HYPE Tests $27 Support as Governance Vote Proposes $1B Token Burn

Market Structure Shifts Higher

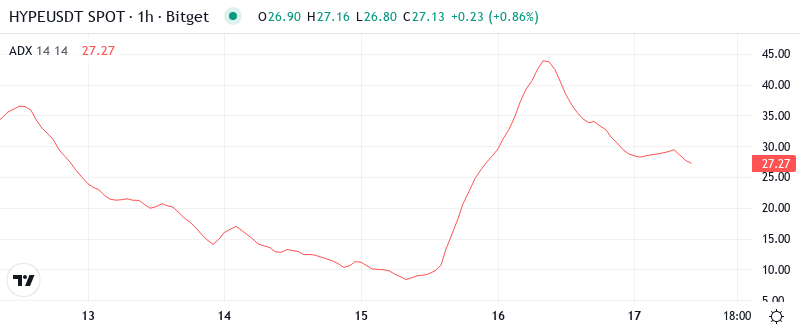

- HYPE has been hovering around $27 following a 30% drop for the month, with December’s lows providing a floor to the slide.

- There’s an offer on the table to put to a vote the incineration of the entire $1B stash of Assistance Fund shares.

- The HYPE token was created as the governance and utility token for Hyperliquid, a decentralised non-custodial smart-contract trading protocol built on the Solana blockchain that offers up to 1000x leverage.

Hyper-liquid is integrated with the main DeFi trading pairs on Raydium, Serum, and Mango, as well as the largest non-custodial liquidity pools like Orca and Dexlab. Hyperliquid’s competitive advantage is that it aggregates that liquidity into one pool and massively leverages those trades on both the Serum and Raydium DeFi markets, generating fees for stakers.

| Metric | Value |

|---|---|

| Asset | HYPERLIQUID (HYPE) |

| Current Price | $27.12 |

| Weekly Performance | -2.87% |

| Monthly Performance | -29.90% |

| RSI (Relative Strength Index) | 35.0 |

| ADX (Average Directional Index) | 27.9 |

| MACD (MACD Level) | -2.29 |

| CCI (Commodity Channel Index, 20-period) | -99.97 |

RSI at 45.94 Signals Neutral Territory After December Sell-Off

With the oscillator reading 45.94, indication reveals that the market has reset itself from overbought extremes but has not yet reached the oversold territory, which ideally sets up for both directional plays still in the realm of possibility. This neutral positioning after HYPE’s 985% annual performance of last year indicates that the ten percent pullback has successfully washed out some of the excessive leverage while not being able yet to reach panic selling often occurring with .30 RSI handles.

What is interesting to note is the manner in which RSI conducted itself throughout the decline from $41.63 to $27.12 and that is it never dipped below the 30 oversold threshold which implies that sellers have not been overly aggressive. Therefore, for swing traders, this equilibrium RSI suggests that the market has not yet run out of the selling steam, however, the governance vote event is the kindling that could lead to momentum swinging in the bullish direction if the token burn proposition is taken up by validators.

Weak ADX at 27.89 Keeps Range Traders in Control

The trend strength is weak as indicated by an ADX of 27.89 which is just above 25, dividing the range and trending markets. In other words, HYPE does not have sufficient direction for trend followers to thrive and the oscillatory price action observed in the previous week between $27 and $30 backs this absence of momentum.

To put it simply, the ADX suggests that we are moving from a very powerful downtrend as seen by the ADX above 40 in the middle of December, to more neutral conditions where neither the bulls nor the bears are in control. Thus, day traders will need to adapt to this phase and focus on range trades within the defined support at $27 and resistance around $31 until the ADX manages to rise above 30, indicating the start of a new directional trend.

20-Day EMA at $37.05 Becomes Key Resistance After Support Flip

The more aggressive bullish view is that rallies will have to start somewhere, and there is still sufficient room for an oversold bounce. The high-volume node extending from $24 to $28 could facilitate this bullish pivot if decisively reclaimed.

If the vote fails, the price seems almost guaranteed to test that support in the low-$20s now, and more than likely head even lower to test sub-$20 prices. Without an active buyback program in place, it’s not obvious where that demand will come from with all of these locked-up “free” tokens still in play to potentially unload. The chart remains “un-broken” as long as the all-important $21 holds as the closing daily candle – but the longer the pause, the harder it gets to ultimately make new all-time highs in the short-to-mid term future.

Resistance Stacks Between $31.40 Monthly Pivot and $39.83 R1

There are several resistance layers above the current price which will pose as a challenge for any potential recovery. Firstly, the monthly pivot is at $31.40 while the 10-day EMA is at $31.82, both critical resistance levels for the returning price. The 10-day also represents a one-week high207.

Bulls are those who are optimistic about the price of an asset and expect it to rise. In this context, bulls are defending the $26.09 level, which is considered a strong support level for the monthly timeframe. A support level is a level where historically the price has had difficulty falling below. The $26.09 level also coincides with the $25 handle, which is a psychologically important level for traders.

The market structure still looks constructive as long as HYPE holds above $26 on any pullback. Yet, consolidation seems the most feasible path considering that the distance from current price at $27.12 to the first significant resistance cluster at $31.40 implies that the gap will act as a magnet if not when the governance vote shows clearer which way the squeeze will go.

Token Burn Vote Creates Binary Outcome for HYPE Direction

Buy-side highs frame the overextension conditions and 0.618 retracement zone. Bears need to retake the $31 level alongside the EMA’s and recent demand barrier. A rise through the mid-$20s or low $30s are contrary structural breakouts until additional confirmation appears on the Volume Profile.

If things don’t go well, and if HYPE comes under this level, in this case, it will be easier to provoke fears for a downward trend. Both recent buyers in the dip and traders will be stimulated to automatically sell based on breakout rules heading toward $20.19. This is the level of institutional accumulation of the monthly S2 tokens on the annual basis.

Considering the oversold bounce potential, neutral momentum readings, and the upcoming catalyst of the Relief Fund burn vote, the most likely short-term scenario has HYPE consolidating between $26-$31 while the community and stakeholders mull over the governance proposal and its potential outcomes. Post-vote, anticipate price discovery type action as this binary result squeezes in-place shorts or stops weak-handed longs from rinsing above $31.40.