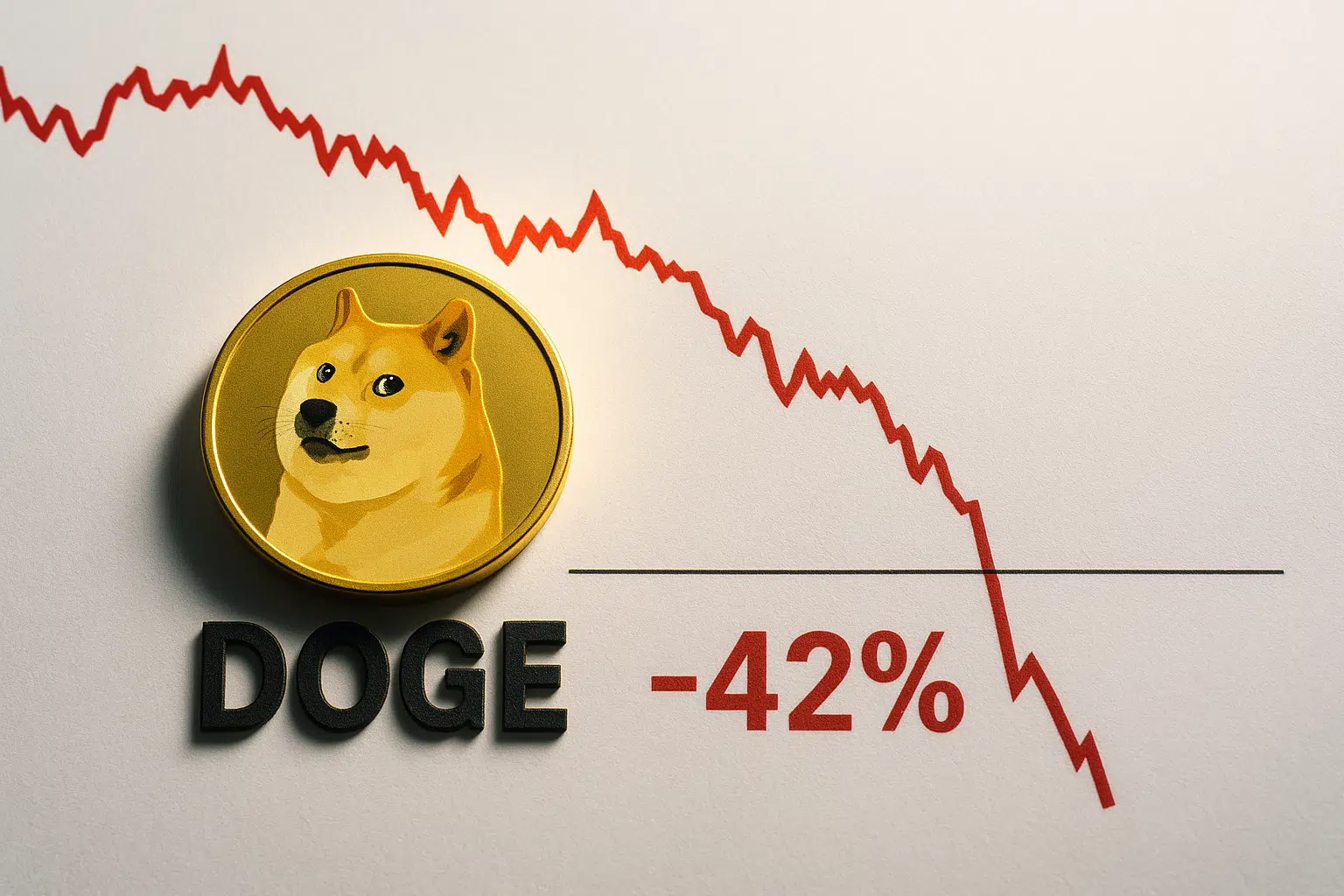

DOGE Tests $0.14 Support as Momentum Exhausts After 42% Monthly Plunge

Market Structure Shifts Lower

- The price carved out December lows just above $0.132, in a zone that caught institutional buying interest.

- RSI had plunged to 40 for the first time on the daily timeframe since the October washout.

- A strong support cluster was forming and it was between $0.139-$0.143. This was now serving as a make-or-break zone for the bulls.

