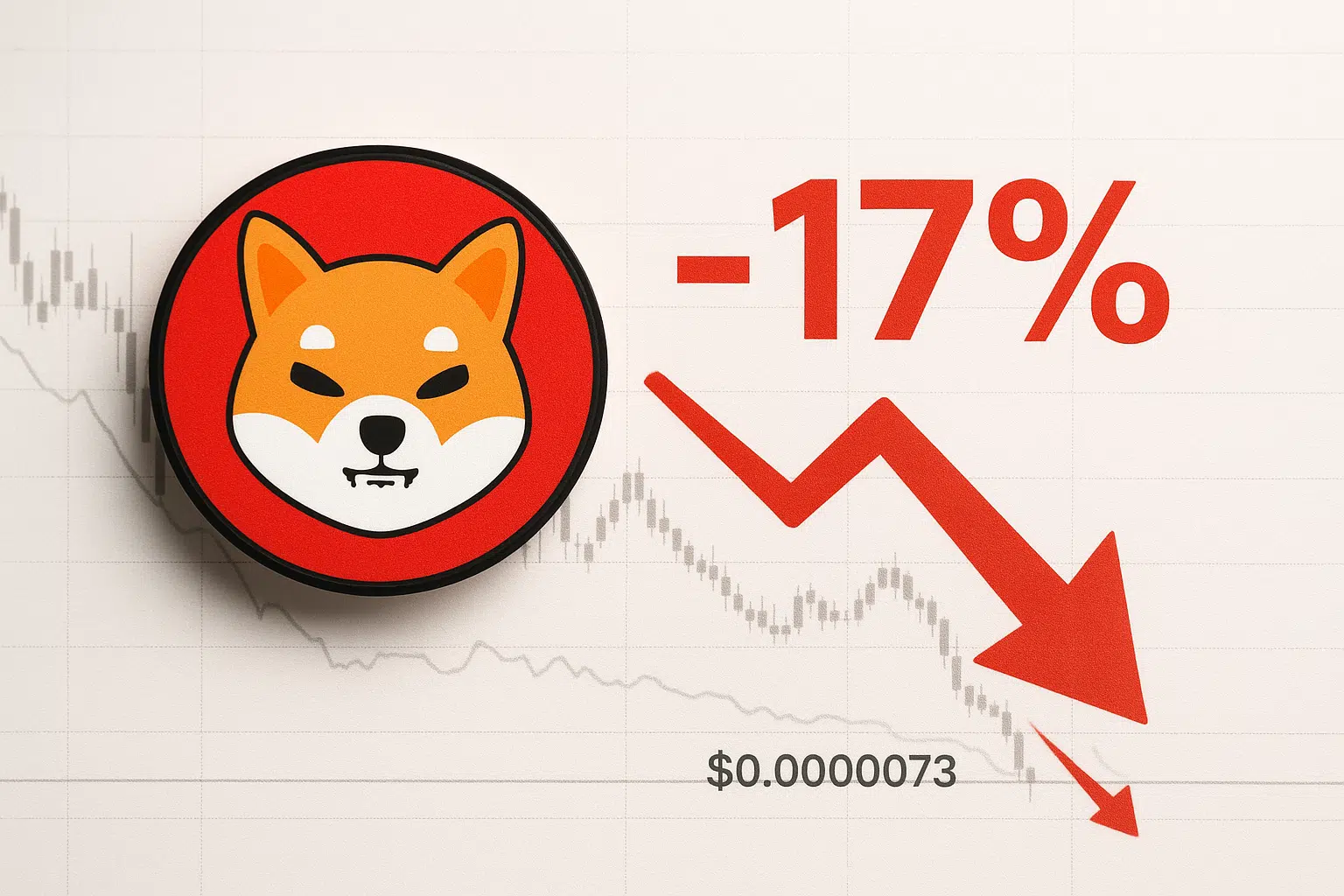

SHIB Plunges 17% as Burn Mechanism Halts, Testing Critical Support at $0.0000073

Market Structure Shifts Lower

- SHIB drops 17.14% this week as burn mechanism completely halts

- Coinbase futures launch fails to stem selling pressure

- Six-time tested support at $0.0000073 becomes make-or-break level

Shiba Inu darted through multiple support levels this week, shedding 17.14% to trade at $0.0000073 as the complete halt of its burn mechanism triggered stop-loss cascades. The devastating drop erased over a month of gains, with SHIB now down 42.85% from its three-month peak despite Coinbase launching regulated futures contracts. The main question for traders is: can the $0.0000073 level – tested six times since June – hold once more, or will the absence of deflationary pressure finally break this critical floor?

