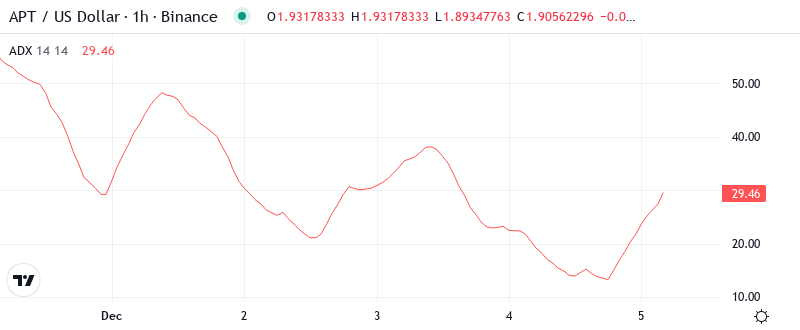

Aptos Tests Critical Support at $1.90 as Momentum Indicators Flash Capitulation Signals

Market Structure Shifts Lower

- APT plunges 16.3% weekly and 25.7% monthly, testing year-to-date lows near $1.90

- RSI drops to 27.5 on daily timeframe – first oversold reading since market-wide August washout

- $1.8 billion token unlock looming in December 2025 weighs on sentiment despite Paxos stablecoin launch

Aptos has tumbled into dangerous territory, shedding 25.7% over the past month to test critical support at $1.90 – a devastating drop that erases months of recovery attempts. The selloff accelerated after news of the massive $1.8 billion token unlock scheduled for December 2025 hit the wires, overwhelming any positive momentum from Paxos launching their USDG stablecoin on the network. The main question for traders is: can bulls defend this multi-month support level, or will the token unlock overhang trigger another leg lower toward the $1.50 psychological floor?

| Metric | Value |

|---|---|

| Asset | APTOS (APT) |

| Current Price | $1.90 |

| Weekly Performance | -16.27% |

| Monthly Performance | -25.69% |

| RSI (Relative Strength Index) | 27.5 |

| ADX (Average Directional Index) | 47.8 |

| MACD (MACD Level) | -0.30 |

| CCI (Commodity Channel Index, 20-period) | -97.54 |

RSI at 27.5 Signals Extreme Oversold Territory – Matches August Capitulation

Reading the oscillator at 27.54, traders see classic capitulation conditions emerging for the first time since the August market-wide flush. This extreme oversold reading typically marks either a sharp relief bounce or the final washout phase before establishing a bottom. Similar RSI configurations below 30 in August preceded a 40% relief rally, though that bounce ultimately failed at resistance.

So for swing traders, this deeply oversold RSI creates a high-risk, high-reward setup where any positive catalyst could spark an aggressive short squeeze. However, the looming token unlock creates a structural headwind that wasn’t present during previous oversold bounces. Basically, the technical setup screams bounce, but the fundamental backdrop suggests any rally attempts might get sold into aggressively.

ADX at 47.8 Confirms Mature Downtrend Nearing Exhaustion Point

At the level of 47.8, the ADX entry indicates extreme trend strength behind this selloff – readings this high often mark climactic moves rather than sustainable trends. The indicator hasn’t printed above 45 since the March 2024 capitulation that ultimately marked the yearly low. What’s particularly revealing is how ADX spiked from 35 to nearly 48 in just two weeks, signaling panic selling rather than orderly distribution.

To clarify, the ADX is indicating that while bears maintain firm control, the trend itself is overextended and vulnerable to mean reversion. Therefore, day traders should prepare for increased volatility as this mature trend approaches exhaustion. The combination of extreme ADX and oversold RSI historically produces violent relief rallies, even within broader downtrends.

Price Trapped Below Entire EMA Ribbon Since Breaking $2.28 Support

Price action tells a clear story through the EMA structure – APT trades below every major moving average after losing the critical 50-day EMA at $2.81 three weeks ago. The 10-day ($2.06), 20-day ($2.28), and 30-day ($2.48) EMAs now stack as resistance overhead, creating multiple barriers for any recovery attempt. Most significantly, the 200-day EMA sits distant at $3.38, marking how far price has fallen from the longer-term trend.

What stands out here is the compression between current price ($1.895) and the nearest resistance at the 10-day EMA ($2.06) – just an 8.7% move would test the first hurdle. The 50-day EMA that previously supported price throughout October and November flipped to resistance after the token unlock news catalyzed the breakdown. Bulls need to reclaim at least the 20-day EMA at $2.28 to shift near-term structure bullish.

Support at $1.82 Holds as Final Defense Before Yearly Lows

The immediate support zone spans from $1.82 to $1.90, where June’s low meets the monthly S1 pivot – this level has attracted buyers six times since summer. Below that, the psychological $1.50 level looms as the next major support, coinciding with the monthly S2 pivot at $1.50. The bear case accelerates on any daily close below $1.82, which would trap recent knife-catchers and likely trigger stops down to $1.50.

Resistance stacks heavy between $2.06 and $2.28, where the 10-day and 20-day EMAs converge with the weekly pivot. Above that, the psychological $2.50 level marks the next significant resistance, aligning with the 30-day EMA. Any sustainable recovery requires clearing the entire $2.06-$2.28 resistance zone on volume to flip market structure.

The market structure remains decisively bearish as long as price holds below $2.28, with each bounce getting sold into lower highs. The December 2025 token unlock creates a fundamental overhang that sellers exploit on every rally attempt. However, the extreme oversold conditions combined with six successful defenses of $1.82 support suggest this level holds significance for institutional accumulation.

Bulls Require Reclaim of $2.06 to Spark Relief Rally Toward $2.50

Should price reclaim the 10-day EMA at $2.06 with conviction, the technical setup targets a relief rally toward $2.28-$2.50 resistance. The extreme oversold bounce could extend further if Paxos stablecoin adoption gains traction, providing fundamental support for the technical recovery. Bulls need sustained buying above $2.28 to neutralize the immediate bearish structure.

The bearish scenario triggers on a daily close below $1.82 support, opening an air pocket down to $1.50 psychological support. This breakdown would confirm the token unlock overhang dominates near-term price action, likely flushing out remaining long positions. Below $1.50, the next meaningful support doesn’t emerge until the 2023 lows near $1.20.

Given the extreme oversold readings and repeated defense of $1.82 support, the most probable near-term path sees APT attempting a relief bounce toward $2.06-$2.28 resistance before the token unlock narrative reasserts control. Without a fundamental catalyst to offset the supply overhang, any bounces likely get faded until the market fully digests the upcoming dilution event.