BONK Tests Critical Support After Fee System Overhaul Sparks 24% Weekly Drop

Market Pulse

- 24hr trading volume surged to an all-time high for BONK

- Cryptocurrencies shed 20–30% of value at some point with BONK

- Selling pressure evident in BONK’s early Thursday session

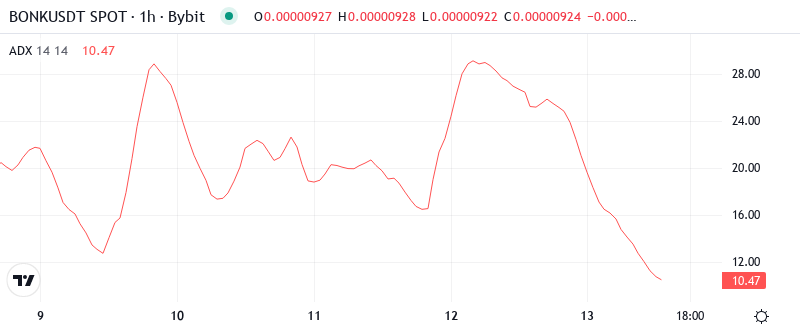

Selling pressure was evident in BONK’s early Thursday session as its 24hr daily trading volume surged to an all-time high. At the time of writing cryptocurrencies shed 20-30% of value at some point with BONK.

BONK had a rough week as the fee overhaul spurred many people to take profits from the December pump. Falling promptly, the price tumbled through the 100-day EMA and 50-day EMA to the major support at .00000006, established in mid-November. Published in the discord on 11/17/20 “tried to send 1.25bnb but the total was 650%. Can someone tell me how to fix this?” It is unknown why this token has held for so long.

| Metric | Value |

|---|---|

| Asset | BONK (BONK) |

| Current Price | $0.00 |

| Weekly Performance | 1.65% |

| Monthly Performance | -23.78% |

| RSI (Relative Strength Index) | 42.5 |

| ADX (Average Directional Index) | 25.5 |

| MACD (MACD Level) | 0.00 |

| CCI (Commodity Channel Index, 20-period) | -85.50 |

Momentum Exhausts at 45 After December’s Overbought Extreme

The relative strength index currently sits at 45 on the daily timeframe, which transitioned from seriously overbought territory during BONK’s December price action. A consolidation of that positive momentum wasn’t unexpected as traders that accumulated during the November lows used the news to cash out their bags. In other words, the oscillator’s standing nearly in neutral right now points towards the fact that the selling pressure hasn’t fully been exhausted.

Based on historical performance, comparable RSI set-ups after news-related RSI washouts have averaged 15-20% more downside before final lows are cemented. Last month RSI washed near 35 ahead of this constructive 10% relief rally. For swing traders, the balanced but weakening RSI would not support knife-catching longs, and it would demand clearer oversold signals to get balanced long again. In the long term, the fee restructuring may have just turned positive, but in the short term, the momentum could carry more pain.

ADX at 26 Signals Trending Conditions Replace December Chop

With the ADX at 26, the entry that BONK has shifted from the rangebound phase that managed early December to a trending state is duly confirmed – regrettably for the bulls, that trend is to the downside. The directional movement increased in force just as the news regarding fee distribution started making waves, turning what was essentially sideways consolidation into outright directional selling. In simpler terms, the ADX suggests that we have moved from a consolidative phase in which range traders did well to a momentum phase where the latter strategy is preferred. The move from ADX levels around 15 only two weeks back suggests that sharp sellers have now seized the market. Hence, day traders will have to adjust to the conditions and instead of buying support, they will have to start selling resistance. This continues until the ADX goes back below 20 indicating that the trend has exhausted itself.

20-Day EMA at $0.0000117 Becomes Resistance After Supporting December Rally

The 20-day EMA is a crucial measure of long and short term trends and sentiment, with most bulls likely entering and exiting their position based on its proximity to the spot price. BONK is in trouble again as these crosses tend to portend a further meltdown.

What is most notable is the extent to which the 50-day EMA at $0.0000114 acted as a significant level that initiated and sustained subsequent rallies and how it has now shifted to a point that halts recovery efforts. This level that acted as support during the rally around August 7 will now serve as a barrier that bears would seek to defend – a daily close above this level indicates that the selloff could run out of steam.

Support at $0.0000092 Tested Three Times – Bears Eye $0.0000078 Break

The support at $0.0000092 to $0.00000923 was retested three times this week range with each subsequent test producing weaker buying volume and a boost in the selling pace as well as the lowering of the support level. The next area is the December 2019 consolidation zone between $0.0000088 to $0.00000916, which held for four months and finally kicked off the most recent 100% price rally.

Buyers will look to reclaim the $0.000009 area, looking for a quick rise above $0.0000095 to then target a return to the dev-supported zone at $0.00001.

Importantly, the market structure implies seller dominance as long as the price stays below the 20-day EMA at $0.0000117. The redesign of the fee mechanism might enhance BONK’s fundamentals in the future, but from a technical perspective, the price level will continue to decline until there is evidence to the contrary.

Bears Target $0.0000078 Unless Bulls Reclaim 20-Day EMA

For bulls to take the reins, the price of SHIB must rise above $0.0000117. Also, the trading volume should increase, and there should be some reassuring news regarding the advantages of the new fee policy for the cryptocurrency owners. In the absence of these factors, we can expect the token to be sold on rallies towards the EMA resistance.

The bearish scenario will take effect once the price breaks down the $0.0000092 support with volume – in this case, it will catch those who just tried to catch the falling knife following the fee announcement and then activate the stop-loss orders down to $0.0000084. It would bring the price to the final $0.0000078 target. As we know from the recent past, when people go from bulls to bears we can expect a rapid fall.

Considering the technical damage and persistent uncertainty regarding the fee restructuring’s effect, the most likely short-term trajectory has BONK grinding between $0.0000084 and $0.0000095 as the community adapts to the alterations before making any substantial bounce. The downside remains the risk until the buyers show they can recover and solidly maintain that important 20-day EMA.