Ethereum Faces Critical Test as Price Hovers Near Multi-Month Support

Market Pulse

- Ethereum was able to lose 15% of its value and now it is $3,532 after the price falling to weekly lows at $3,058. It is less than a month since this incident happened

- Even though the price has dropped, JPMorgan has remained firm on its intention to tokenize traditional banking on Base, thus, as the first to do so, it ensures the establishment of the momentum of institutional adoption

- The technical analysis provides convincing evidence of the price compression, which results from the presence of lower resistance levels and higher support levels

Ethereum’s price trend is presenting a situation of the market seen from two sides. One side is the sharp decline of 15% of the token which is from $4,158 to the current price of $3,532, while the other side is the implementation of the institutional projects that are just the opposite. The announcement of JPMorgan that the token-driven banking services will be based on Ethereum-compatible infrastructure was at the same time that whales removed 28,262 ETH from Binance, which suggests the presence of an electronics sub-floors. The principal issue which is causing a lot of questions among the traders: can the institutional keys put an end to the opposite technical effects, or the pattern charts will prevail over the fundamental market events?

| Metric | Value |

|---|---|

| Asset | ETHEREUM (ETH) |

| Current Price | $3532.72 |

| Weekly Performance | 7.48% |

| Monthly Performance | -14.95% |

| RSI (Relative Strength Index) | 43.6 |

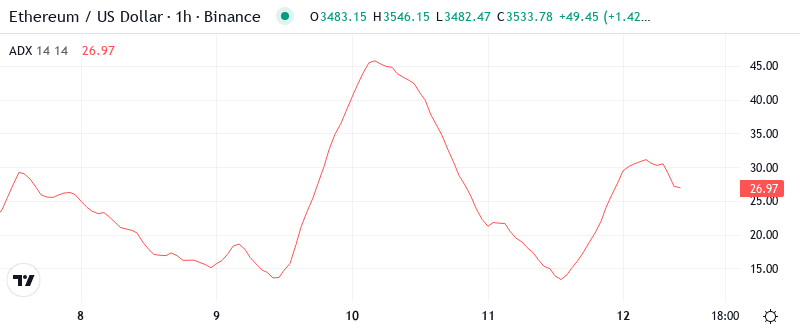

| ADX (Average Directional Index) | 32.7 |

| MACD (MACD Level) | -155.68 |

| CCI (Commodity Channel Index, 20-period) | -56.47 |

RSI Momentum Signals Neutral Territory

The RSI indicator for the daily timeframe of ETH shows that it is trading in the middle range, reading at a value of 52.25. This means that ETH is neither in an overbought nor in an oversold position at this level. This was the position with a sharp increase from the state of being oversold under 30 only a few weeks back when ETH went down to $3,058. The same RSI rebound trend from the oversold position in September was the trigger for the price rise to $4,266, but it was realized in a more organized market.

Swing traders can apply the neutral RSI strategy to make a guess about the asset’s performance in both directions with no immediate limitations on momentum. The RSI is at 43.56 which shows that no major trend has been fatigued, while the monthly RSI reading of 55.34 denotes that the upward trend is still existing though some recent weakness has been experienced. Definitely, the JPMorgan’s tokenized banking information is providing the fundamental winds of the market and, any RSI increase over 60 could be the rebuy interest which corresponds to the core idea of institutional adoption.

ADX Shows Trend Strength Building

The ADX rating of 32.68, which reflects the moderate strength of the trend being formed after weeks of choppy consolidation, is the initial sign. By this token, it appears as if we are changing from a range dull market to a directional economy, even though the latter is still in the balance. The increasing of ADX above 30 is indistinctly the marker signifying that the rollover of trading has changed into new behavior thus, the current levels are particularly relevant for the position sizing.

It would be day traders’ adjustment of the tactics as a necessary one for the current reshaping of the market features. The ADX indicator turned to be more dominant; thus, it is no longer appropriate to engage in those pure mean reversions that worked well during the sideways phase at $3,400-$3,800. The more appropriate way is to operate with momentum continuation patterns which make the trading scheme more credible witnessing the build-up of directional conviction as per the given market structure. The fact that the 28,262 ETH whale directly withdrew from Binance simultaneously with the ADX move show the smart money that is positioning for the main shift.

