Aave Darted to $150 as Whale Exodus Triggers 15% Weekly Plunge

Market Pulse

- A large USDT holder withdrew $1.3 billion worth of stablecoin from Aave and moved it to Huobi token (HTX), causing a crisis of confidence in USDT liquidity.

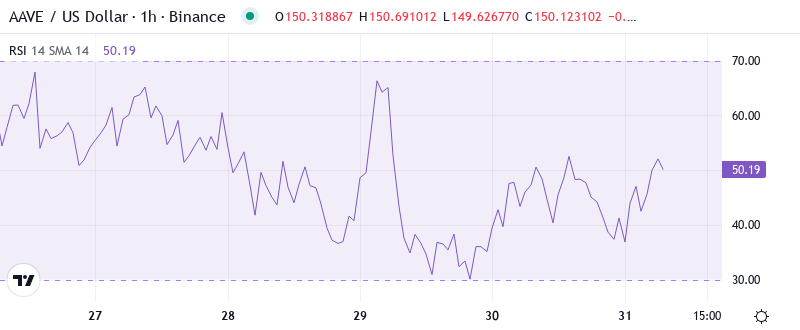

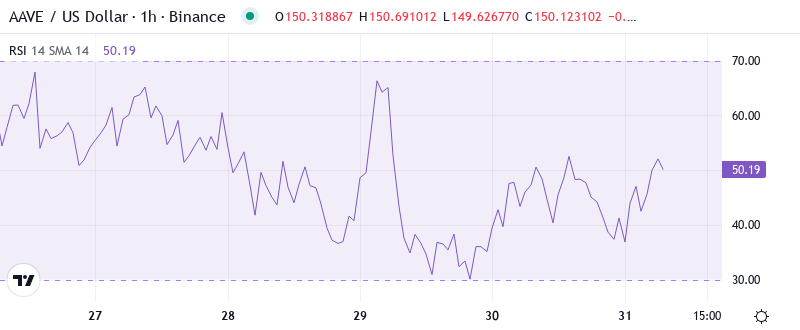

- Momentum indicators have now entered oversold levels for the first time since the end of a summer trading range.

- Buyers are trying to defend the $138 level after a brutal collapse from December’s $207 high.

Aave’s price has been in a steady downtrend since mid-August but has struggled to find a new floor or establish significant support before the downswing. The critical $138-41 zone is the last natural support block before $110-120, which provided anchor for the late July price rebound. Any sustained break above the $140s will face significant resistance at the monthly, 1.5%, 3-week, and 4-hour 21-day moving averages, as well as yearly pivot and monthly demand levels in the $165-175 range.

| Metric | Value |

|---|---|

| Asset | AAVE (AAVE) |

| Current Price | $150.14 |

| Weekly Performance | -0.40% |

| Monthly Performance | -15.45% |

| RSI (Relative Strength Index) | 36.2 |

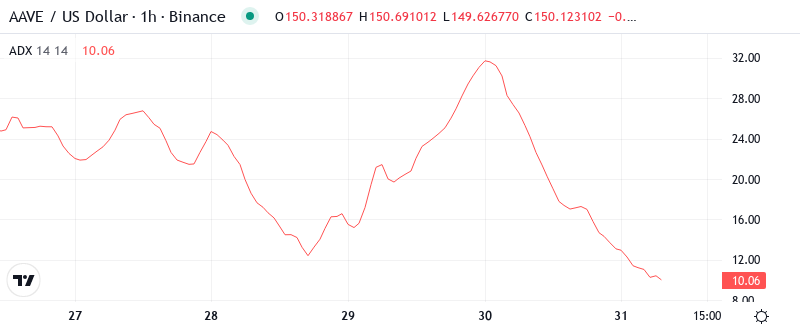

| ADX (Average Directional Index) | 32.9 |

| MACD (MACD Level) | -10.30 |

| CCI (Commodity Channel Index, 20-period) | -75.66 |

RSI Hits 34.75 – First Oversold Signal Since August Capitulation

With the relentless downtrend firmly entrenched, any lows that AAVE prints could be short-lived. If you’ve kept the score at home, AAVE has lost well over 50% in only the first five trading sessions of the new year. The token easily melted through demand around $195-200 established in Q3 and Q4, driving price to lows under $90. Buyers finally emerged around the 88-90 zone from the April double top before the current relief bounce.

