Ondo Tests Critical Support as Tokenization Expansion Plans Meet Oversold Territory

Market Structure Shifts Lower

- Цена снизилась на 25.6% за месяц, нивелируя рост за предыдущие три месяца.

- RSI опустился до редких экстремальных уровней перепроданности.

- Институциональная дорожная карта по токенизации до 2026 года создаёт технический минимум.

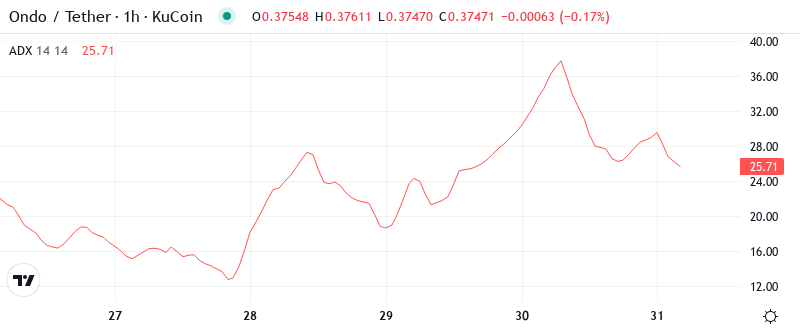

The price has decreased by 25.6% this month making the gained price of 3 months disappear. While RSI falls to rare levels, being oversold provides a positive factor for the coin. The institutional road map meant for tokenization up to 2026 gives a floor technically while it looks for initial support architecture. The immediate test is right between $0.360 and $0.375, with ADX indicating the strength of the real trend.

The sharp drop has seen Ondo move into deeply oversold ranges. The daily Relative Strength Indicator (RSI) has shifted steadily lower throughout November from 50, currently showing the most extreme oversold reading in Ondo’s brief trading history at 33. The 14-day RSI has experienced only one lower extreme at 23 in late September immediately prior to Ondo’s first major leg higher. Additionally, Ondo just entered oversold weekly territory for the first time on record, with the 14-period RSI finally falling under 50.

| Metric | Value |

|---|---|

| Asset | ONDO (ONDO) |

| Current Price | $0.37 |

| Weekly Performance | -3.09% |

| Monthly Performance | -25.61% |

| RSI (Relative Strength Index) | 34.7 |

| ADX (Average Directional Index) | 50.9 |

| MACD (MACD Level) | -0.03 |

| CCI (Commodity Channel Index, 20-period) | -74.68 |

RSI Drops to 26.83 – Matching Rare Capitulation Extremes

It’s possible a short-term bottom is in based on the RSI signature and a notable uptick in buy volume around 30.00. But for a sustainable Ondo rebound, some other metrics are worth watching. The daily MACD is the most oversold since the launch, and the bearish divergence has been in play since the June top also. Any relief rally will need to cool frothy selling and consolidate the breakdown for a bit. A successful retracement will print a bullish RSI divergence on the dailies, while the MACD line histogram improves.

What is interesting is that RSI hardly moved even after yesterday’s news of tokenization for the Solana ecosystem to digest. For potential swing trading, this momentum divergence indicates that news may not be fully incorporated yet or that more solid short-term drivers are needed for the market, with distant 2026 milestones likely insufficient. A weekly RSI of 19.78 is an even starker reflection of that, confirming multi-timeframe exhaustion, which is usually not supported for longer.

ADX at 50.88 Confirms Mature Downtrend Nearing Potential Exhaustion

When you’re on the wrong side of a stock like this, it’s as painful as it gets; and the automatic response is to sell, no matter how oversold it looks. But it becomes even more painful when the downfall extends longer and further than seems rational. The high ADX in combination with the oversold RSI is an interesting mix of technical conditions. Specifically, the trend is still firmly to the downside, but such extreme readings across multiple indicators indicate that we’re now in the vicinity of a possible turning point. Day traders will now need to adapt their game – this is no longer a choppy, range-trading environment but a trend-based arena that is likely to rebound quite sharply on completion of the exhaustion phase.

Price Trapped Below Entire EMA Ribbon Since Breaking $0.50

The current close under the 50-day EMA triggering automatic warning signs is perhaps less worrisome given the mounting volume (30 mil shares traded in just 3 days). Hence, we could be about to reach maximum selling exhaustion right as immediate technical conditions signal “sell”. The next support tier from here we can watch would be between October highs of $0.21-$0.23 as well as the base trend around $0.15.

The most important area of interest lies between the 20-day and 100-day EMAs, that is, $0.587- $0.714. For the foreseeable future, this range is set to define XRP’s prospects until either level breaks on high time frames. consective daily closes above $0.714, would set sights on the $1.00 psychological resistance — a price not seen for over four years.

Support at $0.360 Faces Immediate Test While Resistance Stacks Heavy

We have seen the $0.340 level come into play but failed to hold as new support. As we test the 100-day moving average, it is pivotal that we maintain the range for further consolidation to allow the market to reset. Should the range become resistance it is likely to see a cascade effect to the $0.280 low with stops being triggered.

Bulls are looking to defend multiple support areas immediately beneath current levels, with the psychological $0.30 level likely to act as the next significant floor should $0.360 fail. The monthly pivot point’s S1 at $0.286 adds to the structural support, but a decline to that level would mark another 25% loss. Past performance indicates that ONDO rarely hangs around below $0.35, hinting that this test will shape bias over the medium term.

Selling orders between $0.425 and $0.588 are extremely congested. This zone is home to the 10-day EMA at $0.476, the weekly pivot at $0.552, and the 20-day EMA at $0.587. Each of these areas is 13-56% higher than the current rate, which shows how significant the task is for buyers to even push into the neutral territories. The tokenization theme could act as the fundamental catalyst for such a relief rally, but technical damage needs time to heal after such massive declines.

Recovery Requires Volume Surge Above $0.425 to Shift Momentum

Buy the rumor, sell the news played out with the Equities All Access listing on the Chicago Mercantile Exchange and now we have traders looking for the pre-split stock tokenization to be a buy the rumor event. Mostly right now the XRP token holders are looking for any little reason to get that nearly 60% wick down move back quickly and stir new life back into their old worn out frozen bags.

If $0.360 support fails to hold, the drop is expected to continue to $0.30 and possibly the monthly S1 at $0.286 with pace quickening and stop-loss orders likely getting triggered at $0.333–$0.330. This could serve to trap some of the freshly initiated longs on the dip following planned tokenization and announcements of a new fiat on-ramp.

Because of how oversold the project is across the board, thanks to a small float of available tokens and the coming institutional roadmap news, our most likely scenario over the next several weeks is building a base/accumulation range between $0.36-$0.42. On the long-term downtrends, we do believe a 2026 event will see us trade much higher than that range. The new healthcare focused institutional demand and uptake should provide a nice foundation for the ONDO ecosystem ensuring an even more stable token environment moving forward although we cannot stop the after-tax bleeding for several more years.