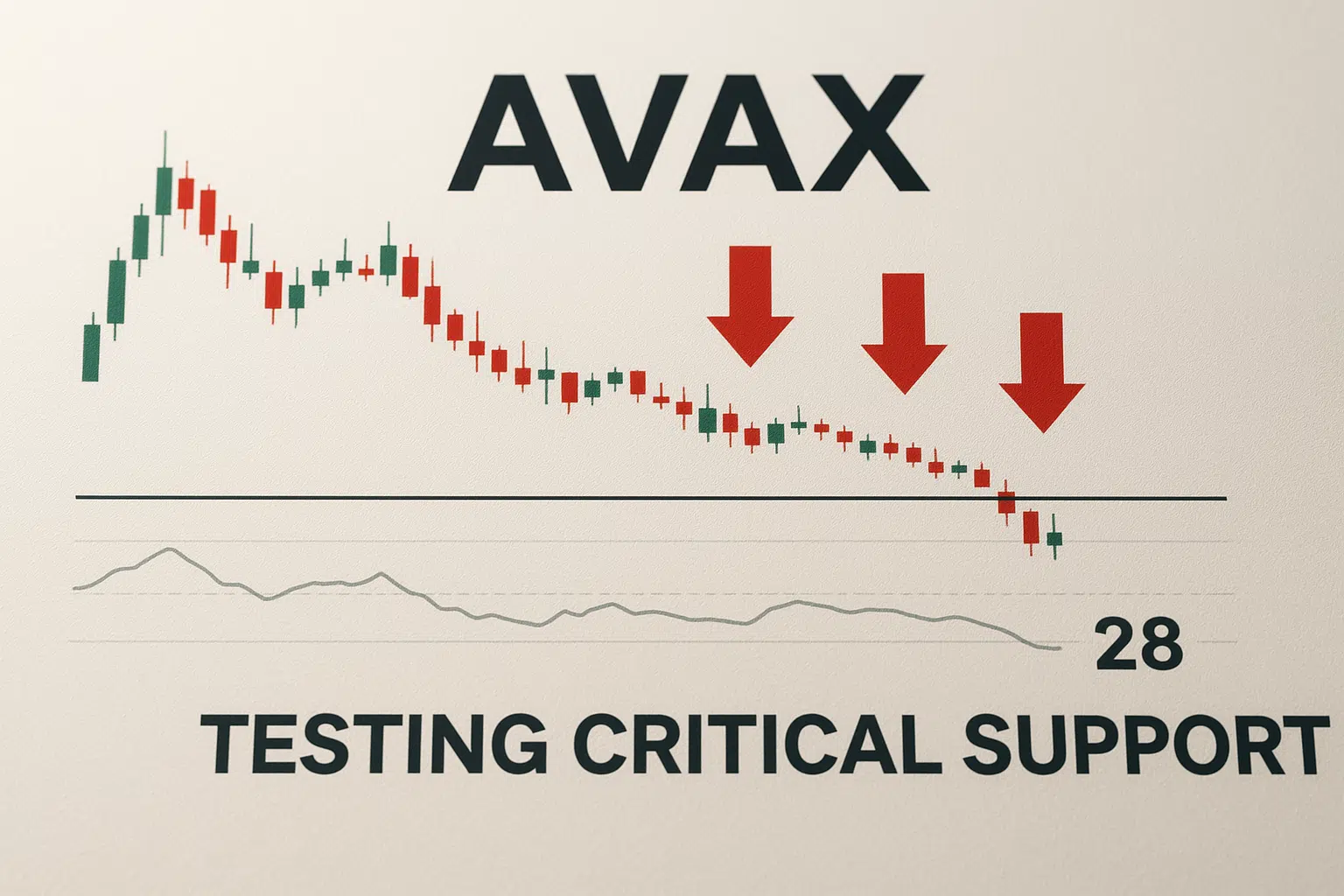

AVAX Tests Critical Support as RSI Signals Exhaustion Below 28

Market Structure Shifts Lower

- Price action confirms bearish momentum with ADX climbing past 55

- RSI plunges to 27.9, matching capitulation levels from previous cycles

- Support architecture crumbles as $13.37 becomes the final defense line

Avalanche’s price has suffered a devastating drop over recent months, with the 3-month performance showing a brutal -48.3% decline that accelerated into a -69% yearly collapse. The inclusion in Coinbase’s new futures suite couldn’t stem the bleeding as AVAX now trades at $13.37, having shed nearly 37% from its weekly high of $21.10. The main question for traders is: can the current oversold bounce sustain, or will the bearish momentum cascade through the final support level?