For swing traders, the oversold bounce is an opportunity, assuming $138 support holds. The 1.3 billion USDT outflow obviously was the fuel that ignited the momentum wash, as the existing fear of liquidity vampire forced sellers to really press bids. The most interesting aspect is that the RSI weekly is only at 46.16, meaning the longer trend hasn’t fully given up the ghost despite the daily oversold retest.

ADX at 32.89 Signals Strong Downtrend After Breaking From Consolidation

Trend strength really picked up as ADX moved from the low 20s to 32.89, which basically validated that sellers started to become confident in this movement. At 32.89, the ADX entry signal lets us know a trend is building but this number doesn’t hit the extremes – above 40 and the ADX signals exhaustion. The shift out of choppy consolidation and into a straight trend occurred right as the news about the whale transfer broke and altered the entire market structure.

In summary, we have moved from a situation where the mean reversion was effective to a dynamic in which the best strategy remains the trend following one. Reassure day traders that will adjust their strategy to this reality: rather than buying the drop without thinking try to mount the resistance. With the same logic that drove the markets overbought in the previous week.

50-Day EMA at $180 Transforms From Support to Resistance Ceiling

The latest failure came at the 20-day EMA, which puts the 38.2% Fib retrace of November lows to highs at $175.55 on notice. The importance of the $161 level, which was a pivotal resistance in December, can’t be overstated. Should AAVE lose $155, the coin will find itself in price discovery mode with $135 as the closest logical support. This could trigger another 15% collapse.

The most important part of chart is still the compression between the 20-day and 30-day EMAs roughly from $163-169, which created a resistance cluster that specifically turned away Friday’s relief bounce. The 200-day EMA remains far off at $224, and so was not surprising structural support as price discovered new lows. Bulls must retake the 50-day at $180 to force any sort of momentum shifting – otherwise, expect any EMA above to function as immediate resistance as sellers show up.

Resistance Wall Builds From $155 to $187 After Liquidity Shock

There are many sell orders at and above the current price level, starting from $155 and going up to the key $160 level. Additionally, between $150 and $155, there is an immediate resistance zone where buyers from Thursday’s rally may be looking to sell to get out of losing positions. In December, there was high trading activity around $165-170, which also indicates strong resistance in that range.

Bullish investors protect several floors even after a drastic drop spurred by whales. An important level of $138.72 not only functions as the monthly pivot S1 but also coincides with the August hormesis lows, which neutralized selling at point on six occasions during the last four months. Subsequently, the monthly S2 at $119.69 would serve as an insurance policy against disaster; however, a breach of $138 might lead to the entrapment of the most recent oversold buyers.

The market structure became definitively bearish once AAVE gave up the $180 level on volume post 1.3 billion USDT withdrawal headlines. Weekly pivot $175.79 is now resistance rather than support, which confirms the higher timeframe downtrend. This is the same setup we had in May before the last flush to $140, so patience will be crucial for dip buyers.

Bears Target $119 Unless Bulls Reclaim $155 Resistance Quickly

If the price can create a higher low near the $145 level, it would likely continue higher to reach the $165 level. This would be the first significant sign of a trend change. The rally will face resistance at the $152 level initially. A break above the 10-day EMA and $156.5 level is likely to attract short-term traders.

The setup will be broken if AAVE refuses hard at $155 and loses $138.72 on volume closes, which should force stops for oversold bounce buyers and likely spill over to the $119.69 monthly S2. A daily settle below $138 will in practice confirm the continuation of the mid-term downtrend, with $100 as the next major support from 2023’s accumulation zone.

Based on the technical damage of the liquidity shock and the location of major moving averages, the most probable path is that AAVE consolidates within $138-155 over the coming weeks. Oversold conditions leave room open for bounces, but each one will find EMA as a seller until stable whale flows or broader DeFi sentiment turnaround.