BNB Plunges 25% as Market Structure Shifts Against Bulls

Market Reality Check

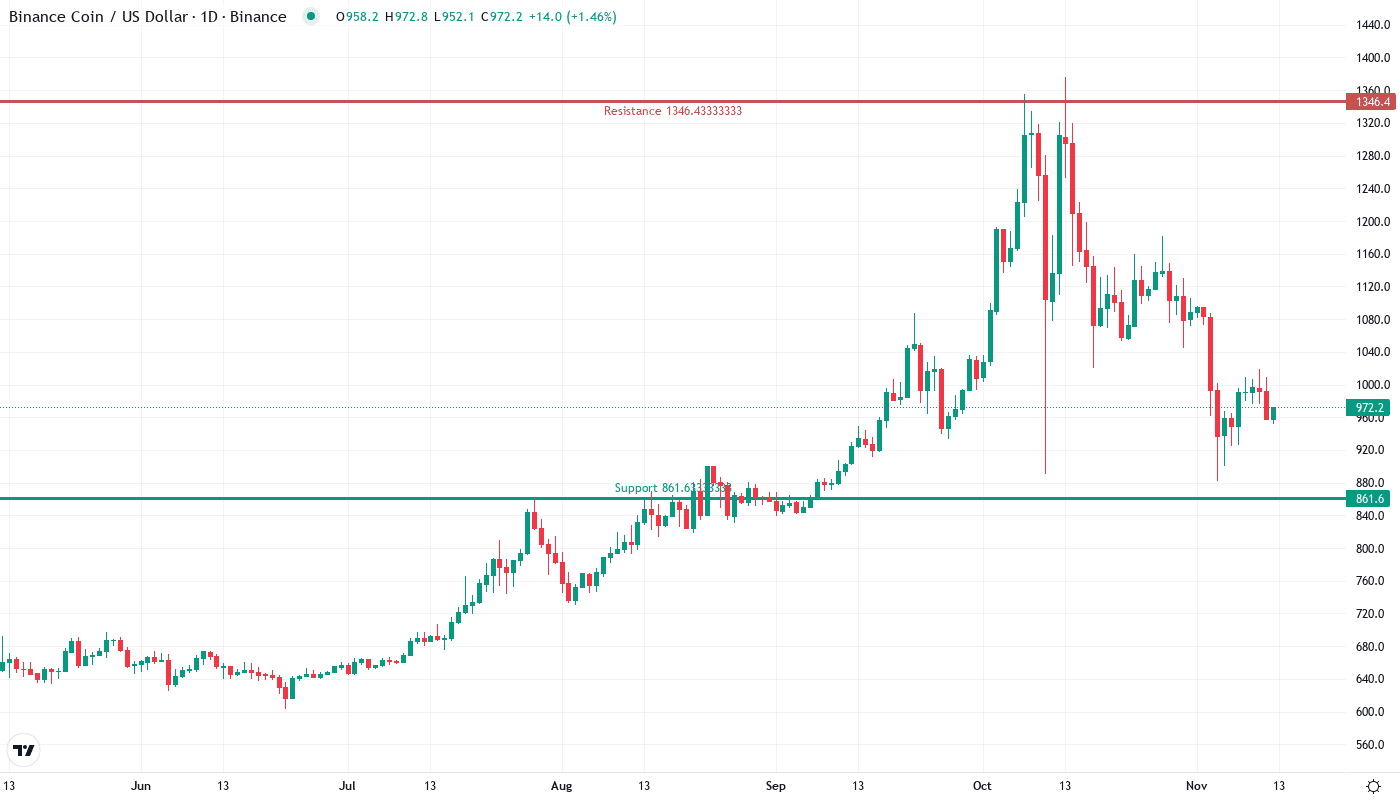

- BNB went down from its peak monthly value of about $1320 and is currently trading at $973, which represents the loss of a quarter of its value.

- Technical indicators show overbought territory on all timeframes which leads to suppose a relief bounce is on the way.

- Even though the selloff occurred, $900 is still the critical support level and thus, it has retained the uptrend structure for the longer term.