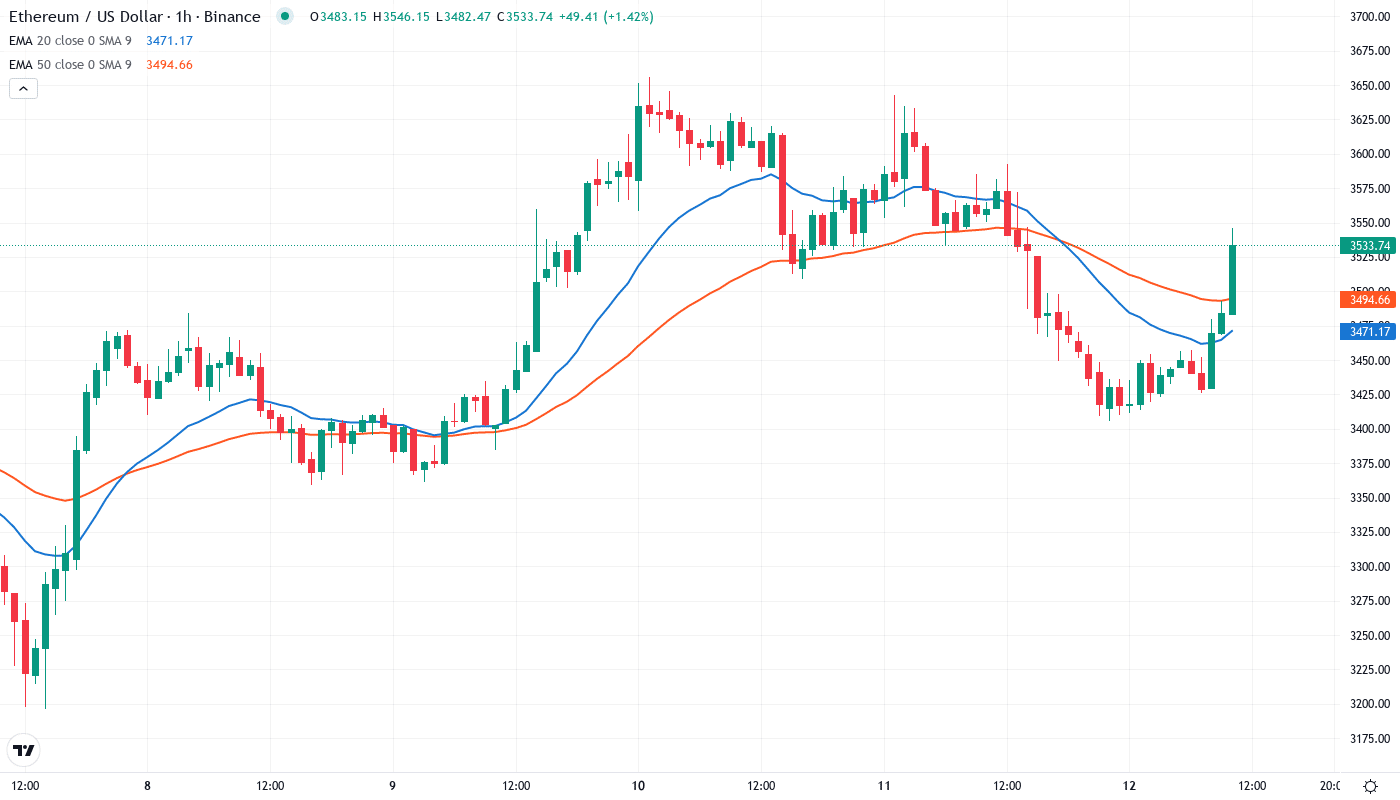

EMA Structure Reveals Compressed Battlefield

The price action is still at the cut-off point of the coming together of the exponential moving averages with Ethereum trending just a notch below the 10-day EMA of $3,536 and receiving the support of the 20-day EMA at $3,653. However, the number one most important of the indicators, the 50-day EMA, at $3,874, is the one holding guard against the immediate move up as it has turned back two attempts this month only. The dense EMA ribbon has a spring effect and the upcoming directional break is a big event.

The $3,021, 200-day EMA serves as an essential bull-bear marker, which is exactly $500 lower than the present levels. The testing of this long-term average in December was the final straw for the downtrend and later resulted in a higher low. Currently, the news of the institutional adoption of JPMorgan that acts as an underlying driver, forces this battle to 50-day EMA, the level that has transferred its role from the safety net to the barrier in November and is still intact since then.

