BNB Tests Critical Support at $836 as Enterprise Adoption Expands

Market Pulse

- AWS payment integration and prediction markets strengthen BNB’s utility foundation while price consolidates

- Six-time tested support at $836 faces another challenge as momentum indicators reset to neutral territory

- Market structure coils between $791-$941 monthly range with ADX signaling shift from chop to trending conditions

BNB slipped 7.8% over the past month to $836.5, erasing gains from November’s rally despite a wave of enterprise adoption news that would typically fuel buying interest. The AWS payment integration through Better Payment Network and PancakeSwap’s prediction market launch represent fundamental catalysts that historically drive price appreciation, yet sellers defended the $941 monthly high with conviction. The main question for traders is: will the confluence of enterprise utility expansions finally provide enough fuel to break the four-month resistance, or does the technical setup favor more downside first?

| Metric | Value |

|---|---|

| Asset | BNB (BNB) |

| Current Price | $836.50 |

| Weekly Performance | -6.38% |

| Monthly Performance | -7.76% |

| RSI (Relative Strength Index) | 37.9 |

| ADX (Average Directional Index) | 25.4 |

| MACD (MACD Level) | -16.58 |

| CCI (Commodity Channel Index, 20-period) | -168.15 |

Momentum Cools to 44.05 Without Signaling Capitulation

RSI sits at 44.05 on the daily timeframe, marking a retreat from overbought conditions above 70 just weeks ago but stopping well short of oversold panic. This balanced reading suggests profit-taking rather than genuine bearish reversal – sellers took control but haven’t triggered the capitulation cascade that typically marks major bottoms. The oscillator’s refusal to breach the 30 floor despite a 16% drawdown from monthly highs indicates underlying bid support remains intact.

What’s revealing is how RSI behaved during similar enterprise adoption phases. September’s DeFi integration surge saw RSI dip to 42 before launching a 35% rally within three weeks. Current levels mirror that pre-breakout compression, especially with AWS payments and cross-chain securities bridges expanding BNB’s addressable market. So for swing traders, this neutral RSI combined with fundamental tailwinds creates an asymmetric risk-reward setup favoring accumulation over panic selling.

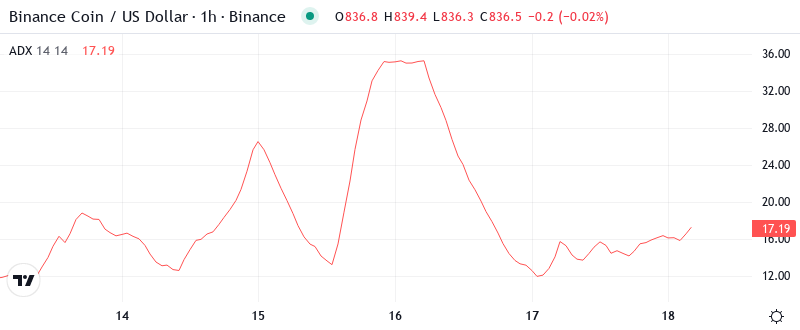

ADX at 25.43 Signals Market Escaping Range-Bound Purgatory

Trend strength finally shows signs of life with ADX climbing past 25, marking the shift from choppy consolidation to directional movement. At the level of 25.43, the ADX entry indicates that the trend is gaining power but it’s not at the extremes yet. Basically, being in this zone means the four-month sideways grind that frustrated both bulls and bears is giving way to trending conditions where momentum strategies outperform mean reversion.

To clarify, the ADX is indicating that we are switching from boundary conditions to a trending state – precisely when major moves tend to unfold. The last time ADX pushed through 25 from below coincided with BNB’s October surge from $500 to $700. Therefore, day traders should suit their strategies to this change by favoring breakout trades over range fades, especially with enterprise adoption news providing fundamental wind to the sails of whichever direction price ultimately chooses.

50-Day EMA at $917 Looms as Key Resistance After Support Flip

Price action reveals a critical inflection point through the EMA ribbons. BNB currently trades below the entire moving average stack – the 10-day ($867), 20-day ($879), and crucially the 50-day EMA at $917 which rejected advances three times in December. That former support area at $917 now transforms into a red line for bears to defend, particularly after price convincingly broke below during the recent selloff.

Looking at the longer-term averages, the 100-day EMA at $930 and 200-day at $881 create a resistance cluster between $880-$930 that coincides with monthly pivot levels. This compression of technical barriers explains why rallies keep failing in this zone despite positive news flow. The successful defense of these levels by sellers, even as AWS integration and prediction markets expand utility, suggests technical resistance currently trumps fundamental drivers – at least until price can reclaim and hold above the 50-day EMA with conviction.

$836 Support Survives Sixth Test as Resistance Stacks at $941

The immediate support at $836 deserves attention after surviving its sixth test since June, bouncing price each time with increasing volume. Below that, the monthly low at $791 provides a safety net, but losing $836 would likely trigger stop-loss cascades targeting the psychological $800 level. The support architecture builds from these levels, reinforced by the tokenized securities bridge news that positions BNB Chain as a settlement layer for traditional finance assets.

Resistance clusters between the December high at $941 and the psychological $1,000 level, with multiple failed attempts creating a formidable ceiling. The monthly R1 pivot at $1,050 adds another layer to this resistance stack. What’s particularly telling is how price rejected precisely at $941 despite the PancakeSwap prediction market launch – a development that should have catalyzed buying but instead met aggressive selling.

Crucially, the price architecture shows accumulation patterns at support despite rejection at resistance. The repeated defense of $836 while enterprise adoption accelerates suggests institutional players are accumulating on dips, building positions ahead of the next trending move that ADX signals is imminent. This creates an asymmetric setup where support looks stronger than resistance despite recent price weakness.

Bulls Need Decisive Close Above $917 to Reignite Rally

Bulls must secure a daily close above the 50-day EMA at $917 to flip market structure bullish and target $941 resistance. The enterprise payment integrations and cross-chain infrastructure developments provide the fundamental catalysts for such a move, but technical confirmation is essential. A convincing break above $941 would open the path to $1,050 and potentially the psychological $1,100 level as momentum accelerates.

The bearish scenario triggers if $836 support finally cracks after six successful defenses, especially on heavy volume. Such a breakdown would trap recent buyers betting on AWS adoption news and likely cascade toward $791 monthly lows. The setup invalidates entirely below $791, which would signal a deeper correction toward $750 despite the expanding utility narrative.

Given the ADX shift to trending conditions and neutral RSI providing room in both directions, the most probable near-term path sees BNB consolidating between $836-$880 while coiling for a larger directional move. The confluence of enterprise adoption with technical compression favors an eventual upside resolution, but price needs to prove itself above key moving averages first.