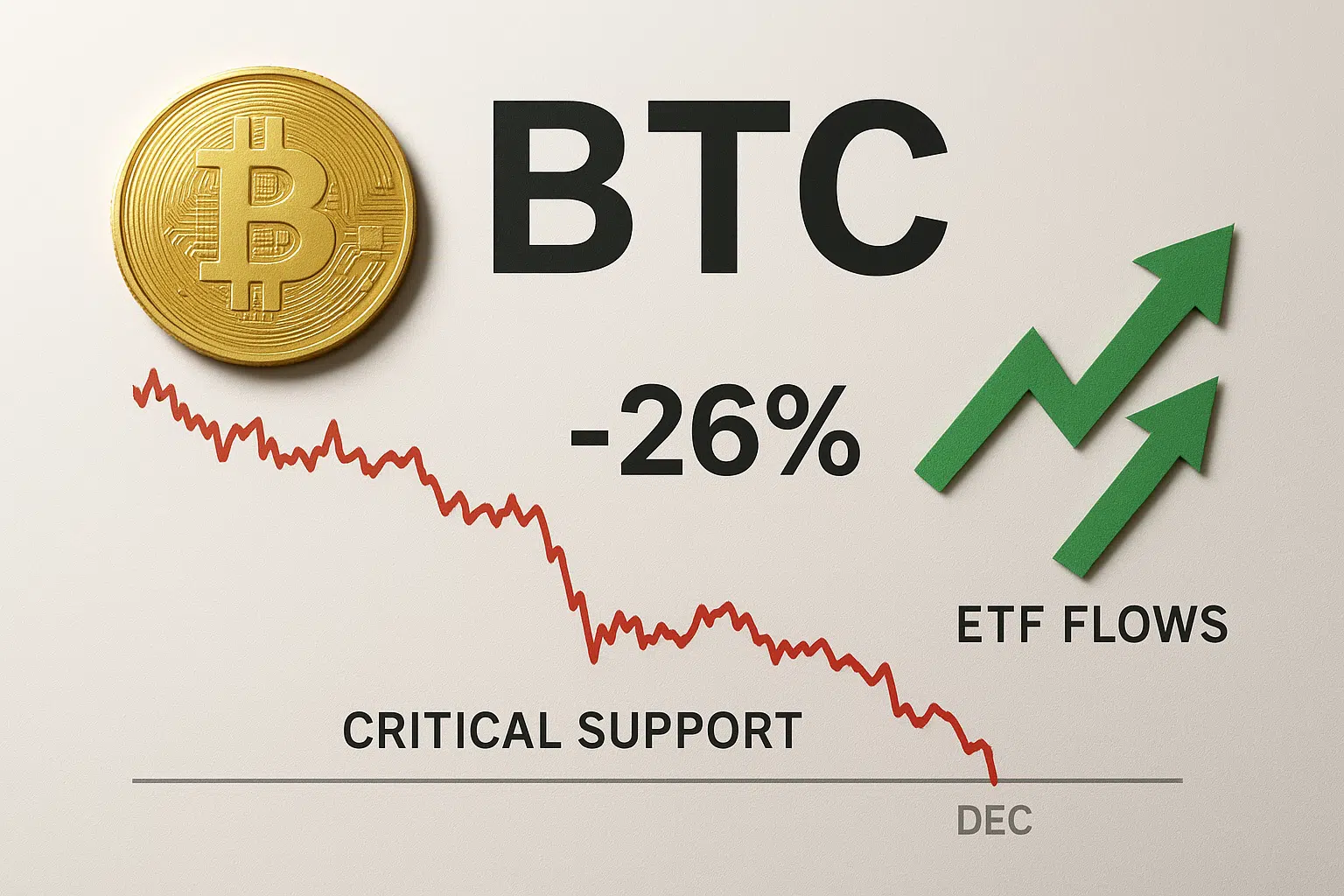

Bitcoin Tests Critical Support as ETF Flows Return After December’s 26% Decline

Market Structure Shifts Lower

- Bitcoin is currently trading at $84,012, which is a 21.9% decline from the December high of $107,795.

- Bitcoin faced rejection just below the psychological $100,000 level.

- Capital reappearance from the ETF resulted in an inflow of $238 million after a short break, indicating that institutional confidence is still relatively strong.

A solid support base continues to form in the $80,000 to $85,000 region as major countries continue to accumulate their positions.

