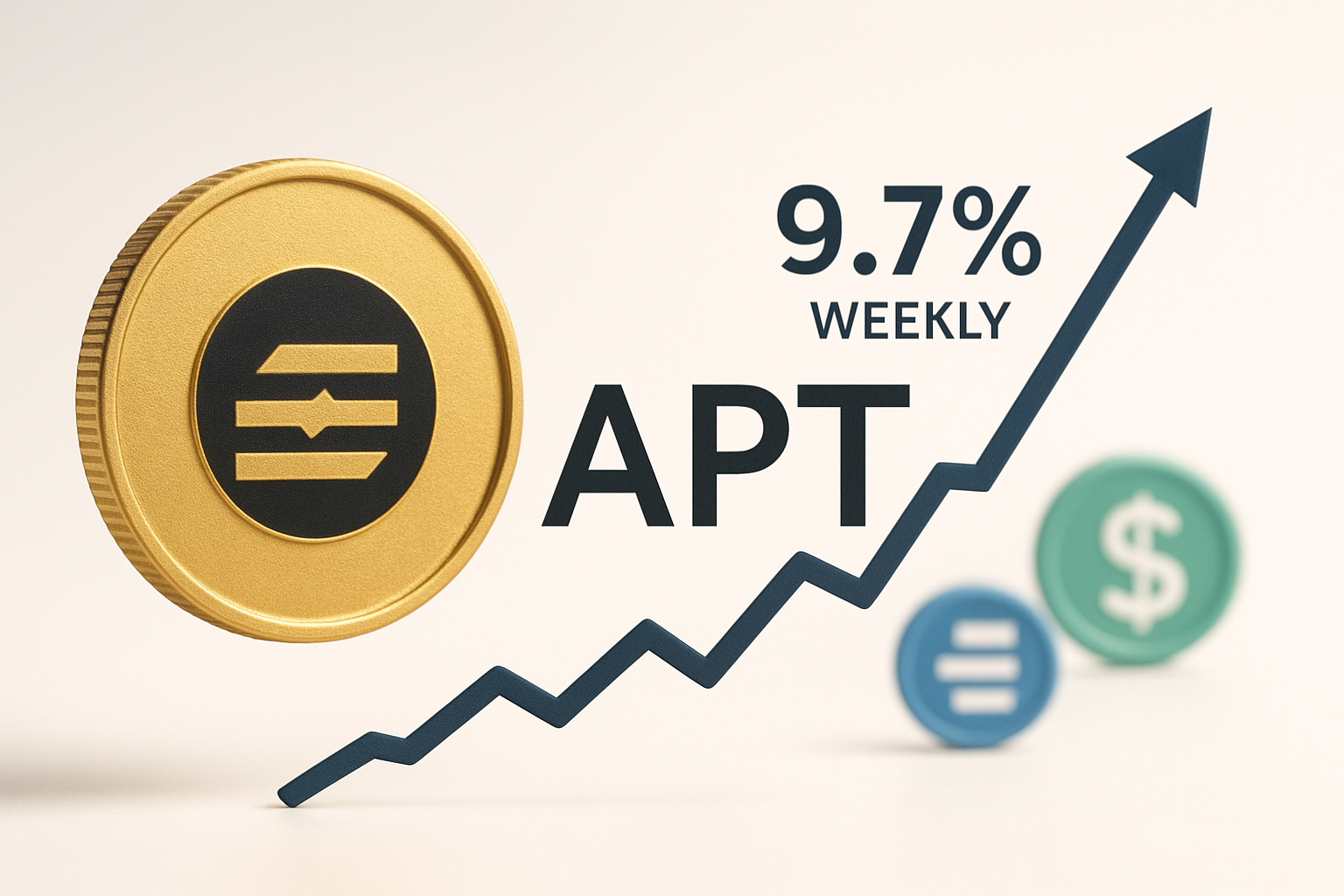

APT Climbs 9.7% Weekly as Stablecoin Launches Target Aptos Network

Market Structure Shifts Higher

- APT reclaimed $2.25 after touching monthly lows at $2.15

- Paxos and CreatorFi both selected Aptos for new stablecoin deployments

- RSI rebounds from oversold territory while ADX signals trend emergence

Aptos surged 9.7% over the past week, recovering from a devastating monthly decline that saw the token shed 34.8% from its November peaks. The rebound from $2.15 to $2.25 comes as major stablecoin players Paxos and CreatorFi announce Aptos as a primary launch network, injecting fresh momentum into an ecosystem that had been bleeding since late autumn. The main question for traders is: can this news-driven bounce transform into a sustained recovery, or will sellers use any strength to distribute remaining positions?

| Metric | Value |

|---|---|

| Asset | APTOS (APT) |

| Current Price | $2.25 |

| Weekly Performance | -21.64% |

| Monthly Performance | -34.83% |

| RSI (Relative Strength Index) | 29.4 |

| ADX (Average Directional Index) | 41.7 |

| MACD (MACD Level) | -0.27 |

| CCI (Commodity Channel Index, 20-period) | -109.69 |

RSI Rebounds From 29.35 – First Oversold Reading Since Spring Selloff

Reading the oscillator at 29.35, traders see classic oversold conditions that historically marked significant bottoms for APT. The daily RSI bounced sharply from sub-30 territory – a zone it hadn’t visited since the broader crypto washout in early 2024. Similar RSI configurations in March and August preceded 40-60% relief rallies within 2-3 weeks.

