BNB Tests $840 Support as Fermi Hard Fork Approaches – Bulls Guard Critical Technical Levels

Market Structure Shifts Higher

- BNB is currently consolidating gains at around $840 after a monthly decline of 5.77%. The Fermi Hard Fork scheduled for January 14 could be a price catalyst for the digital asset.

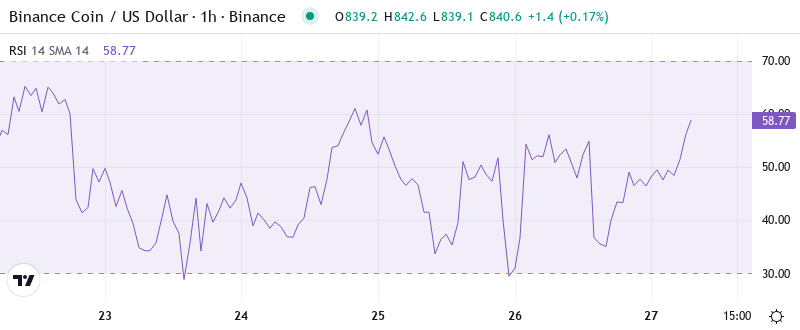

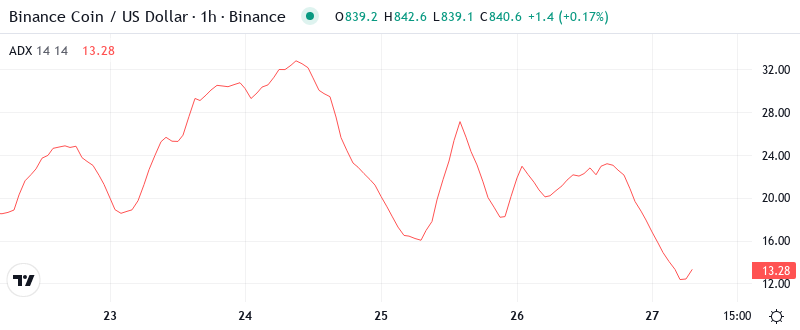

- Mixed technical indicators as RSI at 41.9 is in the neutral zone, but ADX at 29.8 signals moderate trending momentum.

- Bulls defend the confluence of the 10-day EMA at $846.70 and psychological $840 support.

BNB is struggling for upside momentum as the saturated technical setting keeps downside risks elevated. The cryptocurrency is below the 20-day EMA but above the 50-day EMA indicating just how unaffected it is over the shorter-term while also showing short-term bearish pressures are in control. The fact that BNB has created a swing top at $908.48 raises the likelihood of a deeper downward correction, especially should the price close below the late swing low at $801.13. The RSI remains neutral along the midline, however, the MACD below its red signal line threatens to extend losses in the near term. A failure to push prices back above the 20-day EMA could lead to a periodic transfer of cryptocurrency to bears.

| Metric | Value |

|---|---|

| Asset | BNB (BNB) |

| Current Price | $840.40 |

| Weekly Performance | -1.83% |

| Monthly Performance | -5.77% |

| RSI (Relative Strength Index) | 41.9 |

| ADX (Average Directional Index) | 29.8 |

| MACD (MACD Level) | -16.60 |

| CCI (Commodity Channel Index, 20-period) | -81.81 |

RSI at 41.9 Signals Room for Recovery Without Capitulation

With the oscillator dropping 29 points in 15 days, a bounce-type reaction would not be surprising. Past 12 instances when the oscillator declined a minimum of 25 points with the S&P 500 SPX, -1.21% closing below its 200-day moving average as it has for most of September, the index eventually rallied an average of 8.9% over the subsequent month with gains ranging 1.7% to 22.7%.

What is interesting to note is how RSI performed during the fall – the indicator consistently fell from the overbought level of 70 or more since early December, not giving a V-bottom model often associated with washing lows. A similar RSI setup in October was followed by a consolidation phase of several weeks before continuing to rise, indicating that the market could now digest recent CZ AMA statements on stablecoin integration and forecasting market development while engaging in quiet accumulation.

ADX Climbs to 29.8 – Trend Followers Gain Edge Over Range Traders

Recent increase and uptrend indications suggest that BNB still have more room for growth before it hits overbought territory. An impulse move higher could begin to accelerate if BNB achieves that condition. ADX measures trend strength but not direction.

In simple terms, this ADX setup is advising day traders to switch styles from mean reversion strategies to trend following tactics. The slow rise in trend strength, rather than spiking higher, suggests that it’s institutional money getting in place for the Fermi Hard Fork rather than emotional retail traders. For swing traders, this building directional movement is indicating preparation for a potential lengthy move post the $840 support breaking or holding.

10-Day EMA at $846.70 Becomes First Resistance After Supporting December Rally

The EMA ribbons also reflect this broader resistance zone, with resistance extending between $850-880 given the converging EMAs. Falling below the 100-day EMA at $826.61 would put BNB at risk of further downside, with last week’s swing low at $810.8 the next level to watch.

In terms of exponential moving averages, things maintain a firm tilt to the bearish side with BNB trading well below both the 9-day (now acting as resistance after a failed retest Tuesday morning) and 21-day EMAs. Further weakness will almost certainly see a bearish cross of the 50-day down through the 200, and the 9-day could also be on the brink of crossing underneath the 21-day if conditions fail to improve soon. Support levels are spread fairly far apart down here.

Resistance Stacks Between $858 and $916 While $800 Provides Critical Floor

The nearest resistance clusters between $858.45 (20-day EMA) and $870.98 (50-day EMA), where December’s uptrend support has flipped to resistance. This zone has blocked the progress twice last week even with the positive Fermi Hard Fork expectations. Hence we can assume that the sellers are likely to defend these levels. The $900 psychological level and the 100-day EMA at $916.74 will also act as a stiff resistance on the upside.

The support architecture looks more robust thanks to multiple confluence factors at current levels. The $840 psychological level is closely aligned with the 10-day EMA at $846.70, while stronger support is seen at $800, which was last tested in December’s correction. Below that, the weekly Camarilla S1 at $746.13 is the final defense before the bears could have a pop at the $700 psychological level.

The market structure is fascinating – BNB is wedged in a $40 band between $840 and $880, with moving average ceilings above and psychological floors below keeping it tight. Such coiled spring patterns usually lead to a 10-15% impulse move, which could come from the January 14 Fermi Hard Fork catalyzed break above or below it.

Bulls Need Decisive Close Above $870 to Reclaim Uptrend Control

To be bullish, the daily closing price must be above the 50-day EMA of $870.98, which will turn this critical moving average into a support level and raise the price to $916 before climbing to the monthly R1 of $1,103.73 as trader’s antecedent technical advance of the Fermi Hard Fork with faster block moments and a superior network.

If buyer interest and recovery are available, an immediate bounce back to $900 followed by a new all-time high above $950 is in the cards. The Particle Bridge opening, NFT marketplace launch, and GameFi Alpha would all converge, unleashing a surge of bullish sentiment. The weekly R1 resistance at $914 would likely serve as a first profit-taking zone, followed by the R2 monthly at $1009. Several bullish targets would stake at $1164, $1344.98, and $1441.64.

Based on current momentum indicators and the upcoming January 14 catalyst, the most likely short-term scenario is for BNB to consolidate in the $840-$870 area as investors Fermi Hard Fork wait for the event to be implemented. Overextended RSI conditions and increasing ADX point to sideways price action in preparation for the subsequent leg. The upcoming technical update will probably decide if that will be in the direction of $916 or $800.