Ethereum Battles Key Support as Fusaka Upgrade Approaches

Market Structure Tests Critical Levels

- ETH defended $2,820 support after dropping 27% from monthly highs

- Fusaka upgrade launches tomorrow promising speed and cost improvements

- Technical setup mirrors August’s oversold bounce configuration

Ethereum’s price action tells a tale of two timeframes this week. The second-largest cryptocurrency held steady at $2,820 despite shedding 27.2% from December’s peak of $3,913 – roughly $1,093 erased in what became a systematic unwinding of overleveraged positions. The Fusaka upgrade scheduled for tomorrow adds a fundamental catalyst to an oversold technical picture, with BitMine’s aggressive 7,080 ETH accumulation signaling institutional conviction at these levels. The main question for traders is: will tomorrow’s network upgrade provide the spark for a technical bounce, or does ETH need to flush lower before finding sustainable support?

| Metric | Value |

|---|---|

| Asset | ETHEREUM (ETH) |

| Current Price | $2820.54 |

| Weekly Performance | -4.49% |

| Monthly Performance | -27.20% |

| RSI (Relative Strength Index) | 34.5 |

| ADX (Average Directional Index) | 43.2 |

| MACD (MACD Level) | -161.91 |

| CCI (Commodity Channel Index, 20-period) | -99.38 |

RSI at 34.46 Matches August’s Capitulation Zone

What’s revealing is how RSI behaved during this month’s washout compared to previous corrections. The daily oscillator now sits at 34.46, marking the first genuinely oversold reading since August’s capitulation below 30. That August dip preceded a 45% relief rally over the following six weeks, though market conditions differed substantially with less institutional involvement back then.

Interestingly enough, the weekly RSI remains healthier at 40.51, suggesting the longer timeframe structure hasn’t broken despite December’s violence. So for swing traders, this divergence between daily oversold and weekly neutral creates an interesting risk-reward setup – especially with the Fusaka upgrade potentially shifting sentiment tomorrow. Historically, major network upgrades have sparked at least short-term rallies as traders position for improved fundamentals.

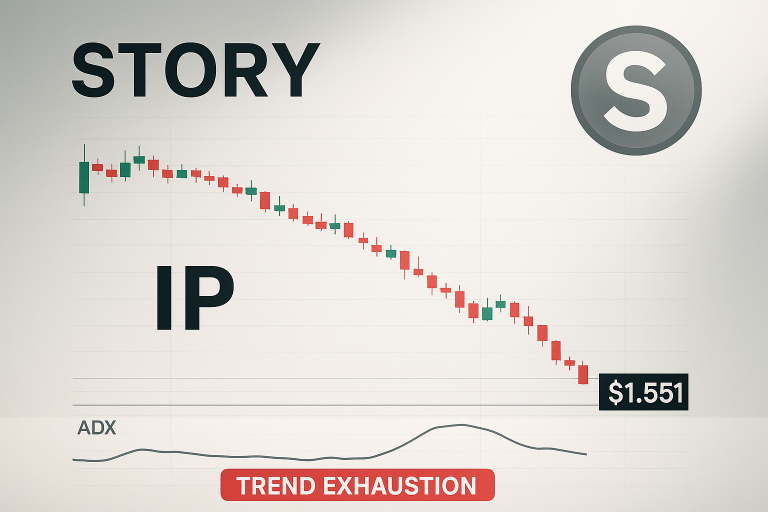

ADX Spike to 43.24 Signals Mature Downtrend Nearing Exhaustion

Looking at trend strength, the ADX reading of 43.24 on the daily timeframe indicates we’re dealing with a powerful directional move – but one that’s approaching historical reversal territory. Basically, when ADX climbs above 40, it often marks the final capitulation phase rather than the beginning of a new trend. The December selloff generated enough momentum to push this indicator into rare territory last seen during the May 2022 crypto winter washout.

To clarify, ADX doesn’t predict direction but rather trend strength, and readings above 40 typically exhaust themselves within days rather than weeks. Therefore, day traders should prepare for increased volatility as this extended move loses steam – the Fusaka upgrade timing couldn’t be more interesting from a technical perspective. BitMine’s whale-sized accumulation during peak ADX readings suggests smart money sees value where retail sees panic.

