HBAR Tests Critical Support at $0.139 as Institutional Momentum Builds

Market Structure Shifts Higher

- WBTC integration brings Bitcoin liquidity to Hedera’s institutional-grade network

- Six-time tested support at $0.139 holds despite 44% correction from yearly highs

- ADX climbs above 27, signaling shift from choppy to trending conditions

Hedera’s HBAR has undergone a devastating 44% drop from its yearly high of $0.220, yet the token demonstrates resilience at the $0.139 support level that has been tested six times since June. The integration of Wrapped Bitcoin (WBTC) onto Hedera’s network arrives as institutional interest accelerates, with the token’s inclusion in ETFs and a 43% Q3 market cap surge providing fundamental tailwinds despite the technical correction. The main question for traders is: can this battle-tested support level hold as new DeFi integrations and institutional partnerships reshape the network’s utility?

| Metric | Value |

|---|---|

| Asset | HEDERA (HBAR) |

| Current Price | $0.14 |

| Weekly Performance | -9.80% |

| Monthly Performance | -15.91% |

| RSI (Relative Strength Index) | 37.0 |

| ADX (Average Directional Index) | 27.1 |

| MACD (MACD Level) | -0.01 |

| CCI (Commodity Channel Index, 20-period) | -98.68 |

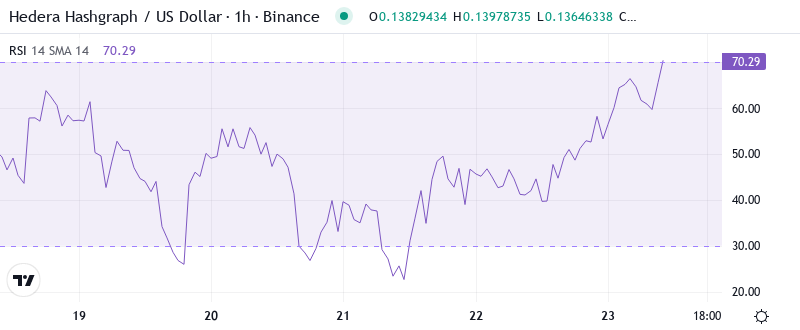

RSI at 46.72 Signals Neutral Territory After December’s Capitulation

Reading the oscillator at 46.72 on the daily timeframe, traders see a perfectly balanced momentum picture – neither overbought nor oversold, with orders viable in both directions. This neutral positioning follows December’s washout from overbought conditions above 70, creating what technical analysts recognize as a healthy reset that often precedes sustainable moves higher.

Similar RSI configurations emerged in September before HBAR’s surge to yearly highs, suggesting the current setup could attract accumulation from institutional players now entering through ETF vehicles. So for swing traders, this balanced RSI reading combined with the WBTC integration news means patience pays – wait for directional confirmation above 50 or a dip toward oversold territory near 40 before committing to size.

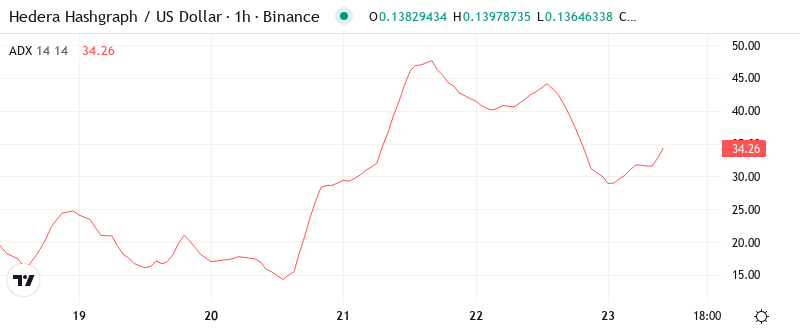

ADX at 27.08 Confirms Trend Strength Building From Compression

At the level of 27.08, the ADX entry indicates that trend strength is gaining power but hasn’t reached extremes yet. Basically, being in this zone means HBAR has transitioned from the sub-20 choppy conditions that dominated early December into a trending state where directional moves carry follow-through – precisely the environment where the new Global Partnership Program announcement could catalyze sustained price action.

To clarify, the ADX is indicating we’re switching from boundary conditions to a trending state where momentum strategies outperform mean reversion. Therefore, day traders should adjust their strategies to this change by riding breakouts with wider stops rather than fading moves at range extremes, especially as institutional flows from the reported ETF inclusions tend to create persistent directional pressure.

20-Day EMA at $0.155 Becomes First Resistance After Supporting Rally

Price action tells a clear story through the EMA ribbons – HBAR trades below the entire moving average structure with the 10-day ($0.144), 20-day ($0.155), and crucially the 50-day EMA at $0.174 all sloping downward. This bearish alignment developed after price failed to hold above the 20-day EMA in late December, transforming what had been reliable support during the Q3 rally into overhead resistance.

What’s more revealing is how the 50-day EMA at $0.174 now represents a 25% move from current levels – a substantial gap that underscores the technical damage done during the correction. The 200-day EMA sits far below at $0.139, essentially matching current price levels and explaining why this zone has attracted buyers six times since June, particularly as the WBTC integration promises to bring Bitcoin’s $1.5 trillion liquidity pool to Hedera’s ecosystem.

Resistance Clusters Between $0.155 and $0.174 as Monthly Pivot Looms

Above current price, sellers have stacked multiple resistance layers with the 20-day EMA at $0.155 converging with December’s volume point of control, while the 50-day EMA at $0.174 aligns with the monthly R1 pivot. The psychological $0.20 level looms as the ultimate test, representing both the round number that attracted profit-taking in December and the gateway to reclaiming the yearly high at $0.220.

Bulls defend a more comprehensive support structure thanks to the confluence at $0.139 where the 200-day EMA meets horizontal support that’s held since June. Below this red line, the monthly S1 pivot at $0.109 offers a safety net 21% lower, though the expanding DeFi ecosystem and 43% Q3 market cap jump suggest institutional buyers would likely step in well before such levels.

This market architecture reveals accumulation patterns typical of smart money positioning – repeated tests of support without breakdown while resistance levels get progressively cleared on each attempt. The Global Partnership Program launch adds fundamental momentum to this technical setup, potentially providing the catalyst for HBAR to finally clear the overhead supply between $0.155 and $0.174.

Bulls Require Decisive Close Above $0.155 to Shift Momentum

Should price reclaim the 20-day EMA at $0.155 with conviction, the technical picture shifts dramatically – this would flip the first major resistance to support and open a path toward the 50-day EMA at $0.174. Bulls need this close to coincide with rising volume as the WBTC integration goes live, confirming that institutional flows are entering rather than just short covering.

The bearish scenario triggers if HBAR loses the $0.139 support that’s held six times – such a breakdown would trap recent buyers attracted by the ETF inclusion news and likely flush positions toward the monthly S1 at $0.109. Volume expansion on any test of $0.139 becomes critical; light volume suggests another successful defense, while heavy volume warns of capitulation.

Given the neutral RSI, rising ADX, and fundamental catalysts from WBTC integration and institutional adoption, the most probable near-term path sees HBAR consolidating between $0.139 and $0.155 while the market digests December’s correction before attempting another leg higher powered by expanding DeFi utility.