Bitcoin has fallen roughly 579% from new all-time highs at $122,980 last month to this week’s trading lows, with a solid rebound in progress across the overall cryptocurrency complex Thursday. The aggressive correction has seen the benchmark crypto form a falling wedge pattern – a typically bullish continuation technical structure – with the still-developing daily hammer reversal bar hinting bulls have stepped in on test of 80K support. Like with equities, higher yields are causing flight to liquidation through selling of crypto. However, as history shows, most doomsayers cycle in and out of the asset class, with last month’s supply squeeze pushing Bitcoin to fresh highs.

| Metric | Value |

|---|---|

| Asset | BITCOIN (BTC) |

| Current Price | $84012.48 |

| Weekly Performance | -11.10% |

| Monthly Performance | -21.90% |

| RSI (Relative Strength Index) | 22.4 |

| ADX (Average Directional Index) | 45.6 |

| MACD (MACD Level) | -5966.31 |

| CCI (Commodity Channel Index, 20-period) | -146.62 |

RSI at 22.36 Signals First Oversold Extreme Since August Capitulation

With the oscillator and RSI signaling extreme oversold conditions, an elusive Tom DeMark 9 count on the daily has achieved a topping signal, and Bitcoin is facing a confluence of support turned resistance both as far back as December. This structural level could act as a turning point if Bitcoin makes it through the weekend in positive territory. The last time we found ourselves at similar levels was back in late-July 2021, when shorts were piling up like crazy heading into a squeeze.

Therefore, swing traders looking to actively trade this major rebound should consider entering in pieces. Buying one-third or one-half of your desired position at initially oversold bounce levels somewhere in the mid-$40k to low $40k range would be prudent. If we do start climbing higher again, add the remaining portion of your trade as Bitcoin approaches its 50-day moving average, today near $49.8k.

ADX Spike to 45.59 Confirms Mature Downtrend Nearing Exhaustion

At 45.59, the ADX reading shows an exceedingly strong trend down, but one that is at historically unsustainable levels. Whenever Bitcoin’s ADX rises above 40, it indicates that the prevailing move has likely exhausted most of its power to the upside or the downside. The previous occasion at which the ADX reached these extremes was the November 2022 FTX wick low.

What is interesting here is how fast ADX surged from 25 to 45 in three weeks, which is similar to the speed of previous washout/capitulation occasions. To reiterate, ADX is saying that while sellers drove December’s price action with force, the trend exhaustion cue implies that bears are approaching exhaustion. Hence, expect price compression and possibly a turnaround soon as ADX turns back down from these lofty levels.

20-Day EMA at $96,174 Becomes First Major Resistance After Support Flip

The moving averages are stacked bearishly from the short-term 10-day that’s about to cross below the 20-day, the primary positive anchor for spot Bitcoin now down to the negative 50-day. The 200-day EMA at $76,229 supplies prospective support should prices continue downward.

When looking at a BTC/USD daily chart, things seem pretty dire for the whole market. Not only is Bitcoin in the gutter, but all hope is likely lost for the current alt season when looking at the BTC dominance chart. The leading cryptocurrency by market cap has spent only a few weeks out of the last year trading below the red line. And while it has held as support this level in the past, the longer the cryptocurrency overshot it previously, the more catastrophic the collapse.

Support Stacks Between $80,052 and $85,334 as Institutions Accumulate

Countries that recently announced increased or new crypto assets will be looking to manage risk at least on a cashflow basis, coincidentally around the price they acquired their first tranche. Additionally, one country that missed the purchase-the-dips opportunity due to insufficient volatility data should be back in the market this week – and this time they come prepared.

Resistance levels above the current price are significant, with the 10-day EMA at $91,129 and as the first hurdle, followed by the psychological level of $95,000 and the 20-day EMA at $96,174. The former December breakdown point at $100,000 is now important resistance where longs stuck in the high will look to exit on an approach. PayPal’s one-tap Bitcoin buying upgrade through Binance Japan will likely facilitate new retail demand, however, breaking through an established resistance stack usually requires more than just convenience improvements.

Importantly, the market structure is still bearish as long as Bitcoin is trading under the 50-day EMA which is currently at $99,489. The lower highs and lower lows structure since December’s high will only be broken with a daily close above $96,174. A weekly close above the 50-day EMA would result in the first signs of a potential medium-term trend change. The technical and fundamental support in the $80-85K region should mark the place where the next major long-term move will develop.

Bulls Need Reclaim of $96,174 to Avoid Deeper Correction to $67K

If Bitcoin is able to reclaim the 20-day EMA at $96,174 with conviction, the technical outlook changes significantly – and we’d have the opportunity to reclaim the $100,000 level. ETF inflows returning post that short pause, paired with nation-state accumulation, would be the fundamental tailwinds needed for such a reclaim. First, however, bulls need to retake $91,129 decisively to relieve bearish pressure.

If the Bitcoin tsunami breaches support at $80,052, it could create a catastrophe for longs as it overwhelmed derivative positions, resulting in a violent deleveraging and causing the consolidation phase to evapourate instantly. This could be triggered if any of the major whales decides to book profits, as a magnified down-move would likely drive derivatives liquidations into the EMA slump window.

The Relative Strength Index (RSI) on the daily chart for BTC/USD reached the lowest level since the capitulation sell-off in March 2020. Such deeply oversold conditions do not materialize often and generally lead to robust mean reversion bounces before the larger trend resumes. Meanwhile, the Average Directional Index (ADX) – a measurement of trend strength – on the weekly chart reached the highest reading since May 2021. This extreme overbought reading typically leads to a prolonged cooling-off period in both corrections and reversals.