XRP Crashes Through Support as ETF Euphoria Evaporates

Market Structure Shifts Lower

- XRP price declined 14.2% this month, falling from $2.29 to $1.85.

- Multiple support levels failed to hold and momentum remains decisively negative.

- Despite oversold technical indicators, fundamental uncertainty and recent partnerships may not halt the downtrend.

XRP dropped 14.2% this month, eliminating the gains that were driven by the ETF in December. The price collapsed from $2.29 to $1.85 and several support levels failed to hold. While many technical indicators show that XRP is oversold, momentum is still decisively negative.

The downward spiral of XRP from the highs of December has initiated a new bear cycle with the digital coin losing 14.2% over the prior month after the first ETF hype was replaced by the first possibility. The descent sped up after the psychological level of $2 was not sustained. This presumed significant profit level brought to the market stop-loss following a landslide down to $1.85, the least expensive score since the ending of November. The most significant thing for merchants is: are the recent AMINA Bank and SBI Ripple Asia agreements resilient enough to suspend this technological failure?

| Metric | Value |

|---|---|

| Asset | XRP (XRP) |

| Current Price | $1.86 |

| Weekly Performance | -9.15% |

| Monthly Performance | -14.22% |

| RSI (Relative Strength Index) | 33.8 |

| ADX (Average Directional Index) | 21.5 |

| MACD (MACD Level) | -0.08 |

| CCI (Commodity Channel Index, 20-period) | -170.22 |

RSI Plunges to 33.77 – Deepest Oversold Reading Since November Washout

With the regulatory panic selloff and recent rebound concluded, XRP price is officially testing a critical support level dating back to the December 2020 breakout at $0.569. If the Ripple slump continues, which is highly plausible given the technical damage and fundamental uncertainty, the token is likely to find support around the 200-day simple moving average (SMA) at $0.374, which has contained all pullbacks since the September 2020 breakout. It adds to this positive view that the 200-day SMA is currently establishing a bullish slope. A daily close below the Monday low at $0.509 will put the 200-day SMA in play.

Surprisingly enough, comparable RSI arrangements beneath 35 have, before, denoted critical bottoms for XRP, particularly if there should be fundamental catalysts to support this. Consequently, for swing traders, this deeply oversold reading also the expanding ecosystem partnerships indicates a technical bounce could serve shortly- any rally does face strong resistance from trapped longs who are keen to escape at breakeven levels.

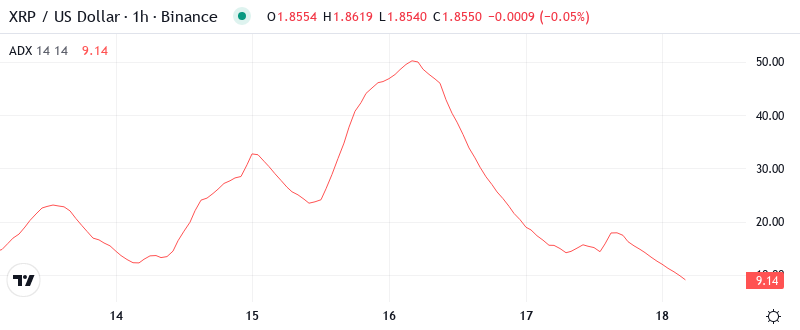

ADX at 21.49 Signals Trend Exhaustion After Violent Selloff

Indicators that give a clue to the trend’s strength show less bearish influence on prices than their recent peak. To be exact, at 21.49 the ADX index shows that sellers showed control during the recent movement, but they were losing it as the movement developed. In simple words, it moved from a strong directional movement to a trading environment movement with no clear trends, making it equally difficult for both bulls and bears.

It is interesting to note how fast ADX collapsed from levels above 40 in late December – a textbook exhaustion move. For those unfamiliar with this indicator, it is essentially suggesting that we are moving from trending back to a sideways market environment and considering that sideways consolidations are notorious for appearing before strong trending moves, day traders will want to adapt their approach towards range-based opportunities while monitoring if the market can produce a solid break above the 25 level for the beginning of a new trend.

20-Day EMA at $2.07 Now Acts as First Major Resistance

The RSI in oversold territory will likely buoy prices in the short term, however, bulls will want to see price reclaim the daily 10-day EMA at $1.95 and the weekly level at $2 to have any chance of a broader reversal. To the downside, the next clear level of support is not until $1.46 as January’s price action was extremely aggressive.

If we focus more on the long-term perspective, the lowest price since 2016 will be confirmed, which could drive additional technical selling in the low $2.10s. This selling pressure is unlikely to cease until there is a final table-cleaning flush, which is likely to occur in the $2.00-2.05 chart support zone. This will certainly be the final hot spot and your ultimate dip buying opportunity to position for the overdue secular bull.

Support Crumbles at $1.79 While Resistance Stacks From $2.19 to $2.29

There are multiple resistance layers above the current price which will make it hard for the price to recover. The first resistance is between the monthly pivot at $2.19 and December’s breakdown level at $2.29. The second resistance is at the level where longs from the ETF announcement rally are still losing money. These technical and psychological resistances combined together will create a very strong barrier. The failed retest at $2.19 which caused the price to fall even further shows how strong this resistance is.

Currently, the Ripple price is up less than 5% since the November 26 close, leaving XRP on pace to post the second-worst monthly performance in its history. With less than a week left in November, these losses extend a historic string of underperformance, as XRP has now lagged the broader digital asset market for 15 straight months. Despite toppling under its long-term downtrend from the April all-time high (ATH) this month, Ripple remains in a precarious position.

The market structure clearly indicated that bears have taken the lead over bulls as every minor surge got sold into, resulting in a lower high. Fundamentally, the token’s uncertain legal status in Japan could be making rallies difficult. Notably, Sunday’s news of SBI Ripple Asia’s ongoing efforts to tokenize making illiquid real-estate funds in Japan failed bring in buyers. This is evident from the token’s near-5% drop on the day – the fourth-consecutive day of decline.

Bears Target $1.43 Unless Bulls Reclaim $2.02 Immediately

If the price of XRP manages to rise above the 20-day EMA, which is approximately $2.02, then we may see bulls push for a temporary rally close to $2.19, the monthly pivot point. To make this happen, there would need to be a surge in buying, which could be triggered by new ETF news, or institutional investors buying up more XRP since it’s considered oversold at the moment.

If XRP continues to respect the $1.79 level and manages to hold the ETF premium, even if it consolidates around $1.90 for a week or two, then the bulls are in charge, and they will make the next move. The ETF premium gives a clue to the general level of retail sentiment because it goes hand in hand with the exposure that the mainstream news gives to the ETF approval.

Considering all current factors, a breather in the brutal $0.90 breakdown seems like a healthy pause before the final leg of this bull run gets underway. Should persistent selling pressure force XRP below $1.79 in the coming days, key levels of support to lean on are $1.51, $1.26, and $1.09. Needing to rebuild a base of higher highs and lows, a close above $2.02 will confirm a temporary low has been established.