Dogecoin Tests Critical Support as ETF Reality Check Meets Nasdaq Buzz

Market Structure Shifts Lower

- Daily trading volume for Dogecoin (DOGE) climbed to a two-month high above $1.1B.

- DOGE has failed to gain price traction.

- The alt dropped 17.5% over the past month.

Dogecoin has been a battleground between the spot and ETF markets over the past month, resulting in a technical breakdown below $0.142 and a cluster of swing lows at $0.123. The ETF side has seen overwhelming retail interest via the ProShares DOGZ-IBO defensive growth index, with shares outstanding climbing to $487 million, marking the largest uptake for any ETF entering 2023. This retail appetite hasn’t been matched by institutional capital, and as such, ProShares DOGZ-IBO has struggled to gain a foothold above the $0.140 resistance in any of the October-to-November ramp-ups. DOGE’s spot market performance has been a complete 180, with fresh swing highs created at $0.281 last week alongside blood-spill collapses to $0.2291. Additionally, cumulative trading volume is over $12.5 billion. High spot trading volumes suggest that spot traders are actively engaging DOGE’s actual liquidity and the ETF market’s momentum.

| Metric | Value |

|---|---|

| Asset | DOGECOIN (DOGE) |

| Current Price | $0.13 |

| Weekly Performance | -11.40% |

| Monthly Performance | -17.51% |

| RSI (Relative Strength Index) | 37.2 |

| ADX (Average Directional Index) | 37.9 |

| MACD (MACD Level) | -0.01 |

| CCI (Commodity Channel Index, 20-period) | -131.40 |

RSI at 37.21 Signals Oversold Territory Without Capitulation Panic

With that in mind, more downside can’t be ruled out but countering a rally attempt could be rewarding for bears given the lack of persistent selling this month. Technically, flukey would-be buyers should want to extend the slide towards $0.10 and the previous Q4 double bottom. Any outsized lurches should immediately expose interested bull market 50%, 62% and 79%.

Therefore, for swing traders, this balanced oversold reading is an interesting setup – we are low enough to attract dip buyers but not so devastated that panic selling has fully run its course. The $1.1bn daily volume despite ETF woes actually confirms this view, as it shows that spot market participants are still at play even as the institutional products wobble.

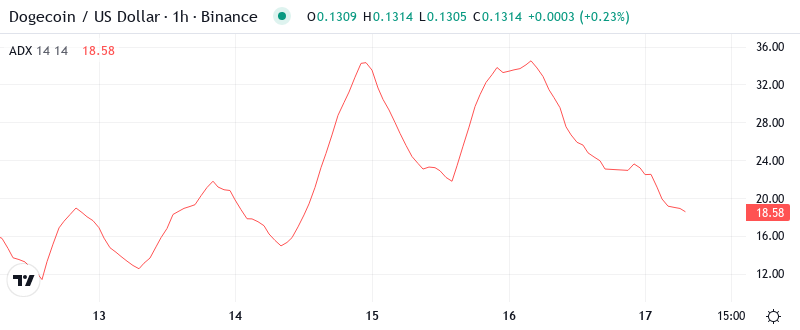

ADX Climbs to 37.94 – Directional Move Gaining Steam

With the ADX currently sitting at a nail-biting junction of whether to break free towards that mark or pull back and open the door to indecision, the coming hours should provide us with much greater clarity on this desperate fourth-quarter defense. Whether it rallies or begins to roll over in steeper fashion will almost certainly be decided today.

Essentially, we’ve transitioned from the flat chop we experienced throughout much of January to a more directional environment. As a day trader, you want to alter your approach to trading in this type of environment, fading moves typically loses its viability as ADX approaches 40 and the edge shifts to continuing to jump on the trend. The news of the Thumzup gave the bears a pause but failed to reestablish the same bullish vibes.

20-Day EMA at $0.1410 Caps Recovery Attempts After Support Flip

Looking at the daily RSI, it’s clear to see that the indicator has broken down from its 70+ overbought zone, but more importantly has now come back down to its midline to test it as resistance for the first time since the rally began. Additionally, three-day the RSI remains in a steep downtrend. That’s typically not a great place to be as it has historically made a mark not only market corrections but full-blown trend reversals.

What is noteworthy that the 20-day EMA neatly turned down yesterday’s bounce after the news of the Dogehash purchase. That previous support region at $0.1410 now turns into a red mark where the bears draw the line. The 100-day EMA hanging at $0.1767 seems so far away now, underlining how much a technical hole has been dug even with the spot volume holding steady.

Support Crumbles at $0.1420 While Resistance Stacks Above

As for support, it looks thin up to the next buy zone between $0.135 and the late November low. Both short-term moving averages, the 4-hour 50 EMA, and the 200 EMA moved below the monthly pivot over this consolidation period. The 50 EMA is about to bear cross the 200 EMA and the closest short-term moving average is the 8 near $0.136. Given the fast pace of the last three NY sessions, along with late December’s low trading volume, this zone would likely get a retest the next time XRP floats downstream.

If the price action recovers, immediate resistance will be met at the $0.1301 upper trendline. Gains beyond the channel give us $0.14 as a tough intermediate barrier with the 55-day moving average stationed near $0.1439 acting to reinforce this level. Subsequently, $0.1501 poses the primary hurdle followed by the psychological $0.16 handle.

The market structure indicates a classic breakdown pattern – a three-day chart descending triangle has cemented the lower low, with more downside now likely. A failure to reclaim $0.1420 this week, even in the face of billion-dollar daily spot volume and news of new corporate players entering the space, reveals that sellers are firmly in the driver’s seat. This dislocation between the spot excitement and price metrics frequently comes before one more down leg in a bottoming process.

Bears Target $0.123 as Bulls Need Miracle Close Above $0.1420

To invalidate the breakdown, bulls need a decisive daily close back above $0.1420, ideally on a strong volume that exceeds the $1.1 billion seen over the past few days. If that happens, and the Thumzup news combines with oversold conditions, a push to $0.15 wouldn’t be out of the question. However, the argument for the ETF disappointment narrative would need to be the opposite – that spot market strength matters more.

If we don’t see a relief bounce back over $0.131, the next downside point of interest is $0.123, at which point the technical damage would become more pronounced and the trap for new dip buyers would become clearer. The higher the ADX, the weaker the chance of a trend reversal.

Considering the technical evidence and the fact that bullish news hasn’t been enough to turn the tide, the most likely short-term scenario is that DOGE will consolidate in the $0.126-$0.134 range. This doesn’t mean the asset is being left for dead, but rather that it’s going through a needed correction as part of a broader trend that needs to consolidate for a while to establish new bases.