50-Day EMA at $3,369 Becomes Next Resistance Target

The moving average structure paints a clear picture of overhead resistance. ETH currently trades well below its entire EMA ribbon, with the nearest resistance sitting at the 10-day EMA around $2,933. More importantly, the 20-day EMA at $3,038 aligns closely with the psychological $3,000 level – this confluence creates a formidable barrier for any relief bounce attempt.

What’s significant is the compression between the 20-day and 30-day EMAs, currently separated by just $124. This tight configuration often precedes explosive moves as the market chooses direction. The 50-day EMA at $3,369 represents the major resistance that bulls must eventually reclaim to shift the intermediate trend – but that’s a 19.5% climb from current levels. Tomorrow’s Fusaka implementation could provide the fundamental ammunition for an initial attack on these resistance layers.

Support Architecture Holds at $2,820 Despite December’s Violence

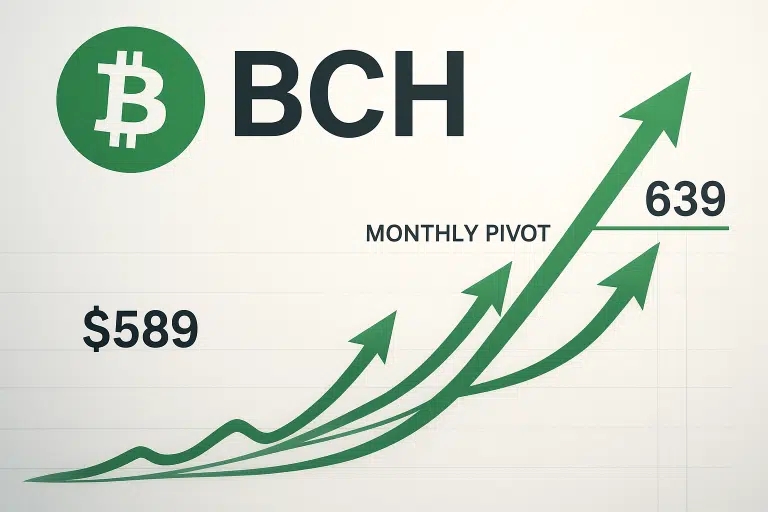

Bulls defend multiple support layers between $2,820 and $2,435. The immediate support at $2,820 absorbed three separate tests this week without breaking – each bounce showed decreasing volume, suggesting sellers exhausted their ammunition. Below that, the monthly S1 pivot at $2,475 provides secondary support, though a break there would likely trigger stop-loss cascades toward the yearly low near $2,274.

Resistance clusters between the weekly pivot at $3,176 and December’s breakdown level at $3,290. This $114 zone trapped late buyers during the initial December decline and will likely see heavy selling on any retest. The monthly pivot at $3,290 adds another layer of resistance, creating a triple confluence that won’t surrender easily.

Crucially, the price architecture shows buyers defending key levels more aggressively than in previous corrections. BitMine’s public accumulation at these levels, combined with Vanguard finally opening doors to crypto ETFs, suggests institutional players see current prices as a gift rather than a threat. The convergence of technical oversold conditions with fundamental catalysts creates an unusual setup heading into tomorrow’s upgrade.

Relief Rally to $3,176 Most Probable Near-Term Path

Should price reclaim the 10-day EMA at $2,933 on volume following tomorrow’s Fusaka launch, bulls could target the weekly pivot at $3,176. This represents a manageable 12.6% move from current levels – well within historical post-upgrade rally parameters. The combination of oversold daily RSI, exhausted ADX readings, and positive fundamental catalysts provides multiple tailwinds for this scenario.

The setup fails if ETH loses $2,820 support on heavy volume, especially if the Fusaka upgrade disappoints or encounters technical issues. A daily close below $2,820 would likely flush positions down to $2,475, potentially triggering another 12% decline. This would trap recent dip-buyers including BitMine’s aggressive accumulation, though their conviction suggests they’re playing a longer game.

Given the technical configuration and tomorrow’s catalyst, the most likely short-term path is for ETH to stage a relief bounce toward $3,000-3,176 before meeting serious resistance. The Fusaka upgrade provides a narrative shift from December’s pure technical selling, while institutional accumulation at these levels suggests smart money expects higher prices ahead – even if the path there remains volatile.