Chainlink Tests Key Support After Mastercard Partnership Sparks DeFi Integration Hopes

Market Structure Shifts Higher

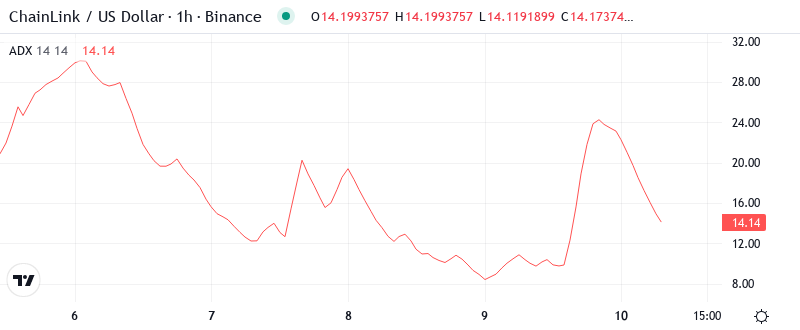

- The price of Chainlink (LINK) has declined by 4.95% over the past week after marking a local high of approximately $15.60.

- Such a significant movement would have wiped out the support levels in the lower timeframes, but the critical levels still remain intact.

- Chainlink finds itself at a critical technical crossroads as the coin trades at $14.15, down 10.84% on the month despite bullish fundamental news such as Mastercard’s partnership with Swapper Finance to allow direct DeFi deposits, this partnership highlights the increasing institutional implementation of Chainlink’s oracle services, however, technical sellers have been driving the price lower, resulting in a 39.9% decline from the three-month top.

The big question for traders is – will the fundamental tailwinds of these new DeFi collaborations be enough to overcome current technical headwinds and engineer a reversal from these oversold levels?

| Metric | Value |

|---|---|

| Asset | CHAINLINK (LINK) |

| Current Price | $14.15 |

| Weekly Performance | 4.98% |

| Monthly Performance | -10.84% |

| RSI (Relative Strength Index) | 51.3 |

| ADX (Average Directional Index) | 25.6 |

| MACD (MACD Level) | -0.16 |

| CCI (Commodity Channel Index, 20-period) | 103.91 |

RSI Rebounds From 44.48 Oversold Zone – Matches Historical Accumulation Levels

With the RSI increasing, the MACD is now curling up, ready to cross bullish. Growth intentions within the MACD histogram are at the largest they’ve been for eighty days, preparing to potentially post a green bar above null for the first time since August. As the last red momentum bar shifts to neutral, if the histogram flips green, it will improve the buy signal.

What is interesting to note is the behavior of the RSI in the wake of the Mastercard announcement. It did not allow the token to escape significantly oversold territory and now hints that the renewed overheavy conditions can let up as consolidation continues. This is the kind of healthy, controlled correction necessary for the token to build momentum for its next leap higher.

ADX at 25.62 Signals Trending Market Returns After December Chop

Trend strength indicators indicate that the ADX has moved above 25.62, which serves as a key threshold that was crossed after LINK was stuck moving sideways without any clear direction in early December. Being in that range implies that the asset has left that frustrating sideways action behind and has entered an environment in which trends are more easily established. The last time the ADX popped above 25 with similar on-chain conditions, Chainlink went on a 45% upswing within three weeks.

In other words, the ADX is suggesting that the strategy for day traders should shift from trying to make profits on range-bound moves to benefiting from news-based momentum moves as markets tighten. News is a key driver to real momentum. The Mastercard collaboration serves as a catalyst for this transition.

50-Day EMA at $16.59 Becomes Key Resistance After December Breakdown

The $13.00 zone has seen successful tests over the past three months, so a break below this level will likely garner a powerful reaction in the form of additional stop-runs. A payout target would be the secondary higher low at $12.80. This could open the gates to the primary higher low at $11.28 or lower. Buyers will want to take control before this scenario unfolds, which means a firm daily close above the 10-day EMA (likely to be just shy of $14.00 at that point). The first upside obstacle will be this EMA followed by the 46 we introduced during the December review if they confluence in the $14.50 zone.

When perceiving the bigger picture of EMA constructs, the 100-day EMA sits at $16.58, which is roughly the same as the 50-day, giving rise to a resistance zone with two barrels. The confluence turns $16.58-$16.59 into the level that bulls must surpass to convert the construct bullish. Notably, EMA reclamation has been catalyzed by institutional DeFi adoption info before, with Q3 seeing multiple resistance level breakthroughs off the back of similar partnership news.

Resistance Clusters Between $16.59 and $18.06 While Bulls Guard $14.06 Support

Above the current price, the sellers have built several resistance levels. The first one is at $16.59, which is the confluence of the 50-day EMA and the 100-day EMA. The next hurdle is the 200-day EMA at $17.28 and the monthly high print at $16.75. The most critical resistance is at the $18 level. The 200-week EMA is also located at the $18.06 level, making it the toughest overhead resistance for the bulls to overcome if they manage to initiate a trend reversal.

Bulls have been protecting the crucial support of $14.06 which has been retested several times since the news about Mastercard. This level is being reinforced by being in agreement with the monthly pivot point, with institutional and whales’ accumulation happening here. The weekly low of $13.44 offers backup support but should the bulls lose $14.06 stop-losses can be triggered above $12.32.

The market structure we can observe an interesting pattern – each test of support has seen declining volume, indicating that sellers are using up their bullets. This disconnect between price downside and volume downside frequently occurs prior to substantial bounces, particularly when there are fundamental drivers, such as the increasing amount of DeFi partnerships onboarding. The next 48-72 hrs will tell if $14.06 will hold as the launchpad for the uptrend.

Bulls Need Decisive Close Above $16.59 to Validate DeFi-Driven Recovery

If LINK manages to go back to and close above the $16.59 EMA confluence while also doing so on strong trading volume, then we can assume that the market’s technical state has turned considerably bullish. It will also open up the next immediate price targets at $17.28, which is where the 200-day EMA is located, and $18.06. The partnership news could very well lead LINK to reach the analyst’s target at approximately $20. The real start of institutional DeFi adoption is with the integration of Mastercard, which will also continue to provide LINK with more solid fundamental support.

The bullish outlook comes into play if price successfully rebounds from the $14.50 level, breaks above last week’s high, and forcefully reclaims the $14.50-$14.67 zone as support. In this case, a continuation pattern toward the $15.50-$15.60 resistance zone will likely develop.

Considering the oversold technical conditions coupled with bullish fundamental news, the most likely short-term scenario has Chainlink ranging between $14.06-$15.50 as the market absorbs the news of increased institutional DeFi usage. This sideways consolidation phase would help the 8 and 21-day moving averages compress even more before the subsequent break, although the Mastercard news makes us believe that break is to the upside once technical hurdles are overcome.