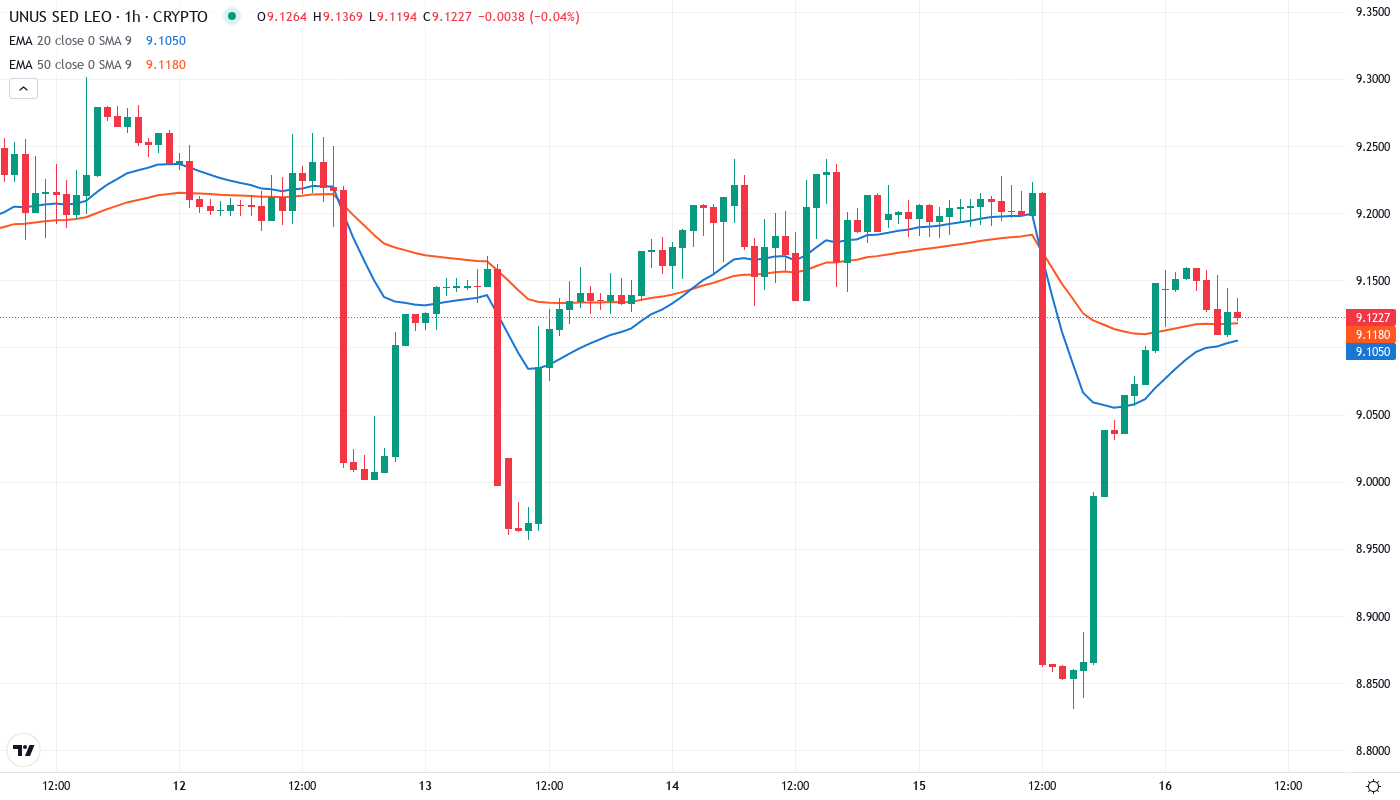

LEO Momentum Resets to 45.34 as Price Tests Critical Support at $9.14

Market Structure Shifts Higher

- LEO token trading flat at $9.14 after defending an important support level for the sixth time in two months

- 12-period EMA crossed above 26-period EMA, a bullish signal, while the MACD histogram is still decreasing

- RSI dropped to neutral territory at 45.34 and ADX climbed to 39.22, indicating the strongest directional movement since Q3

The LEO token is currently trading flat at $9.14, after the price managed to defend an important support level for the sixth time in the last two months. The 12-period EMA has crossed above the 26-period EMA, which is a bullish signal, but the MACD histogram is still decreasing. The RSI has dropped to neutral territory at 45.34, after overbought conditions in December. The ADX is also climbing and is now at 39.22, which indicates the strongest directional movement since Q3.