Dogecoin has crashed through several layers of support within the latest month, 42% off its good high simply because the broader market cooled. It now trades at $0.1397, 20.6% decrease over the previous week – a slump which has pummeled it to the point it is now lower than it was three months ago. The actual question for traders is: can DOGE hang on above $0.14 where institutional interest emerged through current ETF filings, or are sellers about to push it toward the month-to-month low of $0.132?

| Metric | Value |

|---|---|

| Asset | DOGECOIN (DOGE) |

| Current Price | $0.14 |

| Weekly Performance | 3.02% |

| Monthly Performance | -20.63% |

| RSI (Relative Strength Index) | 39.9 |

| ADX (Average Directional Index) | 40.9 |

| MACD (MACD Level) | -0.01 |

| CCI (Commodity Channel Index, 20-period) | -66.89 |

RSI Signals Capitulation Complete – Room for Relief Rally

When the oscillator breaks -30, it’s often right to close reasonable shorts. Historically, downside momentum has at least paused after a trip to -50, but stronger declines typically break -70. By this point, RSI will be oversold, but the oscillator probably won’t hit -90 again until the end of the move. The oscillator better be closer to -100 first, else keeping short positions makes more sense.

What is interesting to note is that the RSI hardly moved despite the action yesterday – it stood at 40.50 versus 37.95 last week. This indicates a new selloff dynamic rather than new buying power. For swing traders, balance-to-slight oversold RSI implies the downside momentum probably peaked in the short run, but a real trend reversal will need a break back above 50.

ADX at 40.9 Confirms Mature Downtrend Nearing Exhaustion

The buying surge is reflected well in the 4-hour RSI as it neared overbought territory again. This has been the case for quite some time and only serves as a testament to DOGE’s excellent performance in the face of an ASEAN-wide downturn that saw Bitcoin dipping sharply to sub-$34k prices. The last time RSI became overextended, DOGE managed to accrue gains for an extra week before topping out.

In terms of directional movement the negative DI is king at 26.95 as compared to the positive DI of 11.45 this tells the day trader that the bears are clearly in control. When the spread between the directional indicators is this great selling pressure is the dominant force and every rally is met by even more selling. Expect continued volatility for the short-term day trading. Watch for the ADX to curl lower from these levels as that would signify that the downtrend is losing a little bit of steam and that could present a nice mean reversion trade for the short-term day trader.

20-Day EMA at $0.148 Caps Recovery Attempts

The 10-day EMA crossed bearishly below the 20-day EMA as the lower boundary of the EMA ribbons also began to slope downwards for the first time since the June 22nd bottom. The EMA ribbons can be an early indicator of trend exhaustion since they adjust faster to market conditions than traditional moving averages. Continued spread between the two will be essential for any bullish momentum to materialize.

Even more indicative is the squeeze of short-term averages, as the 10-day and 20-day EMAs converged from a 15% distance to roughly 3.5%. Certainly, this reinforces the idea that the recent avalanche might be losing its brutal strength. However, the 100-day EMA and the 200-day EMA are far from being considered targets, watching the structural breakdown of the long-term trend. For the bulls, the most bullish short-term goal is to regain the 10-day EMA, which is currently at $0.143.

Support at $0.139 Tested Six Times – Bulls Make Last Stand

Buyers will want to see a solid daily close above $0.154 to first claw back some of these losses and then target a move back to the $0.17- 0.18 area.

There is strong resistance overhead, and the first significant one is at $0.156, the level at which December’s breakdown accelerated. The zone between $0.178 and $0.183 is the monthly pivot and 100-day EMA, which is approximately 30% above the current level. The monthly R1 at $0.2019 appears out of reach for now, as it is a 44% hike, making it a very high cost for a near-term win.

The market structure has an interesting tale to tell – each test of the $0.139 support over the past six weeks was followed by a price bounce; the support has gained in strength over time. Volume rose 18% above the 10-day average last Wednesday, validating the latest rebound as a sign of positive accumulation. Additionally, the newfound support around the $0.139 level indicates that the longer-term investors are less likely to dump their holdings.

Bulls Need Decisive Close Above $0.156 to Shift Momentum

For DOGE to live up to the moniker of “people’s crypto” and evolve beyond a lottery ticket, the present shakeout across the crypto-asset class will likely need to prove itself by giving way to better conditions for bulls. Re-entering a risk-off environment with outright fear over a global pandemic would pose challenges for legacy markets, cryptos, and the broader financial system, at least until a vaccine is widely distributed.

In case the price loses the $0.139 support cluster on a daily close, bears will regain control. If that happens, the monthly low at $0.132 becomes the next target, with risk of cascading stops pushing DOGE toward $0.123 – the next critical support from October’s accumulation zone. This most likely leads to panic among retail holders that entered on the recent ETF hype.

The technical signals are showing that DOGE is oversold and there is institutional interest at the current price so it is likely that DOGE will consolidate between $0.139-$0.148 while momentum indicators are re-establishing some positive trading conditions. The real world adoption narrative is a supportive force but technically the token must spend some time repairing the damage done this month.