| Metric | Value |

|---|---|

| Asset | AVALANCHE (AVAX) |

| Current Price | $13.37 |

| Weekly Performance | -13.90% |

| Monthly Performance | -30.17% |

| RSI (Relative Strength Index) | 27.9 |

| ADX (Average Directional Index) | 55.2 |

| MACD (MACD Level) | -1.71 |

| CCI (Commodity Channel Index, 20-period) | -117.06 |

RSI Plunges to 27.91 – Capitulation Territory Matches Historical Bottoms

RSI sits at 27.91 on the daily timeframe, firmly in oversold territory where capitulation typically occurs. This reading matches the exhaustion levels seen during August’s washout and the December 2022 crypto winter lows. Interestingly, such extreme oversold conditions have historically preceded relief rallies of 20-30% within two weeks, though the weekly RSI at 35.13 suggests the longer timeframe remains far from exhausted.

What’s revealing is how RSI behaved during the recent Coinbase futures announcement – it barely budged from oversold levels, indicating seller exhaustion might finally be setting in. So for swing traders, this deeply oversold daily RSI combined with the music industry adoption news for instant payments creates a potential bounce setup, but the weekly timeframe warns against expecting more than a dead cat bounce without significant buying volume.

ADX at 55.16 Signals Mature Downtrend Nearing Exhaustion Point

Looking at trend strength, the ADX reading of 55.16 indicates an extremely mature downtrend that’s approaching historical reversal zones. Basically, when ADX climbs above 50, it often marks the final capitulation phase before a trend exhaustion – we saw similar readings before major bottoms in May 2022 and June 2023. The current extreme reading suggests panic selling has reached a crescendo.

To clarify, the ADX is indicating we’re deep in trending conditions where contrarian setups start appearing. Therefore, day traders should prepare for increased volatility as the mature trend shows signs of exhaustion, while position traders might start scaling into oversized risk-reward setups. The Record Financial partnership news couldn’t arrest the decline, but it provides fundamental backing for any technical bounce.

Price Trapped Below Entire EMA Cloud Since November Breakdown

Price action remains devastating through the EMA ribbons, with AVAX positioned below the 10-day ($14.33), 20-day ($15.58), and critically, the 50-day EMA at $18.75. This complete breakdown of moving average support occurred despite the AVAX One share buyback headlines creating brief confusion in the market. The 50-day EMA changed from being a support level to a resistance ceiling, rejecting three separate rally attempts in the past month.

Most significant is the compression between the 100-day EMA at $21.11 and the 200-day EMA at $22.66 – both sit roughly 60% above current price, creating a massive overhead supply zone. That former support cluster around $21 now transforms into a formidable resistance barrier that would require sustained buying pressure to overcome. The bearish EMA structure suggests any bounce faces heavy resistance between $14.33 and $15.58.

$13.37 Support Becomes Final Line After Six-Month Descent

Resistance stacks heavy between the immediate $14.33 (10-day EMA) and the weekly pivot at $19.53, with December’s highs near $21.10 creating a triple resistance confluence. The Coinbase futures launch failed to generate enough buying to challenge even the first resistance layer, as sellers defended the $15-16 zone aggressively during three separate attempts this month.

Bulls defend their final support at the current $13.37 level, which aligns with the monthly S1 pivot at $7.50 if extended lower. The psychological $10 level looms as the next major support if current levels fail, representing another 25% downside. Notably, the weekly pivot system shows support levels of $7.50-$13.61, suggesting the market has already priced in significant downside.

This configuration resembles a falling knife pattern where catching the bottom requires precise timing and strong risk management. The bullish divergence forming between price making new lows while momentum indicators flatten hints at a potential reversal setup, but the overall structure remains decisively bearish until price reclaims the 20-day EMA at $15.58.

Bulls Need Decisive Close Above $15.58 to Shift Momentum

Should price reclaim the 20-day EMA at $15.58 with conviction, bulls could target the 50-day EMA at $18.75 as the music industry adoption through Record Financial provides ongoing fundamental catalysts. A sustained move above $18.75 would mark the first higher high in three months and potentially trigger short covering toward the $21 resistance cluster.

The bearish scenario triggers if AVAX fails to hold $13.37 on a daily close – this would likely flush remaining long positions toward the psychological $10 level. Given the extreme oversold conditions and mature downtrend readings, a breakdown here could paradoxically mark the final capitulation low, but traders would need to see clear reversal signals before attempting to catch that knife.

Given the technical configuration with RSI at extreme oversold levels and ADX showing trend exhaustion, the most probable near-term path is for AVAX to attempt a relief rally toward $15-16 before sellers reassert control. The Coinbase futures inclusion and growing real-world adoption provide fundamental support, but the technical structure needs repair before any sustainable uptrend can develop.