Shiba Inu Tests Critical Support as NFT Repayment Plan Meets $7M Wallet Attack Headlines

Market Structure Shifts Lower

- SHIB’s weekly performance shows a 15.4% decline as security concerns dominate the market.

- News of an NFT repayment solution for victims of the Plasma Bridge hack offers some relief.

- The $0.0000072 level has been tested multiple times in the last weeks.

The price of Shiba Inu is currently $0.00000721, which is 15.4% lower than last week. After hitting a monthly peak of $0.0000095, or somewhere in the vicinity of your entry price, SHIB has seen the vast majority of its recent gains vanish into thin air in a schedule right out of the Degen Handbook. Will NFT reimbursement features provide enough support to keep price afloat, or does the news of a Trust Wallet hack for $7 million call for more negative price action?

| Metric | Value |

|---|---|

| Asset | SHIBA INU (SHIB) |

| Current Price | $0.00 |

| Weekly Performance | 0.14% |

| Monthly Performance | -15.38% |

| RSI (Relative Strength Index) | 39.4 |

| ADX (Average Directional Index) | 28.6 |

| MACD (MACD Level) | 0.00 |

| CCI (Commodity Channel Index, 20-period) | -61.59 |

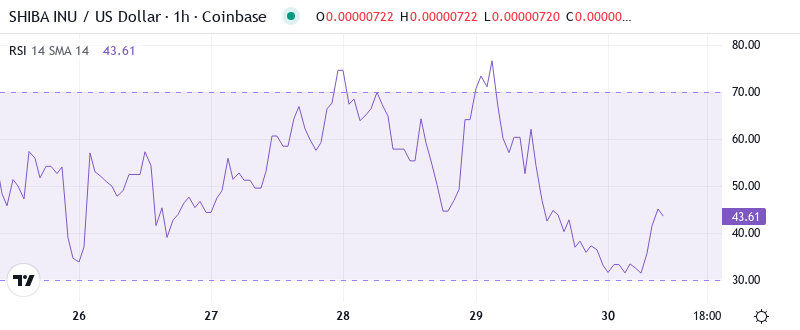

RSI at 39.44 Signals First Oversold Territory Since November Washout

The daily MACD line crossed below the signal line in late December for the first time since July 2021 and remains deep in negative territory, while 12 and 26-day moving averages are now rolling over below the 200DMA. SHIB bulls clearly have their work cut out, but the good news is that an oversold bounce is now becoming increasingly likely to play out given how stretched momentum reads are.

When you consider similar readings for the daily relative strength index (RSI) from two weeks ago, polarized outcomes followed both a brutal short-term relief rally as the token elevated to two-week highs of $0.0000086 and a stomach-churning descent beneath primary support around $0.0000072. The low-low oversold readings were begging for short-term spec longs scaling in near $0.0000075 and down to $0.0000073.

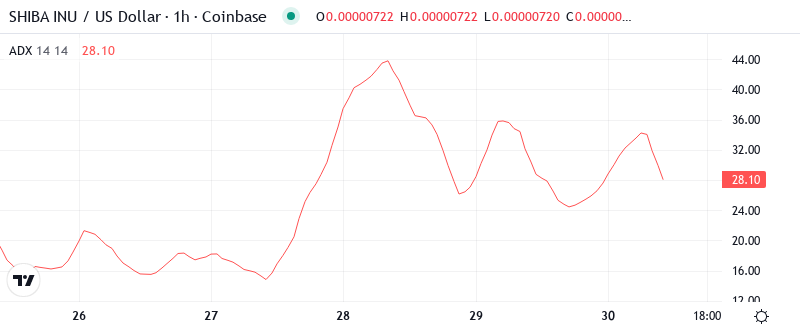

ADX at 28.58 Confirms Sellers Control the Trending Move

The Trust Wallet security occurrence probably raised some eyebrows among trader monitoring the SafeMoon charts. This is a market that thrives on social media buzz, and if it picks up traction beyond the core community, there’s serious potential for the feedback loop of selling begetting more selling to continue into the weekend. We’re not about to tell you where it goes from here – 670 sats could hold, or we go all the way back to the launch zone, 365. Pigs get fat, hogs get slaughtered; selling the farm is entirely optional.

As we’ve seen this week, the most profitable strategy is to favor short setups (duh) and to treat any opening strength as an opportunity to enter or add to positions with a negative bias. If you’re going to flip long, it’s better to wait for bulls to prove themselves with a breakout above the recent day’s high, then bail quickly if the rally fizzles. Frustration and losses mount when trying to catch intermediate bounces “on the cheap” amidst a relentless downtrend.

20-Day EMA at $0.00000824 Now Acts as Dynamic Resistance

The relative strength index hovers in oversold territory, indicating further losses may be limited in the short term. However, the RSI can remain in the oversold region for extended periods in strongly trending lower or bear markets. The 4-hour chart also presents a solid resistance confluence at the 20-day EMA and 50-day EMA.

Another factor that could further exacerbate any potential losses is the position of the 14-day RSI from our last update. Then we discussed the threat of oversold conditions arising from further selling pressure. Fast forward two weeks and the momentum-based indicator is accelerating toward similar conditions with little relief in sight. The index now hovers at approximately 37.5 with a clear line of resistance 21 points above it—a line it has yet to close above. This last occurred back on March 30th when a price rally pushed the indicator to 70, just entering overbought territory.

$0.0000072 Support Tested Six Times – Bulls’ Last Stand Before Air Pocket

The immediate resistance is stacked between $0.00000756 and $0.00000801. The 20-day EMA and the weekly pivot point are located at this zone. This suggests that the bulls will struggle to propel the price above this zone. If the price turns down from this resistance zone again, the bears will attempt to sink the price below $0.00000650 and retest the recent lows.

Although the support structure appears to be shaky, it has gone through multiple tests. In the last two weeks, bulls have tried to protect $0.0000072 on six separate occasions. However, with each rebound, there is less strength, which typically indicates that demand is diminishing. The worrying aspect is that the support level after that is at $0.0000062, which is a further 14% decrease from where we are now.

The market’s unforgiving nature discounts the positive news or events until proven otherwise, leaving tokens vulnerable in the interim. Should price turn, this news could quickly be recategorized as old and immaterial. It’s a self-fulfilling prophecy where the price heralds the news rather than vice versa. For a psychological study, it’s interesting how groupthink operates in this manner.

Bulls Need Decisive Close Above $0.0000076 to Shift Momentum

Buy signals are confirmed by a decisive daily close above $0.0000087, which revives the setup for a bullish weekly MACD cross. At that point, top target flips to the 25-day EMA near $0.0000101 to $0.0000105. A healthy daily close overshoot to the green-line resistance (formerly a flat-bottomed support reinforcing the emotional control of cryptomarket participants) near $0.0000114 is still possible from $0.0000086. The ideal month-end close is year-to-date triangle breakout resistance near $0.0000121.

If the support turns out to be solid, eschew from high-stakes screwing since the initial upside target at $0.0000090 is modest at last Monday’s high. The December 7 high of $0.0000105 is the next upside target, and if that level organically breaks, we’d imagine a lofty test of $0.0000142.

Based on the relentless price action, digesting the recent push higher is justified. Allowing the NFT rollout and repayment system transition to compete with various security risks for the next 30-day cycle keeps the exciting long term prospect fully intact. We expect SHIB to consolidate while the market begins to appreciate Leash outlook.