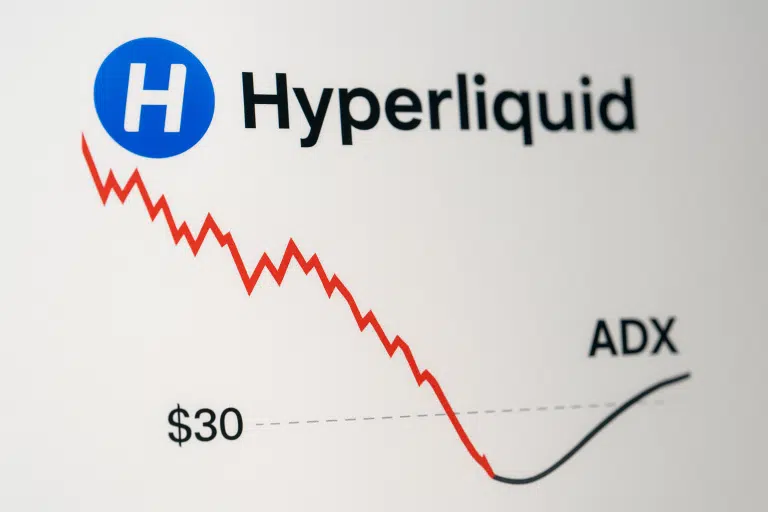

HYPE Tumbles 34% as Token Unlocks Trigger Cascade Below Critical Support

Market Structure Shifts Lower

Summary

- HYPE broke through various support levels and lost $14 over a fortnight.

- The token unlock overhang and $115 million in liquidations accelerated the slump.

- Bulls are making a last-ditch effort to protect $27 following the loss of the $35 mental barrier.

The native token HYPE of Hyperliquid has been absolutely destroyed over the past month, having dropped by 33.88% since December as fears of token unlock led to a destructive liquidation cascade that destroyed $115 million in leveraged positions. The descent from $41.63 to current levels of about $27.41 is more than a correction; it is the complete unraveling of the bullish structure that held the token since its launch. The primary question for traders is whether bulls can defend current levels at all, or if the selling pressure of the lock will push HYPE toward the psychological floor of $20?

| Metric | Value |

|---|---|

| Asset | HYPERLIQUID (HYPE) |

| Current Price | $27.41 |

| Weekly Performance | -21.01% |

| Monthly Performance | -33.88% |

| RSI (Relative Strength Index) | 33.5 |

| ADX (Average Directional Index) | 25.8 |

| MACD (MACD Level) | -2.47 |

| CCI (Commodity Channel Index, 20-period) | -140.35 |

Momentum Exhaustion Signals Capitulation Phase Complete

The Relative Strength Index (RSI) on the daily timeframe is parked at 33.46. This is the first time the token has been in oversold territory since its birth. It also implies that demand for selling is cooling off. In terms of the last month decline, RSI was an interesting indicator. It did not print one bounce above 50 levels indicating investor fear over the unlocking scenario kept on piling pressure.

It was seen that in other tokens that were in oversold conditions and were about to face unlock events, these conditions usually indicate a minimum price. However, for the price to recover the selling pressure needs to decrease. For swing traders, this RSI is too low in combination with the massive liquidation. Hence, we can expect a price rebound, but it will probably be limited as many investors will seize the opportunity to leave the project, and the unlock distribution will continue.

Weak ADX at 25.82 Confirms Trend Exhaustion After Month-Long Slide

When viewed through the trend strength lens, a universe of mediocre choices is understandable. Only with a strong knowledge and understanding of positions and risk can we act with courage, worry less about the “big ifs”, and selectively capitalize on opportunities showcased through the few uptrends in the market while avoiding the loss mines of stocks in downtrends.

In other words, if you see ADX dropping but the price of an asset remains relatively steady after a significant drop, it often indicates that the dominant impulse move has subsided. This means that in the sessions ahead, range traders could have more promising prospects than trend followers, especially if HYPE can build a base in the $25-30 range as the token unlock narrative solidifies and the market absorbs the recent bloodletting.

20-Day EMA at $36.89 Now Acts as Massive Overhead Resistance

The price action between the EMA ribbons is showing an extremely bearish scenario. HYPE is beneath all moving averages, while the closest one, the 10-day EMA which is at $35.89, is approximately 31% higher than the current price. Additionally, the more crucial 20-day EMA, currently at $36.89, switched from acting as support to becoming resistance during the December breakdown, blocking various relief rallies amid the unlock apprehensions.

The 50-day EMA is even higher at $41.19 and almost in perfect synergy with December’s peak, it is the resistance to defeat for the bulls in any recovery effort. The former support zone in the $35-36 area now morphs into an area that bulls must reconquer to imply some hiatus of bearishness – until that time, the technical relief stays bearish, and likely each bounce will lure new rounds of selling from those long at the subsequently high levels.

Support Crumbles at $30 While Resistance Stacks From $35 to $41

There is substantial support between $31.24 ($640-$650 in equivalent BTC) and $30 which held the lows from May and the January-March accumulation pattern. Failure to secure this level would signal $24 or worse is next and reinforce the threshold theory. Competitive spread premiums competed at the recent low and say algos could be instructed to widen these margins in times of intense liquidation pressure.

Bulls are trying to protect the remaining support, $27 being the latest line in the sand after the $30 broke down completely, which was a psychological level that had acted as a brief respite from the falling prices. Thereafter, it’s pretty much an air pocket down to $20 as there is no substantial historical support with HYPE being launched recently. The weekly pivot support would be the subsequent key target to the downside at $20.19 should the current levels give way.

The market structure indicates that there is extreme weakness as long as the price is stuck below $35. In December, the rounding top pattern concluded its determined action nearly flawlessly, the question now is if the bulls can build any base following this 51% slump from the quarterly top. If there is no catalyst that can change sentiment concerning the token unlock pressure, we’d say that the downside is the easiest path.

Token Unlock Resolution Required Before Any Sustainable Recovery

In order to reverse this risk and stabilize near the March and May highs, we believe the necessary conditions are: re-establishing $5 billion, or half, of the expected $10 billion of liquidity by July expiry, and executing another $5 billion by September; completing this rationale within the next week; notch a new recent organic order win; and optimize rapid deployment of the all-inclusive integrated Hyena offering to cultivate those new opportunities.

If the $27 support breaks, the next target is $20. New buyers would likely come in at the weekly pivot support.

Considering the technical damage and ongoing unlock uncertainty, the most likely near-term trajectory remains further volatile ranging between $25-30 as the market processes the recent breakdown and awaits visibility on token distributions. Either unlock resolution or substantial adoption related to the Hyena platform amalgamation would act as the necessary fundamental driver to underpin a proper recovery off these depressed levels.