What’s revealing is how RSI behaved during the Paxos announcement – it surged from 29 to 39 in just two sessions, showing genuine momentum behind the news catalyst. So for swing traders, this oversold bounce combined with fundamental developments creates an actionable setup, though resistance awaits as RSI approaches the neutral 50 zone where sellers often re-emerge.

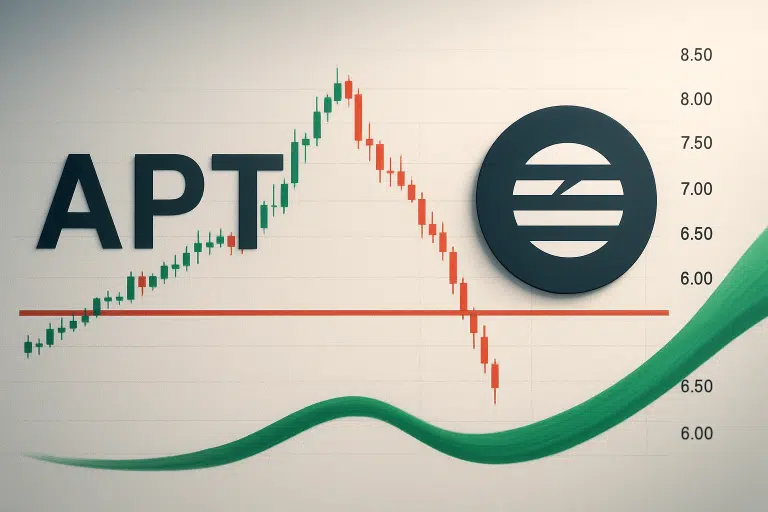

ADX at 41.68 Signals Mature Downtrend Nearing Exhaustion

At the level of 41.68, the ADX entry indicates that the downtrend has been extremely powerful – but such extreme readings often coincide with trend exhaustion. Basically, when ADX climbs above 40, it suggests the current move (whether up or down) has likely captured most of its potential energy. The indicator peaked at similar levels during APT’s previous major bottoms.

Crucially, as stablecoin partnerships provide fundamental support, the technical picture shows a market primed for mean reversion. Therefore, day traders should adjust strategies from trend-following to reversal setups, watching for ADX to roll over below 40 as confirmation that selling pressure is finally waning.

20-Day EMA at $2.66 Becomes First Major Resistance Target

Price action tells a clear story through the EMA structure – APT trades well below the entire moving average stack, with the nearest resistance at the 20-day EMA ($2.66). The 50-day EMA sits higher at $3.12, creating a substantial overhead supply zone that bulls must eventually reclaim. Most telling is how price rejected at the 20-day EMA three times during December’s decline before capitulating lower.

Looking at the broader picture, that former support at $2.66 now transforms into the first real test for any recovery attempt. The CreatorFi partnership announcement pushed price 9.7% higher, but bulls need to prove they can sustain momentum by converting this resistance back to support – otherwise the bounce remains just another lower high in a persistent downtrend structure.

Support Builds at $2.15 While Resistance Stacks Up to $3.12

The immediate resistance zone extends from the 20-day EMA at $2.66 through the psychological $3.00 level, where December’s breakdown accelerated. Above that, the 50-day EMA at $3.12 represents the next major hurdle where trapped longs from November likely await exits. Each level contains significant volume from prior trading, creating natural friction zones.

Bulls defend the critical $2.15 support – a level tested twice this month and reinforced by the Paxos stablecoin selection news. The monthly pivot at $2.76 sits between current price and major resistance, offering an intermediate target for any sustained recovery. Below $2.15, the next meaningful support doesn’t emerge until the yearly pivot near $1.38.

This configuration resembles a typical bottoming pattern where news catalysts arrive just as technical indicators reach extremes. The structure favors buyers as long as $2.15 holds on any retest, with stablecoin developments providing fundamental backing for technical support levels.

Bulls Need Close Above $2.66 to Confirm Trend Reversal

Bulls require a decisive daily close above the 20-day EMA at $2.66 to signal genuine trend change. Such a move would confirm the stablecoin partnerships as sufficient catalysts to shift market structure, opening an initial path toward the 50-day EMA at $3.12 where more substantial resistance waits.

The bearish scenario triggers if price rejects hard at $2.66 and breaks back below $2.15 on volume – this would trap recent dip-buyers attracted by the Paxos news and likely cascade toward the yearly pivot at $1.38. Watch for RSI failing to break above 50 as an early warning signal.

Given the oversold bounce, extreme ADX readings, and fundamental catalysts from both Paxos and CreatorFi partnerships, the most probable near-term path sees APT consolidating between $2.15-$2.66 while building energy for a more decisive move once the stablecoin launches materialize into actual on-chain activity.