XRP Tests $1.85 Support as ETF Flows and Swiss Retail Adoption Clash with Technical Weakness

Market Structure Shifts Lower

- XRP fell 3.2% weekly despite over $1.1 billion in spot ETF inflows.

- Technical indicators suggest a balance between supply and demand with potential range-bound trading.

- Key support and resistance levels cluster between $1.77 and $2.22, shaping near-term price action.

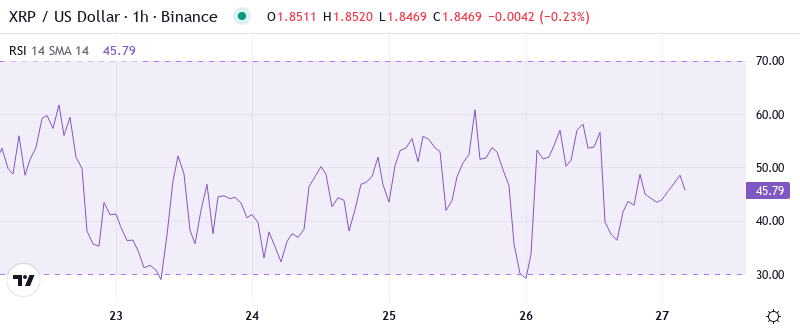

Despite over $1.1 billion flowing into spot ETFs, the digital asset XRP slumped 3.2% on a weekly basis. This suggests that institutional investors showed significant interest in XRP but it failed to lift prices. However, prices are still above the 20-day EMA ($1.08) but the flat 20-week EMA ($1.72) and the RSI just below the midpoint suggest a balance between supply and demand.

XRP’s two disparate markets lament since the month’s open. Amid a deepening selloff, questions are being asked about the sustainability of XRP’s multi-year high institutional inflows. The cryptocurrency fell to $1.85 earlier this week before recovery, marking a 3.2% loss on the week and wiping out 16.9% from March. The $1.1 billion in ETF inflows apparently did not matter for the sellers clearly on the drive; the towering technical resistance at $2.22 proved formidable. It’s looking more and more like the downward technical test will be too much for the daisy chain of fundamentally constructive transfers to hold back. The future outlook indicates XRP will fall further unless fundamental factors—like the cautious elastic payment infrastructure of a Swiss subsidiary—help this slide.

| Metric | Value |

|---|---|

| Asset | XRP (XRP) |

| Current Price | $1.85 |

| Weekly Performance | -3.25% |

| Monthly Performance | -16.92% |

| RSI (Relative Strength Index) | 37.8 |

| ADX (Average Directional Index) | 26.1 |

| MACD (MACD Level) | -0.07 |

| CCI (Commodity Channel Index, 20-period) | -86.92 |

RSI Drops to 37.8 – Approaching Oversold Territory for First Time Since October

With the 43% drop from $0.582 to $0.33, one might expect a substantially larger bounce meeting historic percentages. A less likely scenario would bring sub-$0.25 prices into play barring broad market collapse. The likelihood of this is diminished by BTC maintaining the $6,000 level support. Should XRP go below $0.275, the next stop would likely be $0.23 and possibly break to the downside of the pennant.

Swing traders will find that daily RSI reading near oversold territory to be another interesting setup. An RSI of 36.86 on the weekly timeframe confirms the weakness seen during the week. This momentum indicator provides a guide on the path of least resistance and implies that unless buyers return to the market soon, lower equity prices will be required to attract them. In terms of buyers vs. sellers, positive ETF flows have not been able to generate enough of the latter to even come close to reversing momentum. This should be expected, as most “flows” reported seem to be related to institutional internalization and derivatives market-making. This continues to support short-term bears in control of the shorts.

ADX at 26 Signals Weak Trend as Market Transitions From Rally to Consolidation

At 26.05, the ADX entry signal suggests the trend is running out of gas after last month’s dynamic price action. The directional movement has sellers ever so slightly on top with -DI at 23.02 and +DI at 11.83, yet there’s not a lot of confidence on either side of the tape. Put simply, the ADX suggests we’re moving from a trending environment into a trading-range environment where non-trending, range-bound plays make more sense.

Hence, day traders need to adapt their tactics accordingly. The deteriorating trend dynamics and Swiss retail traction form an interesting interplay—solid underlying tendencies vs. technical vulnerability. ADX readings below 30 tend to signal accumulation ranges ahead of the subsequent thrust, particularly in combination with oversold RSI circumstances and crucial news of adoption, as in the case of SPAR.

20-Day EMA at $1.93 Becomes First Resistance After Supporting Rally Since November

The price levels to watch on the downside are the 10-day EMA, followed by the $1.75 demand zone. If this support breaks down, a revisit of the $1.70 price level is on the cards. The 17-day EMA coincides with this demand zone that might stall a further decline.

The 100-day EMA hasn’t even been tested since price swept below that level earlier in the month. A quick glance at the daily chart shows not only the 200-day EMA beginning to coincide with this downtrend but also the 20-week MA. Should XRP manage to break through $2 with convincing volume and hold, it seems inevitable price will return to the 20-week MA at $2.60.

Resistance Stacks Between $1.93 and $2.22 While Triangle Apex Looms

There are several resistance levels in close vicinity: the 20-day EMA at $1.93, the round-number level of $2.00, and the 50-day EMA at $2.08. The monthly high of $2.22 from December is the upper end of the monthly trading range and fits perfectly with the long-term triangle on XRP, which has been developing since 2021.

Bullish defense of support saw the weekly low maintained at $1.77, supported by the monthly pivot point S1 at $1.79. Next is the 200-day EMA at $1.86, located marginally below the current trading level. Importantly, SPAR Switzerland’s announcement of adoption coincided with price testing these levels of support, indicating that fundamental buyers were met at technical levels.

Looking at market structure, there’s an unmistakable accumulation zone between $1.77 and $1.86. Near-term price-action weakness should push the triangle’s apex further right in your chart. If ETF flows and real-world adoption do lead us, the massive will intersect with the incredible around 10:00 am EST Tuesday, March 30—brace for increased volatility.

Bulls Need Decisive Close Above $1.93 to Reverse Technical Damage

If the price rises above the 20-day EMA, reaching $1.93 is a solid spot to look for. Then, when it gets to $2.00, the next goal would be to reach the 50-day EMA at $2.08 and work on turning it into a supportive level. ETF flows and Swiss retail adoption are underlying factors driving price changes. To detect new strengths beyond these averages, technical analysts need confirmation via sustained price increases.

The setup will be invalidated if XRP loses the $1.77 support that has held multiple times this week. A break below this level will trap recent ETF buyers and likely push down to $1.66, taking the triangle pattern off the table. Bears will take strong control on a daily close below the 200-day EMA at $1.86, signaling that institutional buyers cannot support price action at current levels.

Based on the chart, the props constrain a break above $1.93 for XRP at $1.77 and $2.00, but the $1.93 break has added impulse resistance at $2.20, which unblocks price acceleration towards $3. The deepest support around $1.77 makes it the hardest level to overcome, but a break through it opens the door to undetermined new lows as previous all-time highs become next support levels.