The recent memory is marked by the remarkable downward trend of BNB at 25.35% over a month, which is one of the thons of the most naked-feeling sell-offs. The price has decreased by around 25% ($1,320 to $973) due to the fact that the entire crypto market had been under pressure. The selloff was even though liquidity has not been particularly high consisting of 90% out of the total market. crypto remains scarce. This is cited, for example, by the fact that the price of Bitcoin, the leading cryptocurrency, has been falling by 9.03% in this period. The demotivation among traders is detected by the fact that the general sentiment is neutral, according to Tradingview and Glassnode data. The latter shows on-chain funds’ performance in real-time Gary is positive and speaks for the investments made, for instance, in sustainable technology which bear fruit further down the line. BNB’s sustained liquidity is one of the drivers, as well as Binance’s public approach, which was fostered by the ALLO integration and the company’s palette of offerings, such as the green bonds from the blockchain platform Hong Kong. The most pressing question on the minds of traders is whether this correction has already exhausted itself or not $900 support level will be broken due to the additional selling pressure?

| Metric | Value |

|---|---|

| Asset | BNB (BNB) |

| Current Price | $972.60 |

| Weekly Performance | 3.70% |

| Monthly Performance | -25.35% |

| RSI (Relative Strength Index) | 40.3 |

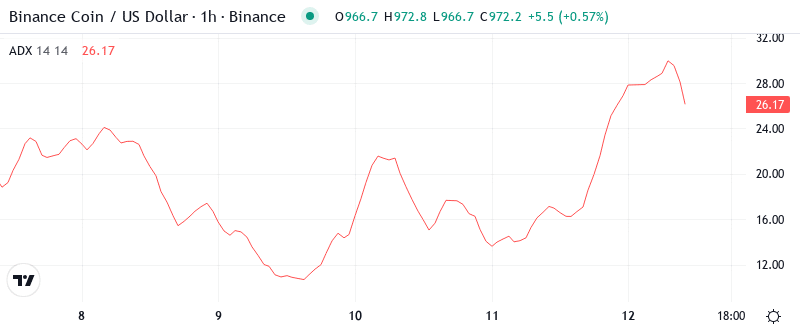

| ADX (Average Directional Index) | 26.0 |

| MACD (MACD Level) | -36.83 |

| CCI (Commodity Channel Index, 20-period) | -74.49 |

RSI Momentum Signals

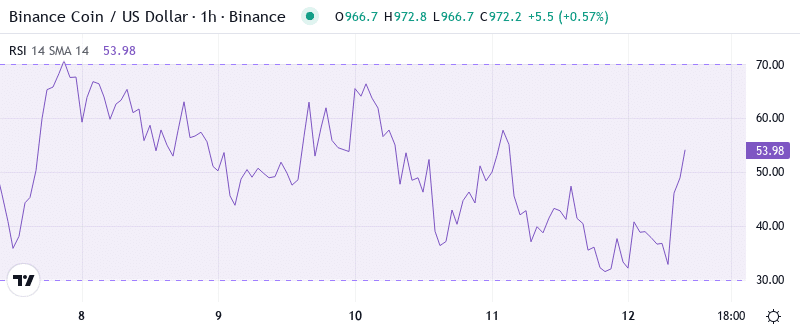

The daily RSI is at 40.32, which indicates it has reached the oversold territory after being above 70 for weeks during the run-up to $1,320. The contrasting jump from one state to another is similar to the September adjustment when RSI had similar values and subsequently it regained 35%. The weekly RSI of 54.00 provides an alternative perspective, being still neutral despite the monthly devastation, which indicates the higher time-frame structure is not entirely destroyed yet.

The overbought daily RSI for swing traders along with the neutral weekly readings makes a preferable risk-reward setup. The last time there were similar RSI configurations was in October when we had multi-week consolidations instead of immediate trend reversals. The momentum indicators indicate that the sellers are worn out in the short-term, but the bulls need to show their strength by recovering the daily 50 RSI level before they can confirm any lasting bounce.

