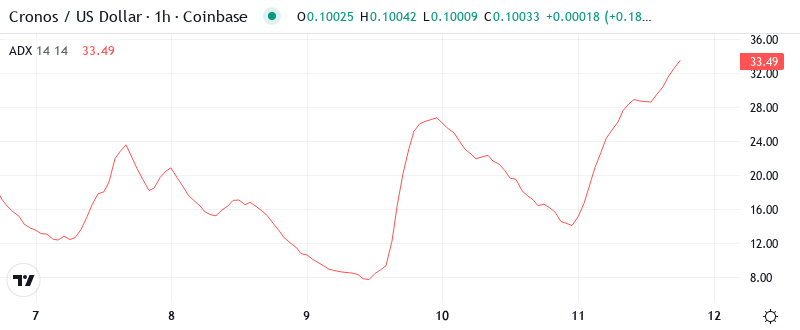

Cronos Darts Through Key Support as Web3 Gateway Launch Fails to Spark Rally

Market Structure Shifts Lower

- Cronos (CRO) down 9.3% on the week

- Cronos (CRO) down 32% on the month

- Worst weekly performance in nearly a year for the eighth-largest EETH asset

Despite the recent announcement of Cronos One – a Web3 gateway solution due to launch at the end of April – Cronos (CRO) is down 9.3% on the week and 32% on the month. The total loss marks the performance worst the week in nearly a year for the eighth-largest asset on the Messari 10.ereum equivalent cryptocurrencies (EETH).

The Cronos (CRO) token hasn’t done so well in the last week, and in comparison, it has lost 9.3% in value. The week started off on a high note when the community was given the awesome Cronos One gateway to play around with as they pleased and investors were also given access to CRO investment products by 21Shares. However, hindsight shows that sellers began to take profits from the positive announcement as soon as the 10-day EMA met up with the horizontal resistance at $0.104. For the first time since the illiquid days of summer, CRO is back below the penny psychological level.

| Metric | Value |

|---|---|

| Asset | CRONOS (CRO) |

| Current Price | $0.10 |

| Weekly Performance | -9.28% |

| Monthly Performance | -26.69% |

| RSI (Relative Strength Index) | 37.1 |

| ADX (Average Directional Index) | 30.2 |

| MACD (MACD Level) | 0.00 |

| CCI (Commodity Channel Index, 20-period) | -121.32 |

RSI at 37.6 Approaches Oversold Territory for First Time Since October

The relative strength index serves as a momentum oscillator, measuring the speed and change of price movements. RSI oscillates between zero and 100. Traditionally, and according to Wilder, RSI is considered overbought when above 70 and oversold when below 30.

For swing traders looking for reversal setups this RSI setup indicates we are getting close to the buy zone but are not quite at extreme oversold levels yet. One would think the Cronos One launch and ETF products would give solid fundamental underpinning but the technical position clearly indicates sellers are going to be spoiling the party! A reading on the RSI of CRO below 35 suggests we are at a major pivot point over the past 18 months or so and we are not quite there yet, but we are getting close to it.

ADX Climbs to 30.2 as Downtrend Gains Conviction

With the ADX above 30 for the first time in nearly four months, a downside breakout promising further Ward momentum is clearly in play.URITY also remains on a sell signal, with no imminent warning signs. Remember, the last time we saw similar reports of funds loading up on lean hogs, Ward sent prices their lowest in nearly ten years.

In such bearish price action ADX tends to range between 40 and 60. This gives very nails-on-chalkboard trading as the waterfall continues to cascade lower while the 6-period ATR begins to shrink as sellers pull back. Smart bears will wait for volatility to spike once more before turning the screw and losing Thursday’s lows for an emotional dump climax.

Price Trapped Below Entire EMA Ribbon Since Breaking $0.107

The moving average structure is broken, meaning that all previous higher lows are now broken levels, and will be a struggle to retest as resistance. In price consolidation, moving averages acting as support get consumed and turn to resistance, so the more moving averages that are beneath price, the more potential resistance levels that will need to be overcome to reclaim higher ground.

The situation doesn’t look good for those hoping to see more price action over the coming days. Early MFI print under 50 is a slowing momentum precursor, as is its cascading sister reading since Nov 4th, both lessening bullish enthusiasm. The RSI ticked above 50 a few days ago, hoping to keep above that psychological level.

Support Levels Thin Out Below $0.10 Psychological Floor

There is a strong resistance ranging from $0.104 to $0.112 as the 10-day EMA and the 50-day EMA are located at $0.104 and $0.112, respectively, with the breakdown level from December of last year at $0.117. Furthermore, the weekly pivot is located at $0.115, resulting in a triple intersection. Buyers have to conquer this area if they want to keep building on the recent bullish momentum.

However, should XLMBTC rebound, the first hurdle to cross would naturally be $0.10 and the 20-day moving average at 3050 satoshis. Following that, the once-formidable 3400 level should put up less of a fight due to the number of times it been tested in recent months. A daily close over 3400 satoshis would suggest XLM can now test higher and start to repair some technical damage by flipping prior support into resistance.

The market structure has distinctly changed in character since the December highs, although having launched infrastructure updates and secured institutional offerings, CRO continues to see relentless selling pressure that is more powerful than any of the positive news. In such cases, the charts end up having the last word in the short term at least.

Bulls Need Reclaim of $0.107 to Shift Momentum

Buyers need to push Cronos back above $0.107 to change the short-term dynamic and confirm at least a temporary bottom has formed. This would open the $0.112 level for a retest. Conversely, the recent low at $0.101 will be a crucial support to hold on a daily closing basis. A break below $0.101, and subsequently the $0.1 level, would spell trouble for Cronos in the short term.

If the situation worsens and leads to a further selloff, we expect the 200-day SMA at $0.075 to hold. Any weak hands that remain will be shaken out below this level, leaving newcomers with a favorable risk/reward window if the core team can turn price action around. The market is still digesting the excessive exuberance built up over the 12 weeks of declines. The average on the downside has been 8% each week with 2 weeks contracting.

The Relative Strength Index (RSI) reads sub-30, implying an asset possibly being oversold – barring a clear downtrend in which case it can maintain sub-30 to over 70 levels if it trends low enough. The latter is the case for Crypto.com Coin (CRO) after its wick-slammed down to the mid $0.09’s in an emotional dump on Tuesday. The $0.095-$0.10 magnet is now resistance after the violative swing breakdown. The 200-day Exponential Moving Average (EMA) placed around the $0.12 threshold got smashed too.