Celestia Tests Six-Month Lows as Matcha Upgrade Fails to Spark Recovery

Market Structure Shifts Lower

- TIA dropped more than 23% in the past week

- Matcha update launched with a 16x increase in network throughput

- $0.60 support level holds after six tests since August

The Tachyon Protocol (TIA) felt the full force of the market sell-off over the past week, dropping more than 23% in the process. The project has launched the new, groundbreaking Matcha update, which brings with it a 16x increase in network throughput.

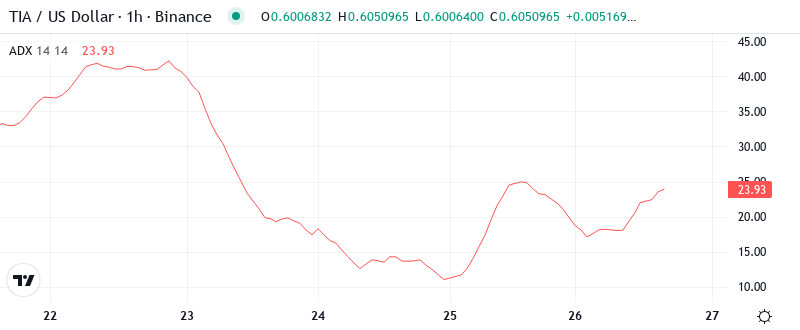

Celestia’s native token TIA is getting hammered yet again, down 23.24% on the week to $0.605 – a level not seen since early Summer. Even the announcement that Matcha upgrade will go live next week with 16x throughput improvements and a blending of 50% of the necessary block rewards wasn’t enough to slow the selling. The ongoing support test will once again have traders pondering an important question: will the $0.60 level that’s held through six separate tests since August finally break, or will the highly favorable risk/reward setup finally trigger the relief bounce longs have been hoping for?

| Metric | Value |

|---|---|

| Asset | CELESTIA (TIA) |

| Current Price | $0.61 |

| Weekly Performance | -23.24% |

| Monthly Performance | -43.36% |

| RSI (Relative Strength Index) | 28.2 |

| ADX (Average Directional Index) | 29.0 |

| MACD (MACD Level) | -0.10 |

| CCI (Commodity Channel Index, 20-period) | -106.51 |

Momentum Exhaustion Hits Extreme as RSI Plunges Below 30

The key macro narrative surrounding DeFi’s first (of many) L2 scaling solutions remains unchanged. The fundamental blockchain trilemma of processing power, security, and decentralization suggests a multi-blockchain world. And like the Internet (where myriad protocols emerged for myriad use cases), the winning blockchains will likely be the ones that find product-market fit with concrete use cases (such as NFT gaming, DeFi lending, programmable loyalties, etc).

When you look at the RSI (relative strength index) of TIA below 30 times, the stock price is extremely oversold and due for a bounce. The previous occasions with the RSI(14) below 30 were on 10/13/21, 09/20/21, and 02/23/21. On each occasion, TIA had a bounce of more than 25% over the subsequent two weeks.

ADX at 29 Confirms Bears Control the Trending Move

The ADX at 29.04 shows that sellers have taken over a real trend rather than consolidation. The month-over-month change from sub-20 readings does the explaining – the uptrend morphed into the selling trend after the December supports gave way. In other words, it transformed from the type of playground a range trader loves to the type of road a short trader thrives on.

Trend strength readings higher than 25 usually continue for a few weeks before they exhaust themselves, so this downtrend likely has a little while longer. Bottom line, oversold is a technical status not so easy to profit from in a strong-trending stock. The more those plungers press, the less wriggling the knife victims will likely have to do before being sold. It’s just a basic truth of the trading world that stocks move technically before they do fundamentally.

20-Day EMA at $0.77 Now Caps Any Relief Attempts

The relentless selling over the final six weeks of 2021 also left behind a sequence of lower highs and lower lows that reveals the trend’s unambiguous deterioration. The 10-day EMA is brushing up against the 20-day, which will bear-cross if the downtrend persists. Reeling buyers can at least hope for relief once the overbought 10-day and under-fire 20-day EMA join forces.

The price has not held above the 50-day EMA for over three consecutive days since the retest in early May. Paired with the short float, this shows just how imbalanced supply and demand currently are. The price isn’t going to experience a sustained move higher until this dynamic shifts, and likely accelerates to the upside once it does. Assisted by the unwinding of a highly levered short-base above and below the 50-day EMA, this development could begin as soon as late next week.

$0.60 Support Survives Six Tests While Resistance Stacks Above

Support-wise, we could return to July’s low at $0.65 before the long-term downtrend resumes full control. That break also sets up $0.60 as the next natural target, the low from last June.

Bulls have been surprisingly effective at defending one key level – $0.60 support, which has held up against six different tests since June. Volume has also increased with each test, indicating that some accumulation is occurring around these levels. Difficult to say if its longs averaging down or bottom-fishers. The upgrade announcement led to a brief relief rally from this support, but bulls exhausted that momentum in a few hours, and bears resumed the downtrend.

This market is a nailbiter, every move down reeks of desperation, on the edge of a breakdown. Yet, the support keeps holding meanwhile every relief rally is dominated by sellers. Sub $0.60 means much lower, but until $0.73 reclaims itself as support, the risk remains to the downside.

Bears Target $0.50 as Bulls Cling to Final Support

Bullish investors need to see the price decisively close above $0.77 on a daily basis, then they can set their sights on the 50-day EMA at $0.96. The upgrade on Matcha with higher throughput may be the key driver of price if metrics on adoption begin to uptick, but first the price has to lead again. Without claiming that 20-day EMA, any bounce will still be seen as a dead cat bounce and will likely set its sight on 2020 lows.

If the price remains stuck between the moving averages, coiling into a more severe downtrend before August doesn’t seem out of the question. Well-timed social media and optimistic headlines would be needed to fend off a breakdown in that scenario. For now, the technical and psychological decompression phase appears to be off to a decent start.

Considering the extensive technical damage and the Matcha update failing to spur buying interest, the most likely short-term trajectory has TIA retesting $0.60 support, the breakout line from the November 2020 double top. A break below that could extend the correction down to the 200-day moving average (DMA), recently at $0.55. Otherwise, a more solid rebound above $0.77 will be needed to turn the tide.