Polkadot Tests Critical $1.72 Support as Momentum Exhaustion Signals Capitulation Phase

Market Structure Shifts Lower

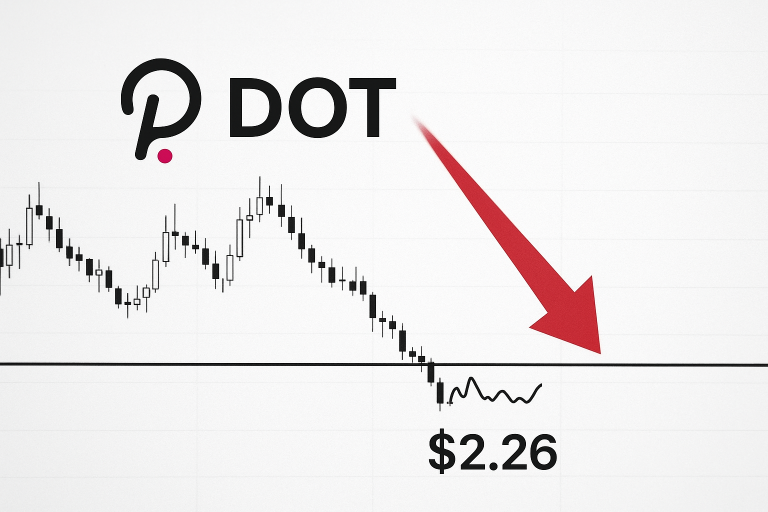

- The price of DOT is $1.72, which is the same in both weekly and monthly low, after falling 25.2% last month

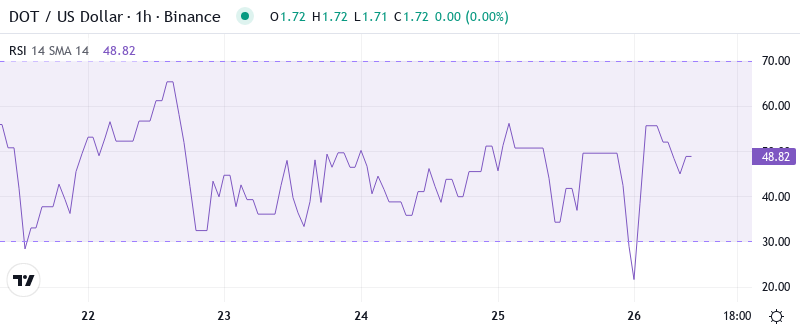

- RSI fell to 32.35 on the daily timeframe – the first oversold report since August rinse

- Bulls are defending the $1.65-$1.75 zone that has served as support on multiple market shifts

The price action of DOT so far in 2020 has been a disaster, and it forgoes any signs of hope on the monthly chart. Since making all-time highs just below $4.00 back in July 2018, Polkadot has been a one-way street lower, and the selling only accelerated once weekly historic price-overhead resistance collapsed at the $2.20 level. By the beginning of September, DOT was already trading 15% below its IPO price, with no signs of a bottom insight.

| Metric | Value |

|---|---|

| Asset | POLKADOT (DOT) |

| Current Price | $1.72 |

| Weekly Performance | -2.27% |

| Monthly Performance | -25.22% |

| RSI (Relative Strength Index) | 32.4 |

| ADX (Average Directional Index) | 45.9 |

| MACD (MACD Level) | -0.17 |

| CCI (Commodity Channel Index, 20-period) | -100.02 |

RSI Drops to 32.35 – Momentum Matches August’s Capitulation Low

With the RSI at 32.35, traders could be looking at oversold levels not seen since the August washout last year. This barometer is based on recent gains versus losses, and over the last few months, when the Impulse is below 50 (or not increasing), the S&P 500 has tended to struggle. The Scout Report also has the 30-week DEMA oscillator (a volume-weighted RSI) at 32.35, a level last hit in August 2024. The oscillator measures recent fund buying versus selling.

Therefore, for those relying purely on technical analysis, momentum indicators like the relative strength index (RSI) are an important tool when assessing the overall health of a trend and whether to open a long or short position. Interesting in this case, the RSI measures the speed and change of price movements on a scale of zero to 100, with an asset deemed overbought if the RSI is above 70 and oversold if it’s below 30.

ADX at 45.94 Reveals Extreme Trend Strength Behind the Selloff

The current ADX is signaling that we are reaching one of the most powerful directional moves Polkadot has experienced. This is not the normal choppy, indecisive trend to the downside. This is a well-behaved downtrend with strength that tends to max out in the 45-50 ADX range. In short, whenever ADX reaches these high levels, the trend is often strong but running out of gas. Reversals will need a driver to push that across the goal line though.

People who follow trends and took advantage of the price drop should now think about taking their profits. When it comes to Polkadot, an ADX reading higher than 45 has always been followed by a powerful reversal or long consolidation period. The leveraged pair delistings on Binance contributed to these trends, yet with ADX overextended, it is no longer opportune to open new short positions. Consequently, day traders must get ready for higher volatility and potential bear traps.

20-Day EMA at $2.03 Now Acts as First Major Resistance Overhead

Looking ahead, DOT is likely to test immediate support at the $1.76 October 12 peak, followed by $1.62 September 29 high. Buyers emerged ahead of the latter price barrier following September’s minor 23% correction.

An upward rally may have difficulty when it encounters stiffer competition in the $2.20 area. This ceiling contains the 50-day moving average and is close to a congested resistance area that halted the relief rally in late February and the initial advance last October. A substantial rise above $2.20 would enhance the upside and could launch a more substantial rebound.

Support at $1.65 Faces Sixth Test as Bulls Make Their Stand

The bulls continue to defend a critical support zone, $1.65 to $1.75, that has withstood multiple bear raids in 2023. This week marks the sixth test of that low, and each time it has bounced at least 15-20% from those levels. This floor becomes even more significant when you consider that the monthly pivot point is located at $2.64, which is nearly $1.00 above current prices.

There is a lot of resistance between $1.90 and $2.25. The overall 20-day exponential moving average (EMA) is the first obstacle at $1.91. The $2.00 level is a crucial psychological barrier. Next, the 50-day EMA will come into play around $2.03. The more times the price is rejected at these levels, the stronger the resistance.

The market structure indicates a coiled spring condition between underpinning support at $1.65 and overhead resistance at $2.00. The 20% range is similar to the coiling consolidation patterns witnessed in August and November but the recent occurrence of positive fundamental news (U.S. DC integration, ETF inclusion) in conflict with negative technical signals makes this the most finely balanced set-up for some time. Most outcomes are still possible.

Bulls Need Decisive Close Above $2.00 to Shift Momentum

If the price should rise again and stay above $2.00, at the end of a day, this will give bulls the signal that there is a “double bottom” around $1.65 and there is an additional amount of $2.35 bullish commitment.

As long as DOT remains below $1.90, bears are in control, and if we lose $1.65, there is little support until $1.20-$1.30. This would likely stop out any remaining longs and set off a washout to $1.00, especially if cryptocurrencies are still under pressure.

Due to the very oversold conditions, multi-test support at $1.65, and constructive fundamental news, the most likely immediate direction has Polkadot ranging between $1.65-$1.90 as bulls gather momentum for a relief rebound. Yet, investors need to keep their guard up as the robust downtrend pattern will be maintained until buyers demonstrate they are able to recover and sustain $2.00.