Monero Vaults Past $387 as Privacy Coin Defies EU Regulatory Headwinds

Market Structure Shifts Higher

- XMR evidenced its clear bullish trend by jumping over the $350 resistance mark and also affixed a 29.7% monthly gain, in contrast, bearing the EU restrictions as a risk

- As RSI at 63.1 and ADX climbed past 31 the technical momentum built up indicating of a real trend strength

- Buyers target a psychological level of $400, but the support strengthens in the $344-$354 range

A month ago, Monero was $387.23, 29.7% more than it now and gets encouragement from the EU’s announcement of the 2027 privacy coin ban and strict identity check requirements. The cryptocurrency, which stands up for the right to privacy, has almost added $90 compared to the monthly low of $281, and fast sellers who were waiting for the gasping regulatory body to relax the regulations took the opportunity. The traders’ main concern: is it possible for XMR to continue this way toward the almost seven years resistance at $422 with the regulatory issues hovering?

| Metric | Value |

|---|---|

| Asset | MONERO (XMR) |

| Current Price | $387.23 |

| Weekly Performance | 11.93% |

| Monthly Performance | 29.69% |

| RSI (Relative Strength Index) | 63.1 |

| ADX (Average Directional Index) | 31.3 |

| MACD (MACD Level) | 18.78 |

| CCI (Commodity Channel Index, 20-period) | 119.83 |

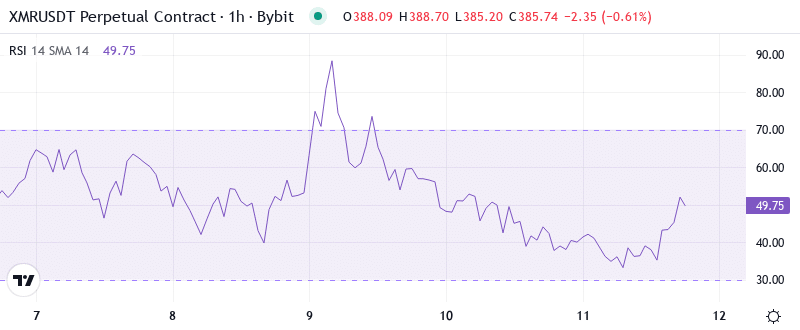

RSI Momentum Signals Controlled Advance

The current daily timeframe reflects an RSI index of 63.1, thus, Monero is at a bullish position and does not have extreme overbought conditions. This balanced reading indicates that a higher continuation is possible while, at the same time, avoiding the levels over 70 which usually cause sharp corrections. RSI configurations that were similar to this one in September occurred before XMR’s rise from $150 to $200, making it possible for the present configuration to help support a further upward movement.

This regulated RSI leap is an indication for swing traders that they can be getting into the market on the minor pullbacks to the $370-$375 area. The weekly RSI which stood at 63.6 is a confirmation of the multi-timeframe alignment that buyers have power, which is also a reason that selling is the only more appropriate trading strategy. The RSI by and large remained over 50 during the EU regulatory news cycle, thus, the disparity between strengths is underscored, with the weak hands bearing the cost.

ADX Confirms Trending Market Conditions

The ADX entry is at 31.3, which means that Monero has transitioned from ranging to a clear trending state. The value over 25 here says that the directional movement is getting stronger and the privacy coin manages to escape the $280-$350 consolidation boundary that prevailed in December trading. To put it simply, being in this zone indicates that the market has made its decision – it wants to go up.

The rocket-like journey of the ADX from below 20 to above 30 marks the transition from choppy conditions to trending price action. For this reason, day traders need to alter their methods in accordance with the new conditions and concentrate more on breakout trades than on mean reversion. The privacy regulations statement which is the main trigger for this trend change really laid the stone for it since the people who expect the price to go down (in this case treat it like a asset) ran away while the financial supporters of privacy held firm.

