HBAR Tests Six-Month Support as Institutional Adoption Narrative Builds

Market Structure Shifts Lower

- HBAR price fell 23.2% to $0.1107, approaching six-month support at $0.1024.

- Bearish technical indicators dominate despite ongoing institutional developments.

- A daily close below support risks a drop to $0.08, while regaining EMAs is necessary for recovery.

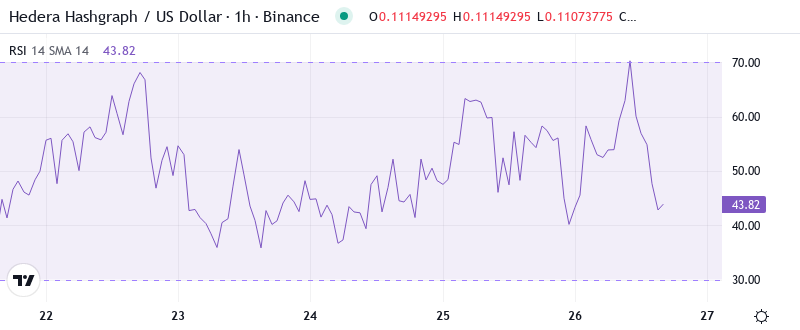

Hedera Hashgraph (HBAR) price declined 23.2% this week after penetrating the 61.8% retracement of the May-June downtrend at $0.1223 and forming a bearish engulfing candlestick on July 15. The loss was the largest since the week ending May 23, and it was the lowest weekly close since July 23.

HBAR descended by an elevator this week, losing 23.2% to $0.1107 as the broader market turned risk-off. It now hovers inches away from its six-month support at $0.1024, a level that has caught falling knives since June. What makes the current setup all the more intriguing is how price has become decoupled from the narrative – the institutional hints and enterprise partnerships keep coming, but sellers have shown up in numbers instead. The pressing question for participants, then, is whether the institutional narrative will be enough to anchor this and provide sufficient demand, or if the technicals will persist and drive this lower.

| Metric | Value |

|---|---|

| Asset | HEDERA (HBAR) |

| Current Price | $0.11 |

| Weekly Performance | 5.34% |

| Monthly Performance | -23.19% |

| RSI (Relative Strength Index) | 36.3 |

| ADX (Average Directional Index) | 35.3 |

| MACD (MACD Level) | -0.01 |

| CCI (Commodity Channel Index, 20-period) | -54.83 |

Momentum Exhaustion Signals Capitulation Phase Complete

The daily Ichimoku Cloud suggests this corrective process remains ongoing after the bearish TK Cross during the first week of February could not be successfully crisscrossed. HBAR’s 50-day simple moving average (SMA) also edged below its 200-day SMA at that time, following the couple of death crosses that occurred earlier in the month.

Therefore, traders should exercise caution as the oversold bounce scenario also creates a potential bull trap where buyers are lured back into the market by the bounce only to be steamrolled by the realization that the broader downtrend is still intact. That said, technical reversion-to-the-mean rallies can cause violent short-covering rallies as we saw on September 22nd.

ADX at 35.25 Confirms Sellers Control the Trending Move

When assessing the strength of a trend, the ADX reading is the go-to indicator and anything over 25 is considered a strong trend. A reading over 50 signals an extremely strong trend, and some traders will use this level as a measure to maximize leverage to their positions. Conversely, anything below 20 calls into question the integrity of the trend.

As a result, day traders must play the short side until ADX on the daily chart drops below the 25-level, telling us that the weak hands have given up their positions. Counter-trend longs face considerable risk because that high 70s ADX reading tells us that the weak hands are using every rally to escape their losing positions. The adoption story that will be in every newsletter and on every financial TV channel this year hasn’t translated into buying yet, so technicals will have total control of price discovery for weeks to come.

20-Day EMA at $0.1186 Caps Rally Attempts After Support Flip

Looking above, the first battleground will be the 10-day EMA at $0.1125, followed by the 20-day at $0.1186, which combined act as the first critical resistance zone. The dashboard is going to start flashing some warning signals if we don’t start seeing daily candle closes back above these levels soon.

What stands out here is how the 50-day EMA has flipped. It was solid support during the accumulation phase in November, neatly catching wicks for the retests. Now on roughly 24% to the upside, the EMA has turned into significant resistance. The 200-day EMA is all the more distant, sitting at $0.1774, and marks the line in the sand for bull/bear market structure. To even begin considering re-taking the 20-day EMA, the bulls would first need to break the current area followed by resistance on resistance cluster.

Defense Lines Form at $0.1024 as Bulls Guard Six-Month Support

The immediate resistance ranges between $0.1186 (20-day EMA) and the $0.12 level. The monthly pivot at $0.1563 and the resistance near $0.1510 form a strong resistance zone. To break through this zone, substantial volume will be required. The institutional adoption news could be the driver of this volume but first, the price will have to prove that there is enough demand at these levels.

Bullish hopes remain pinned on the $0.125 breakout – this must be reclaimed to give a sustained recovery real legs to tackle the recession resistance at $0.15-$0.155. Current price still padlocks >10% below this with the MT bullish structure teetering on the edge of breakdown, close to its first bearish cross in a month.

The market structure shows an important inflection point is near. The squeeze between $0.1024 support and $0.12 resistance leaves a 17% range that will need to give way shortly. ADX is confirming trending conditions with momentum extremely oversold. The next direct move should be pretty explosive as the bearish technicals fight against the bullish fundamentals with the institutional year “not normal”. They are setting up for divergence, which usually ends with a bang in one direction.

Technical Breakdown Targets $0.08 Unless Bulls Reclaim $0.12

To change the current bearish short-term trend, the bulls additionally need to push past the 20-EMA and establish support above these levels. This would likely push the price to test 50-day EMA resistance of $0.14. A positive breakout above this level could eventually lead the price towards the $0.15 resistance point.

If the $0.1024 support fails to hold on a daily closing basis with solid volume, the bearish scenario activates. This would indicate the long-term range has been breached to the downside and likely lead to a quick, sharp move to $0.08 as stop-losses are triggered. The $0.08 level represents the last defensible bottom and is roughly 28% below the current price.

Due to the oversold bounce potential, institutional narrative, and six-time tested support just below, the highest probability path in the near term would be HBAR consolidating between 0.1024-0.12 while momentum indicators reset from extremes. This sideways digestion would allow the 20-day EMA to catch up to price where then a more optimal risk-reward setup occurs for the next directional move possibly with institutional news as the fundamental catalyst for a trend change.