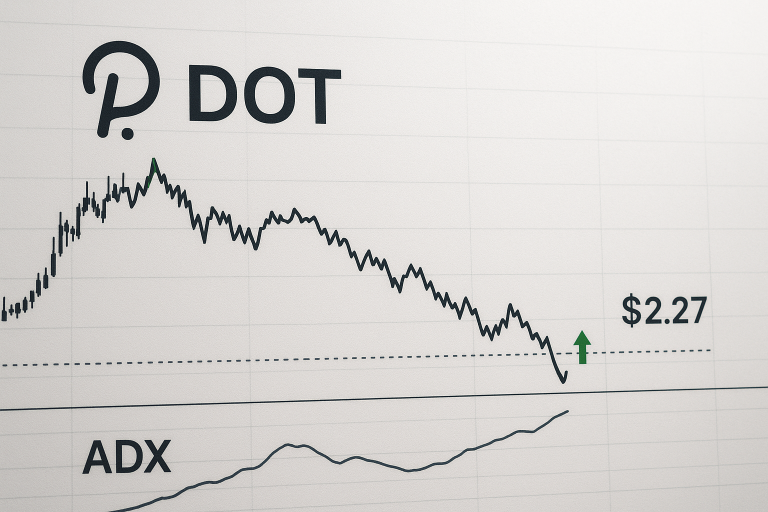

ADX Trend Analysis

A level of 26.04 for ADX signifies a moderate trend strength- which is not so high as to indicate capitulation but it is stand-alone stronger to lean on for the confirmation of a genuine downtrend. The ADX goldilocks zone at that time was normally present at the time of a healthy correction that takes place in a larger uptrend. It had a reading that went from below 20 levels to 21, which displays the significant change from ranged-bound action to directional movement that was achieved in a snap of fingers as the stop-losses triggered below $1,100.

In other words, the ADX is predicting that we will move from a slow decline to possibly a neutral condition. Therefore, it is advisable for day traders to reevaluate their strategies – the trending dominated December by choppier, range-bound setups. Since the ADX is beneath 30 at present, you should look forward to movements in both directions rather than a prolonged one-sided direction of the market until the ADX either falls to below 20 (which will signify consolidation) or rises beyond 35 (which will indicate trend acceleration).