| Metric | Value |

|---|---|

| Asset | SHIBA INU (SHIB) |

| Current Price | $0.00 |

| Weekly Performance | -13.63% |

| Monthly Performance | -17.14% |

| RSI (Relative Strength Index) | 35.8 |

| ADX (Average Directional Index) | 19.8 |

| MACD (MACD Level) | 0.00 |

| CCI (Commodity Channel Index, 20-period) | -187.62 |

Momentum Exhaustion Signals Capitulation Phase Complete

RSI sits at 35.80 on the daily timeframe, marking the first oversold reading since the August washout that preceded a 65% rally. What’s particularly revealing is how momentum collapsed from neutral territory to oversold in just five trading sessions – a velocity of decline that historically marks capitulation events rather than orderly corrections.

Similar RSI configurations in September and November both resulted in sharp reversals once the oscillator dipped below 40. So for swing traders, this oversold bounce setup offers compelling risk-reward, especially with the psychological $0.0000070 level just 4.8% below current price. The complete halt of SHIB burns explains why momentum shifted so violently – without the deflationary mechanism supporting price, sellers overwhelmed any dip-buying interest.

Weak ADX at 19.77 Keeps Range Traders in Control

Looking at trend strength, the ADX reading of 19.77 confirms what price action already suggests – SHIB lacks directional conviction in either direction. Basically, being in this zone below 20 means the market favors range-bound conditions over trending moves, which explains why price keeps bouncing between the same levels despite dramatic percentage swings.

To clarify, the ADX is indicating that we’re still in boundary conditions rather than a trending state, despite this week’s sharp decline. Therefore, day traders should adapt their strategies to fade moves at range extremes rather than chase momentum. The Coinbase futures launch hasn’t generated enough institutional flow to push ADX higher, suggesting the new derivative product needs time to impact spot market dynamics.

Price Trapped Below Entire EMA Cloud Since Breaking $0.0000085

Price action tells a clear story through the EMA ribbons. SHIB trades below the 10-day ($0.0000078), 20-day ($0.0000081), and crucially, the 50-day EMA at $0.0000088 – creating a stacked resistance zone that rejected recovery attempts three times this week. The 50-day EMA changed from being a support level to resistance after the burn halt announcement, trapping late buyers who entered above $0.0000090.

More telling is the compression between the 100-day EMA at $0.0000098 and current price – a 33% gap that represents the largest discount to this average since the summer lows. This stretched condition typically results in mean reversion bounces, though the absence of burn mechanics removes a key catalyst that previously triggered such recoveries. Bulls now need to reclaim the 20-day EMA at $0.0000081 to shift near-term structure bullish.

$0.0000073 Support Tested Six Times – Bulls’ Final Stand

Support architecture shows remarkable resilience at current levels despite the burn mechanism failure. The $0.0000073 level has caught falling knives six times since June, with each test accompanied by volume spikes suggesting institutional accumulation. Below this, the next meaningful support sits at the psychological $0.0000070 level, which aligns with the 200-week moving average.

Resistance stacks heavy between $0.0000081 (20-day EMA) and $0.0000095 (monthly high), creating a 30% overhead supply zone. The critical liquidation zone identified in recent analysis sits right at $0.0000082, where overleveraged longs from the Coinbase futures launch remain trapped. Any relief rally will face serious selling pressure at these levels.

This configuration resembles a descending triangle with support at $0.0000073 and declining highs – a pattern that typically resolves lower unless bulls can generate surprising strength. The complete halt of burns removes the supply-reduction narrative that previously supported higher valuations, leaving SHIB dependent on broader market flows and speculative interest.

Bulls Require Decisive Close Above $0.0000081 to Shift Momentum

Should price reclaim the 20-day EMA at $0.0000081 with conviction, the technical picture improves dramatically. Bulls would then target the 50-day EMA at $0.0000088, where December sellers cluster. The Coinbase futures launch could provide the liquidity needed for such a move if institutional players begin position-building at these oversold levels.

The bearish domino falls if $0.0000073 support fails on volume – this would likely flush positions down to $0.0000070 or potentially $0.0000065, where the next high-volume node sits. Without the burn mechanism creating constant buy pressure, any breakdown could accelerate faster than previous corrections as the fundamental support structure has weakened.

Given the oversold RSI, range-bound ADX, and six successful defenses of $0.0000073, the most probable short-term path involves a relief bounce toward $0.0000078-$0.0000081 before sellers reassert control. The absence of burns fundamentally alters SHIB’s value proposition, but oversold conditions rarely persist without at least a dead-cat bounce attempt.