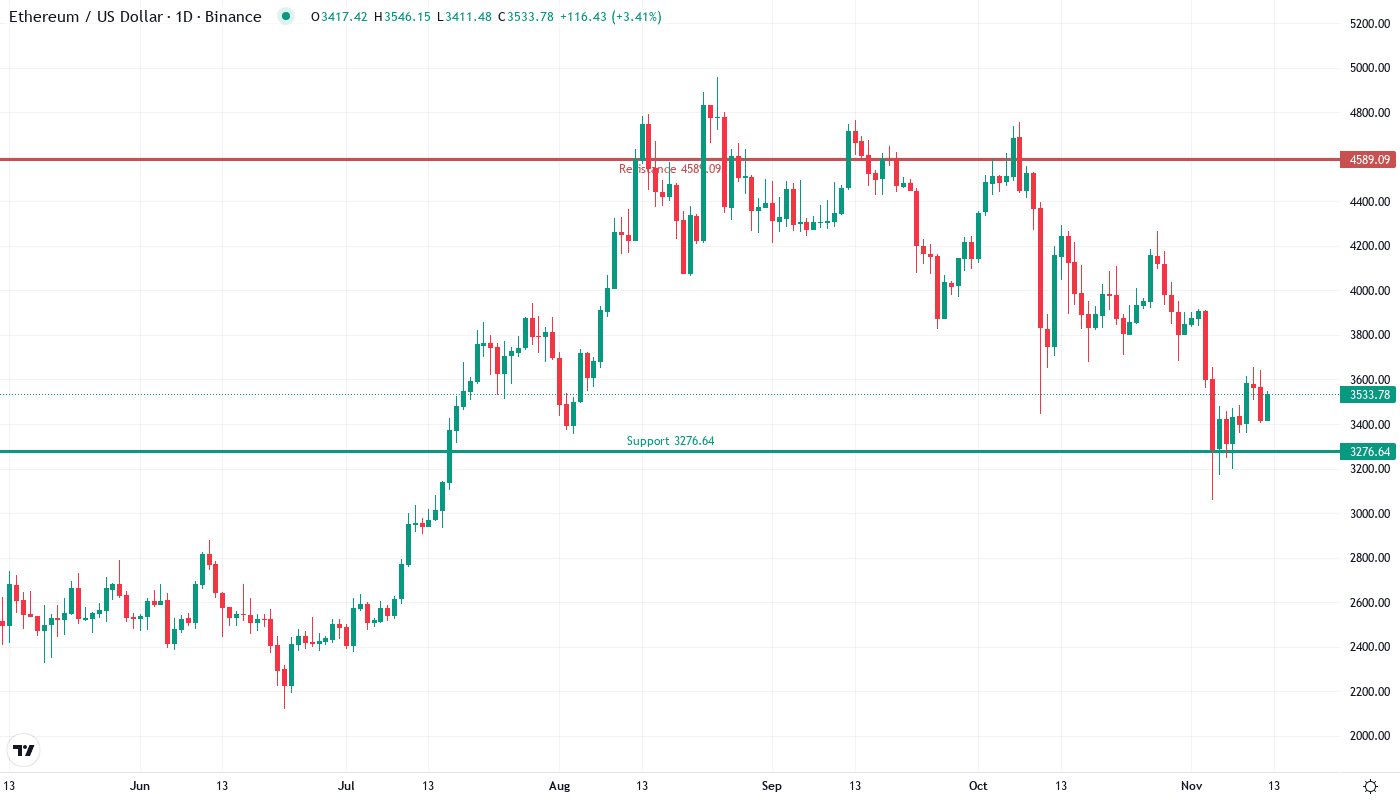

Critical Support and Resistance Zones Define Risk

Immediate resistance bands stay in range of $3,870-$3,926, where the 50-day EMA meets with old support that turned to resistance from early December. This area has given back two different rally efforts over the past three weeks, which proves its establishment as the main obstacle that has to be jumped by bulls to invert the trend. Furthermore, the psychological $4,000 level corresponds to the pivot highs of November thus forming an even stronger wall that necessitates heavy volume to breach.

The recent success of the $3,058 week defense has led to a higher backing of the framework which is different. The weekly low, which is the same with the Pivot S1 level of this year at $3,276, has formed a confluence zone that has been the target of aggressive buying. I now consider that the immediate support is at $3,387 where the monthly low cuts the horizontal structure from October. Any significant breakthrough beneath this would create a path to the 200-day EMA which is near $3,021, however, the level might be secured by the natural buying pressure due to the increased institutional interest through the blockchain initiatives of JPMorgan.

An Uptrend-and-Downtrend Trading Handbook

Bulls need a decisive daily close above $3,874 to reclaim the 50-day EMA and signal trend reversal. Such a move would target the resistance cluster at $3,926-$4,000 where profit-taking likely emerges. The combination of institutional adoption news – JPMorgan’s tokenized banking and continued whale accumulation – provides fundamental fuel if technical triggers align.

The outlines mark a shift of play for the bears who would seize the control if the price reverses back hard at the current level and break $3,387 support accompanied by volume. The situation that is provided mentions a retest of the $3,058 weekly low after which the $3,021 EMA could be affected if the cold wave is powerful enough. The network congestion caused as a result of the 70% rise in Uniswap which may carry a negative effect on the price of ETH since folks are dealing with high gas fees.

The technical analysis of Ethereum which is a type of cryptocurrency, instead of the Ethereum Tracker Fund which is an exchange-traded fund tracking Ethereum or something else is as follows. According to the present momentum indicators and the changes in the institutional sector, it is almost certain that the cryptocurrency will move within the price range of $3,350 to $3,750 for a while, after having completely digested the volatility it went through. As long as JPMorgan is in the news or making some statements, it represents a new fundamental floor for the prices, and shorting the asset becomes way less of a chance, thus, the only problem is the technical resistance which is against quick rises until otherwise it is proven.