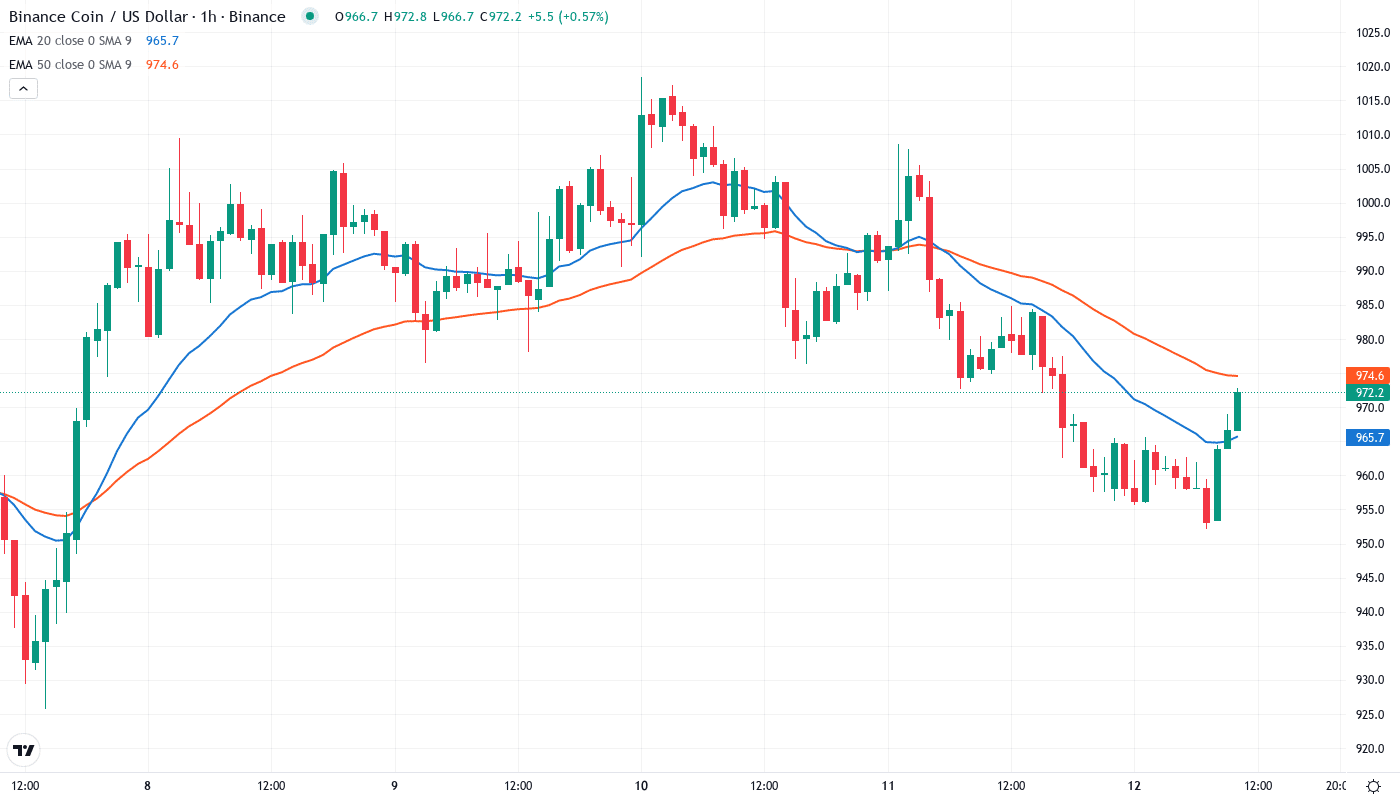

EMA Structure Analysis

The price movement of BNB in relation to the EMA ribbons illustrates the extent of the technical damage. Presently, BNB is trading at $973 as it is squeezed between the 10-day EMA at $993 (immediate resistance) and the 50-day EMA at $1,040 (major resistance). The 20-day EMA at $1,025 which is still going downwards, is the one that tells us that we have changed the trend to the downside. The most worrying part is that the 200-day EMA is really high at $880, so even though it is a strong support, it is also a sign of how far the rally went.

The 50-day EMA switch from support to resistance serves as the main battleground for the bulls. Both times it turned down proposals, it set the level as the boundary to respect for all recovery tries this week. The bright side is that even amid the selloff, BNB is still clear over the 200-day EMA and has kept the macro uptrend structure intact. An application of this would be that during the February month, the bulls should retake the position and consolidate above the $1,040 price mark to be able to end the bearish EMA alignment.

Critical Price Levels

The key immediate resistance areas are identified in the vicinity of $990-$1,025 where the 10-day and 20-day EMAs are in sync with the levels of recent breakdown. The resistance front is made firm by the three culminated attempts of this level to recover after the first failure, thus it will be an initial hurdle for any kind of negotiation. In addition to this, the mental $1,100 mark and the 50-day EMA on a high point of $1,040 comprise a very strong resistance cluster that is probably going to limit any short-term increase in prices.

The monthly pivot system makes the support structure look a lot more durable, which is the case here. The S1 level of $901 placed solid resistance during the selloff process of the previous day and was also backed up by the $900 psychological round number. Junior to that, the weekly 200 EMA at $880 and monthly S2 at $597 put together a very strong support zone. It should be noted, though, that the really important technical damage would occur only after the prices move down to these levels. The market structure turns adverse only when the bulls fail to cover the $900 level in any retest.

Prospects for Trading

Bulls need a decisive close above $1,025 to signal the correction has exhausted itself. Such a move would flip the 20-day EMA back to support while opening the door for a retest of $1,100. The continued positive fundamental developments – from SoFi Bank launching crypto trading to Standard Chartered’s stablecoin credit card partnership – provide the narrative support for recovery if technical conditions align.

Considering that the total eqity iX has increased from $720.17 million to $754.33 million or $34.16 million (4.75%) in just a month, the total equities of iX are bulletproof now. As long as all the stocks that make iX index remain well-performing, the index will be thriving. As a result, iX index is likely to reach $1,200. Based on these data and projections, iX is a stable and reliable investment option.

Considering the present momentum indicators and the support level prevailing solidly at $900, the scenario that seems to be highly probable for the short term is that BNB will fluctuate between the ranges of $900 and $1,025 while it moves along in the bearish movement digestion stage. The sideways grind of BNB facilitates the resetting of moving averages and the neutralization of momentum indicators before the next trend manifests itself.