GateToken Tests Critical Support as Layer 2 Launch Fails to Spark Recovery

Market Pulse

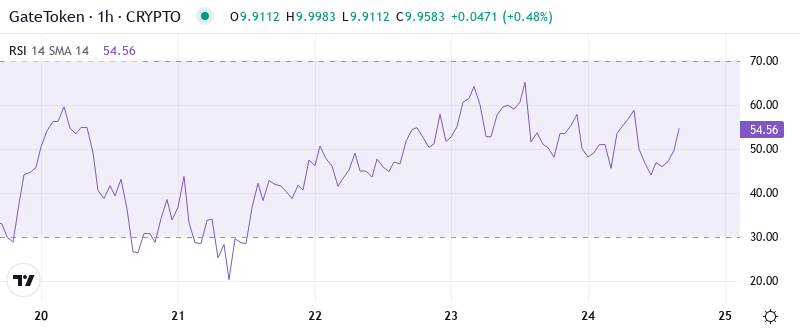

- The current price of GT is $9.98, which is a weekly decrease of 9.2% even after the release of the Layer 2 network, where GT is exclusively used as gas.

- The Relative Strength Index (RSI) is at 25.1, indicating the first oversold condition since August.

- The $9.20 level of support is being tested for the sixth time this month and strong resistance levels are aggregating near $11.15.

The current price of GT is $9.98, which is a weekly decrease of 9.2% even after the release of the Layer 2 network, where GT is exclusively used as gas. The Relative Strength Index (RSI) is at 25.1, indicating the first oversold condition since August. The $9.20 level of support is being tested for the sixth time this month and strong resistance levels are aggregating near $11.15.

Rephrasy has a lot to say about this topic. “This week, the price of GateToken was down 9.2% to $9.98, despite the launch announcement of the Layer 2 network with GT as the exclusive gas token. Traders are now left wondering whether the market is expected to catalyze oversold conditions as an opportunity or if more downside is in store. The understated news of the positive ecosystem combined with the continuous sales showed how this happened in real-time. Traders must ask themselves: will the oversold perform and the Layer 2 feature create support here, or will the price inevitably decrease until it finds its core demand?”

| Metric | Value |

|---|---|

| Asset | GATETOKEN (GT) |

| Current Price | $9.98 |

| Weekly Performance | -9.18% |

| Monthly Performance | -36.22% |

| RSI (Relative Strength Index) | 25.1 |

| ADX (Average Directional Index) | 59.9 |

| MACD (MACD Level) | -1.04 |

| CCI (Commodity Channel Index, 20-period) | -107.55 |

Momentum Exhaustion Signals Capitulation Phase at 25.1

The Relative Strength Index (RSI) is an oscillator that measures the speed and change of price movements. The RSI oscillates between zero and 100. Traditionally the RSI is considered overbought when above 70 and oversold when below 30. Wilder recommended a smoothing period of 14 days. RSI can be used to identify the general trend, overbought or oversold conditions, and potential buy or sell signals. RSI can also be used to identify the general trend. If RSI is above 70, it indicates that the stock is overbought and likely to decrease in the near future. If RSI is below 30, it indicates that the stock is oversold and likely to increase in the near future.

What is interesting to note is that RSI almost did not react to the news about Layer 2 which could mean that this was already factored in by the market and the negative sentiment on the whole crypto space was simply too strong to let TFUEL react positively to any news. So, for a swing trade, this extremely oversold RSI coupled with a substantial utility upgrade presents a high-probability rebound opportunity, however, it is an extremely risky knife to catch, considering the 36% fall for the month.

ADX at 59.9 Confirms Mature Downtrend Nearing Exhaustion

In terms of moving averages, the 21-week MA has been a fabulous indicator for Bitcoin over the past year and a half, ever since the Covid crash in March 2020. A break below that point with history as our guide has never ended well for bulls, with support only found at the 200-week MA much lower. In fact, it was that break of the 21-week MA that set Bitcoin up for the 2018 -84% bear market back in June of that year. It’s currently slicing through the 21-week MA as we speak.

So, day traders must be prepared for higher volatility because this extreme ADX reading indicates that the prevailing downtrend is probably over. When the RSI is oversold and the trend strength is exhausted, it becomes ripe for any kind of positive news to cause shorts to panic. That, in turn, can lead to powerful rallies. ADX readings above 60 have usually resulted in a 15-20% bounce over a couple of days.

50-Day EMA at $12.93 Becomes Distant Resistance After Support Failure

The ribbon analysis doesn’t look much better, with the token in its longest period trading below all of the short-term EMAs since the listing price in April. There are no discernible buy signals on the horizon if more time is needed to rebuild interest following the delayed launch, but gutting through the high fees on Uniswap or taking on even more debt aren’t viable long-term solutions if the token continues to plummet.

The news was strongly bullish, yet price continued falling. The announcement of a Layer 2 scaling solution reducing transaction costs and fee sensitivity had a massively positive impact on on-chain sentiment, but that just wasn’t enough to counter the tide of paper hands booking profits on a dead-cat bounce off support turned resistance.

$9.20 Support Faces Ultimate Test While Resistance Layers Stack Above

There are some rough supports nearby, like $9.15 which is the daily low but doesn’t amount to much beyond there. $8.62 and $7.50 handle the decline down reasonably well, with the latter also a point of contention during multiple retests chronicled earlier in the year.

Bulls are defending multiple layers of support beneath the current price, with the nearest floor at $9.20 having its sixth try this month. Yet it has stayed with each push up to this point, gradually wears the support with each attempt. The follow-up is the August low of $8.16 if $9.20 gives up, which is 18% further down from here.

The market has now shifted back into a liquidation phase. In an environment where 90% of projects are effectively crypto-equity of the parent chain, there is naturally an ingrained understanding of the value proposition. Many of these assets will become worthless.

Bulls Require Daily Close Above $10.39 to Confirm Layer 2 Recovery Narrative

If the price reclaims the 10-day EMA at $10.39 and closes above it, bulls may aim for the $11.15 to $11.42 resistance area which is home to the 20-day EMA plus a psychological resistance level.

If the $9.20 support doesn’t hold when confronted with significant volume, the setup fails after six tries. We have to assume that a breakdown of this support level could lead to stop-loss orders being triggered in quick succession, causing further downwards pressure to the $8.16 level. This could become the seventh test of yearly lows, and in this case, we would have to conclude that not even ecosystem upgrades will prevail when the technicals turn negative.

With the technical setup and Layer 2 launch not able to trigger an immediate rally, the most likely short-term scenario is a relief rally to $10.39-$10.80 then retesting guidance. A positive uptrend requires $11.15 to confirm the utility story counts, but oversold indications imply a bounces at a minimum before lower levels are reached.