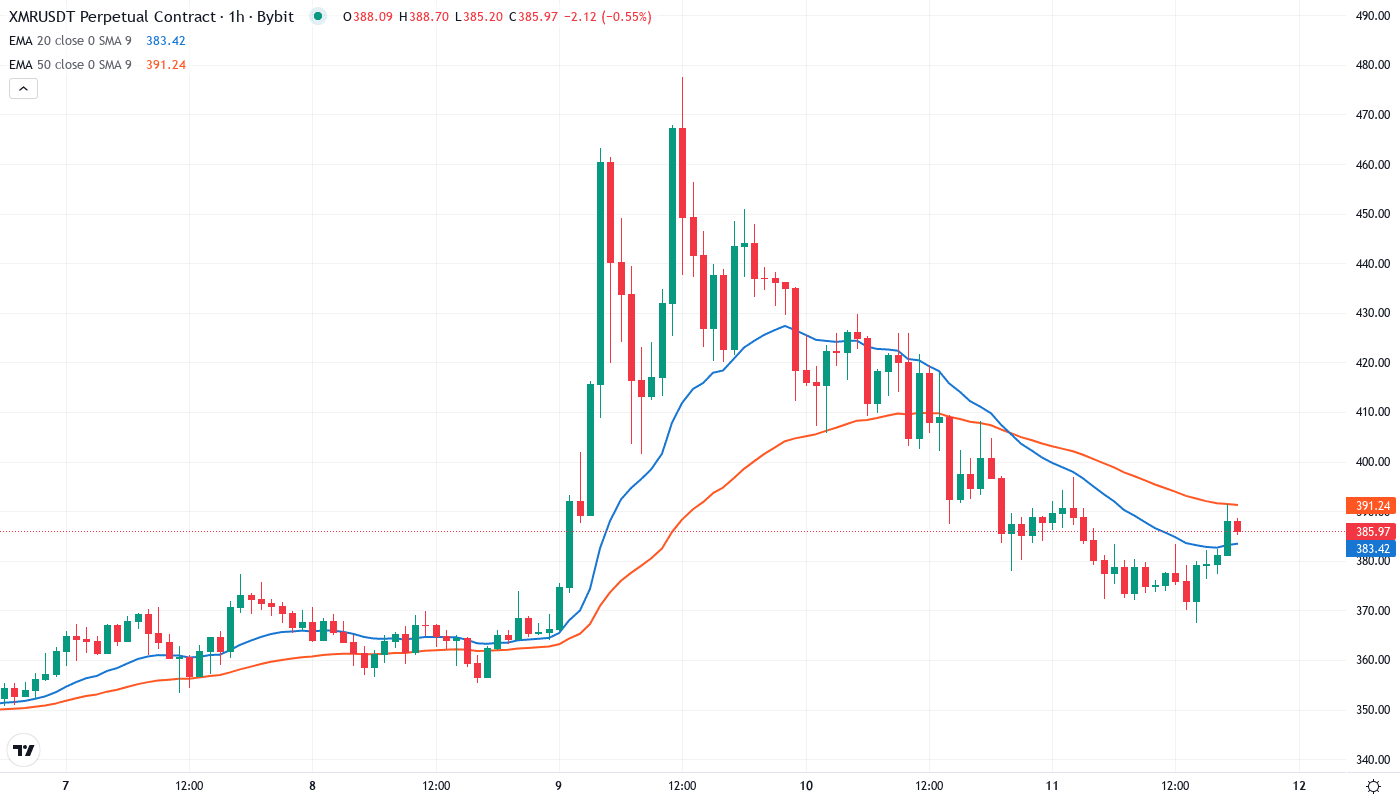

EMA Structure Builds Bullish Foundation

The EMA bands transparently display the movement of price actions. XMR has the 10-day EMA of $371.03, the 20-day EMA of $354.93 above its current price, and importantly, the 50-day EMA at $331.16 above its price – a level that turned down the attempts three times in early December before finally demolishing it. The complete configuration over all the major moving averages gives a bullish signal for the scrapping or continuance of those bullish contracts.

The migration of the 50-day EMA from being a resistance level to becoming a support level is a major transformation of the structure. The recent resistance area at $331 has now changed into a crucial line for the bulls to protect against any pullback and a retracement. Besides, the 200-day EMA which is aligning at $296.94 is a sturdy support. It has exactly plucked the December selloff when EU concerns reached their peak.

Critical Zones Define the Battlefield

Of course! Here’s the paraphrase of the text you provided below: The immediate resistance hos clusters in the zone from $400 up to the recent high of $422 where seven years of price history converge with psychological round numbers. This area rejected XMR advances in 2017, 2021, and again in early 2024, making it the ultimate trial for current momentum. Bulls require the continuous volume and possibly the good news flow to smash through this castle.

The architectural framework for support is now increasingly formidable with the notable increase in this week’s figures. The $354-$344 channel represented the 20-day EMA, and the previous resistance level made it a natural pullback target. It is worth mentioning that the next level, which is $331 (50-day EMA), acts as a line in the sand – any daily close below it would indicate that the post-regulation rally has reached its limit.

The XMR price remains above $344 even after a profit-taking situation through the market structure indicates that buyers are the ones in control. Weekly pivot points at $372.37 offer intermediate support, while the monthly pivot at $314.93 highlights the overall stop loss for the entire uptrend.

Two Paths Emerge From Current Levels

A continuation of the breakout would only be realized if the bulls achieve a daily close above $400, after which they can aim for the $422-$440 area where long-term resistance and Fibonacci extensions overlap. The need for the RLUSD ecosystem to grow and privacy of institutional investors could be the main driving force, holding of, existing financial sectors dealing with surveillance questions.

In the case of the hard bear market situation, it happens when the price at $400 rejects very hard. There should be a possible breakout below $354 and a retest of this level on high trading volume, in which case this would be the scenario that traps the recent buyers and the price moves to $314 by the likely cascading. This kind of action would provide the evidence that the EU ban news has indeed completely dominated the technical buyers thereby the price would be heading to a deeper correction to the 200-day EMA.

The continuous surge in privacy adoption and the factors offsetting regulatory concerns make it probable for XMR to consolidating between $370-$400 for the near term before again making a move towards the seven-year resistance at $422.