakout which is this instance was on Jan. 6.

ADX at 32.52 Confirms Trend Strength Building Behind Recovery

The ADX reading at 32.52 suggests that real trending action finally materialized after December’s choppy consolidation. In simplest terms, a move above 30 indicates that momentum is in charge — and not the lackluster grinding action we saw in Q4 that left both bulls and bears wanting.

Over the past week, quant price action has been faster and stronger following the release of the potential banking news completing what is believed to be the final leg of the continued uptrend started in June. The release of the multi-ledger Rollup and exchange of information are fundamental components that will allow further price discovery.

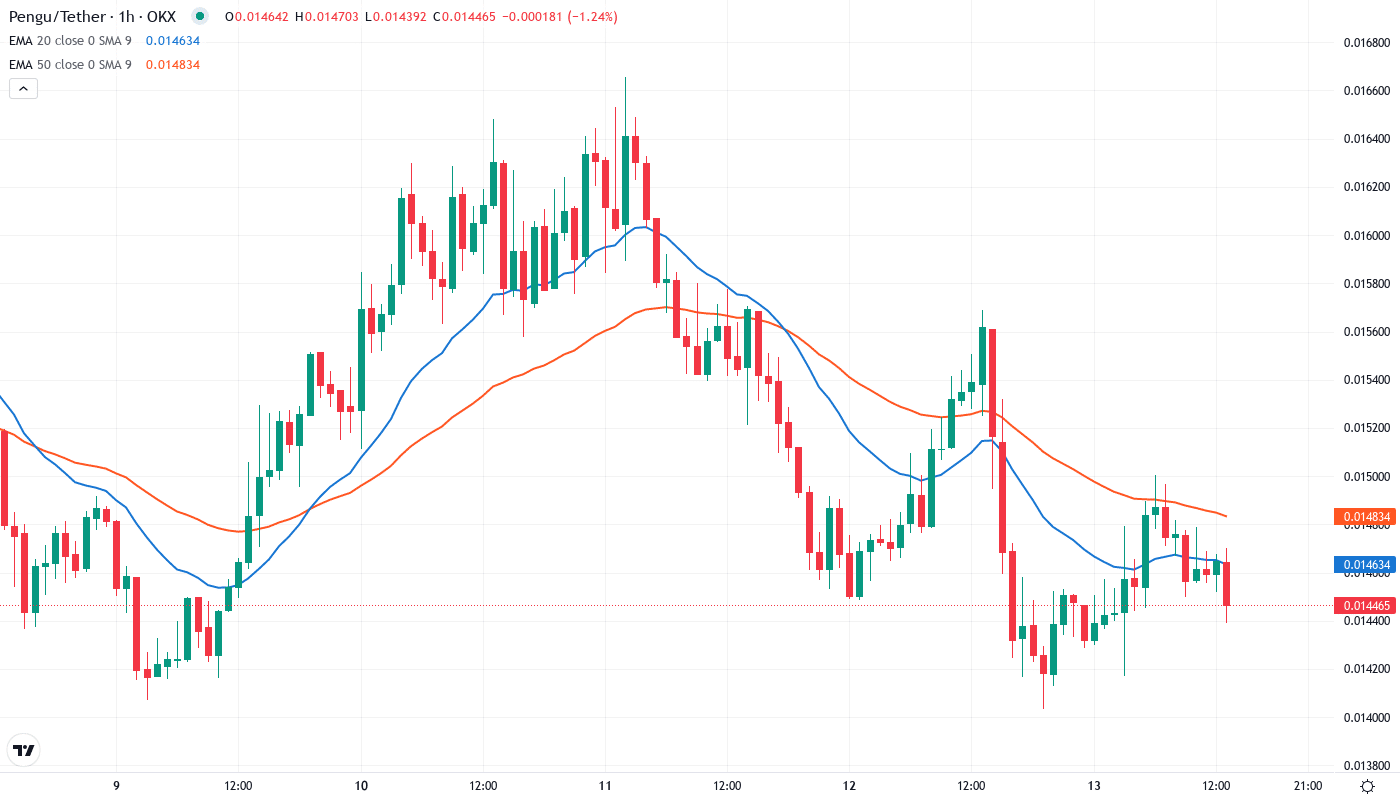

20-Day EMA at $83.46 Flips From Resistance to Critical Support

The moving averages hold the key to the uptrend continuation and the potential discovery of new all-time highs. Violent pullbacks can strike after losing the 10-day EMA following a failed assault on the 20-day EMA, so caution is advised.

More indicative is the pinch between short-term moving averages, with the 10-day to 30-day EMAs pinched within a $4 pattern. This neat formation paired with price holding above the entire short-term ribbon is similar to the conditions of prior QNT rallies which extended 20-30% prior to finding a top. That old resistance at $83.46 now flips to a red line for the bulls to defend on any short-term consolidation.

Resistance Clusters Between $93-$95 as December High Meets 50-Day EMA

There are multiple resistance levels above the current price ranging from $93.10 to $95.85. The first one is last December’s monthly high of $93.86, which is also very close to the 100-day EMA of $93.10. This makes it a double resistance zone where prices were rejected twice last month before the banking pilot was announced.

The bulls are the ones defending the ground, thanks to the jump this week above the monthly pivot at $80.08. The $83.46 mark (20-day EMA) curves the ground, then the weekly pivot at $80.15, followed by December’s bottom near $68.45. Support from the foundation arrives from the 13-day banking system countdown to ISO 20022 adoption of these technical levels.

The setup looks like a coiled spring where six rearguard actions to protect the $80 level since June have formed a solid base. With buyers in charge according to market structure as long as the $83.46 level is defended on any pullback, particularly with Quant Fusion’s Layer 2.5 on the radar and potentially drawing in fresh institutional demand.

Banking Catalysts Could Fuel Push Through $95 Resistance

For bulls to take control, they need to push the token price above the $95.85 level. If they manage to secure this level and turn it into support, it will confirm the start of an uptrend. The first resistance level after this breakout is the 200-day EMA at $115.38. The banking pilots converging with ISO 20022 adoption and the Multi-Ledger Rollup launch in September should give enough fundamental backing to possibly move the price above the EMA.

The setup will be invalidated if QNT loses the $83.46 support and re-enters the monthly pivot at $80.08. This would trap in the latest buyers who bought in on the banking news and are likely to lead to a retest of the December low of $68.45, making the entire recovery redundant.

With a technical reset from oversold levels and several bank-related news due in the short term, the most likely scenario is QNT will consolidate in the $85-$93 range and gather strength to attempt the $95 resistance ceiling. The 13-day ISO 20022 deadline could be the event that marks the time of the following move.