UNUS SED LEO’s focus concerns the controversy surrounding Bitfinex and decentralized exchange platforms. Bitfinex is working with an EOS-based DEX to gain market share and throughput while Mana, an EOS DEX, suffered an “arbitrage attack” with fake MANA flooding the market due to insufficient upfront costs for listing assets and shorts on margin trading applying excessive pressure. Focus on only one ISL-Compliant DEX with UNUS SED LEO Exchange can mitigate these risks. Buying crypto-assets with a credit card is unsustainable as XRP takes the largest losses, highlighting why investment/trading should be done on a margin.

| Metric | Value |

|---|---|

| Asset | UNUS SED LEO (LEO) |

| Current Price | $9.14 |

| Weekly Performance | 0.60% |

| Monthly Performance | -5.03% |

| RSI (Relative Strength Index) | 45.3 |

| ADX (Average Directional Index) | 39.2 |

| MACD (MACD Level) | -0.07 |

| CCI (Commodity Channel Index, 20-period) | -55.51 |

Oscillator Cools From 67 Without Capitulation Signal

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. RSI oscillates between zero and 100. Traditionally and according to Wilder, RSI is considered overbought when above 70 and oversold when below 30.

Based on the history of previous RSI pullbacks in larger timeframes, the odds clearly favor bulls compared to similar patterns that ended up marking the eventual top (with a general thesis that historically the 30 RSI level was where most of LEO’s larger timeframes bottomed for the yearly bull run). The decision of what to do here is fairly binary: close all leveraged positions and wait for a clearer direction or buckle up if you still have the net long exposure and attempt a swing scalp to recoup some of the unrealized loss against USD.

ADX at 39.22 Signals Mature Trend Nearing Decision Point

With the ADX at 39.22, we are seeing the strongest trending pressure since the summer – a ramp up from the choppier, range-bound trading witnessed throughout Q4. This higher trend pressure is coinciding with the token approaching key support/turning support into resistance, with the 20-week currently at $6.45. Therefore, consolidation at these levels is more likely to be viewed as a breather in a definitive uptrend than meaningless ranging. To reiterate, with ADX approaching 40 in the vicinity of a key support test, price tends to determine its larger intentions within a week or so.

Current trading conditions make trend-following strategies more advantageous than mean reversion strategies. An elevated average true range (ATR) and directional movement (ADX) signal strong trending behavior that also coincides with a lack of overbought or oversold readings in the relative strength index (RSI). This indicates that the market wants to move in a certain direction but hasn’t picked that direction yet. Buyers and sellers see the trend but are waiting for more confirmation. This sets up breakouts nicely.

20-Day EMA at $9.24 Becomes First Resistance After Support Flip

The daily closes underneath it since December 7th perfectly align with interim lows at $9.09, which is a level that must hold to prevent January’s bullish breakout from being fully retraced. This demand zone is marginally reinforced when drawing from December’s final bear trap of $9.06 and the $9.07 swing low earlier that month.

What is most indicative is the contraction among all short-term averages as the 10-day EMA is less than 2% from the 50-day at $9.32. This tight pattern reflects similar scenarios from recent quarters, which ultimately led to quite sudden 15-20% moves in one direction. The 100-day EMA at $9.34 provides an extra barrier to resistance, while the 200-day is far too low at $6.14 to be a support at this time. Bulls will need a daily close above the 100 at $9.33 to turn the short-term bearish EMA trend back in their favor.

Resistance Stacks Heavy Between $9.67 Monthly High and $10.17 Pivot

Sellers have created resistance above the current price by several key levels. The overhead supply zone extends from $9.67 (bi-weekly high from December) to the previous support line at $9.90. This zone is further strengthened by the 1:1 (orange) fib extension level sitting around $9.78. Additionally, 100-day MA is currently located at $9.70 making this zone extremely tough to breach.

The support architecture looks more positive as the $9.14 level has shown impressive staying power over six different occasions in the past eight weeks. A break below this crucial floor would likely see the monthly pivot at $9.39 as the first backstop, although it’s too close for comfort. The larger and more important underlying zone is between $8.60 and $8.63, where the monthly S1 pivot point and the November low come into contact and represent approximately 6% downside from current pricing.

This market structure isn’t the best for those looking to catch sustained moves. The consistent attacks on the $9.67 resistance have likely weakened it somewhat, but buyers probably won’t have a clear edge until a daily candlestick closes above it. The defense of the $9.14 support likely has bulls feeling confident, but considering how many times it’s been struck, stops should be placed slightly above it.

Bulls Require Decisive Close Above $9.67 to Reignite Uptrend

If the price were to rise and hold above the $9.67 monthly high by the end of the day, we would see a much more bullish technical situation. All EMAs would become support levels once again, and $10 level would become within reach at this point. The uptrend momentum is also very likely to give us a price target of $10.96 based on the weekly pivot high. The RSI is neutral, and the ADX is high, which makes us believe that we have enough power to go higher.

If the price tanks below $9.14 after lastly rejecting the three-month resistance zone from $9.31 to $9.32, the sellers may increase momentum, eyeing a breach of the pivotal $9.00 level. A more aggressive negative shift beneath this barrier could then violate the uptrend line drawn from the $6.54 low and possibly test the 50-day simple moving average (SMA) next, currently near the $8.80 level.

Based on the technical setup and prolonged consolidation phase, the most likely short-term scenario is more sideways price action between $9.14 and $9.67. The market seems to be comfortable absorbing the latest rally while getting ready for the next significant move. Ideally, traders should brace for a breakout in the next 1-2 weeks because tight EMAs, very high ADX values, and a flat RSI seldom coexist for long.