Ethereum Classic Tests $13 Support as Momentum Indicators Flash Warning Signs

Market Structure Shifts Lower

- Ethereum Classic price is on a back footing this week despite recent gains marked between November and December.

- The crypto is set to close to around 3.65% in the red.

- It remains vulnerable to further downside as the week comes to a close.

Ethereum Classic has been moving steadily down, having lost 3.65% throughout the course of the last week to settle at $13.238 as the sellers remain in the driver’s seat following the rejection from December’s peak of $17.22. The monthly gauge shows an even bleaker picture with ETC losing 15.24% while the 3-months loss amounts to nearly 40% – that has wiped out the entirety of summer’s gains. Sentiment has taken another knock following the emergence of the prodigy of the Ethereum network, Kaspa, which has gone over 150 million transactions per day compared to ETC’s 24,000 during the peak times. This has brought tailwinds to the narrative about the network losing valuable competitiveness. The ultimate question stands next to the traders and it is whether the bulls can stand firm in protecting the psychological level of $13 after the repeated attempts or this time the notable level gives in to the relentless supply.

| Metric | Value |

|---|---|

| Asset | ETHEREUM CLASSIC (ETC) |

| Current Price | $13.24 |

| Weekly Performance | -3.65% |

| Monthly Performance | -15.24% |

| RSI (Relative Strength Index) | 42.6 |

| ADX (Average Directional Index) | 20.3 |

| MACD (MACD Level) | -0.37 |

| CCI (Commodity Channel Index, 20-period) | -96.05 |

Momentum Exhaustion Signals Potential Capitulation Phase

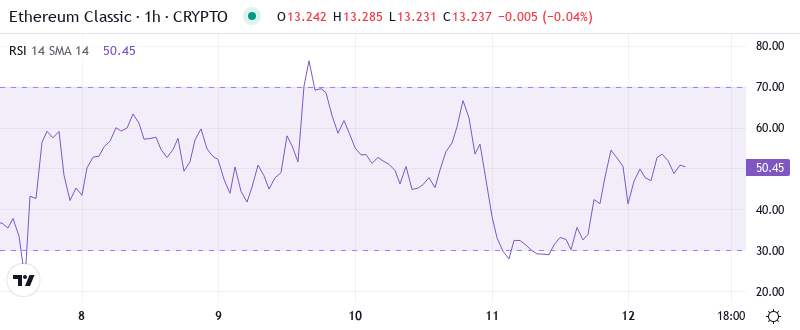

The Relative Strength Index (RSI) is currently 48.38 on the daily chart and is slightly below the 50 handle following a decline from 68.51 last week, which coincided with the rejection of price at multi-month highs. As we head into early December, most of you will be well aware that the fifth month of the year is typically one of the weaker periods of performance for the precious metals space, a fact that appears to have been overlooked based on such a bullish RSI print heading into last month.

Taking the weekly timeframe into consideration is key – RSI comes in at 45.09, dropping below 52.64 last week, signaling the swing-term trend has turned bearish. As such, this all-purpose, cooling RSI establishes that the falling knife probabilities should be abided until panicking out happens (RSI at 30 or below), or until the uniform 50 line gets retaken on a momentum basis. The absence of oversold rebounds is notable in light of the 40% drop from Q2 top levels, which suggests further losses, while the consolidation would route an oversold uplift.

ADX at 20.30 Keeps Range Traders in Command

With a segment of the Ethereum Classic (ETC) faithful feeling a bit marginalized, they have not given up on the battle by any stretch of the imagination. We pay full gratitude to the stayers and holders that see in ETC what once motivated them. However, without committed bulls to officially halt the correction, the bears are likely to win, and that will keep the trip towards our final state quite simple. The bounce also confirms the Dollar Tree stock’s position within a trading range between $13.24 and $15.52 that stretches back to July. The Dollar Tree stock may be overly volatile for most swing traders, but the pattern provides a few options for position traders, including going long here and adding exposure when other protection stabilities supply trends start the next trip higher. This often requires a six to nine-month holding period.

20-Day EMA at $13.71 Caps Recovery Attempts

The EMA ribbons themselves are starting to condense as the moving averages tighten due to continued consolidation, although the latest drop in ETC has now opened up greater separation between the shorter duration EMAs. We would expect the 10-day EMA to arc lower faster into coming sessions unless buyers step in to rescue prices.

The significant aspect though is the razor-thin 1.8% gap between current price ($13.238) and the 10-day EMA at $13.48 which is the immediate barrier for any rebound. The bigger resistance looms with the 100-day EMA at $16.09 and 200-day at $17.54 which are the quarterly peaks, where the sellers swarmed. The 20-day EMA at $13.71 levels, which provided a floor earlier now turns into a stiff barrier for the bears to fortify their technical edge.

Support Crumbles Below While Resistance Stacks Above

The 10-day EMA at $13.48 and the key $14 level represent the first hurdles that the stock needs to overcome. In case of upward momentum, some overhead resistance is expected, especially given the stock’s recent performance. The monthly pivot point at $15.04 coincides with the 50-day EMA, which implies that this could be a strong resistance level. Furthermore, the stock is also likely to face resistance from the highs of late December 2019 at $17.22.

The bulls are having a tough time defending the $13.238 support level for the sixth occasion since November. As each test of this support weakens the buying pressure, it makes it more likely for a breakdown. If the current support breaks down, the next real critical level lies at the weekly low at $12.59. Most likely the psychological round number at $12, and possible bargain hunters will keep XRP above this low. However, once the selling gets over this level, losses can extend very quickly to November’s lows in vicinity of $11.28. This area is protected by the monthly S1 pivot point at $11.13. On the fundamental side of things, XRP transaction metrics within the network are ageing when compared to other platforms, providing additional downside pressure.

The market structure is showing a descending triangle pattern with lower highs going back to October and $13.24 acting as the horizontal base. These formations typically break to the downside, unless bulls can orchestrate a solid recapture of the 20-day EMA and some continuation of volume. If the base fails, the measured move of the pattern takes us to $11.50 which conveniently lines up with the monthly S1 pivot level where institutions algos like to fill bids.

Bears Control Near-Term Trajectory Below $13.71

The bulls need to push the price above the 20-day EMA at $13.71 and the immediate resistance at $14.69. If successful, a relief rally to $15.04 is likely. A breakout of this level may start a new uptrend. The first target on the upside is $20 and then $25. The 20-day EMA is flattening out and the RSI is just above 40, which suggests that the selling pressure has reduced. This positive view will be invalidated if the ETC turns down from the current levels or the overhead resistance and plummets below $11.50.

If the actual situation in which the precious bond between the two people dies, the circumstances could be worse, creepier, and more dangerous. But, it’s good to remember that the beam of trust and love exists in the happy relationship and deteriorates and dies in the unhealthy one.

Based on the technical setup and underlying headwinds of unfavorable network comparisons, the most likely short-term direction is that ETC will continue to grind within a range of $12.59 and $13.71. Price doesn’t have any reason to shift momentum; therefore, the downside is expected to be the path of the least resistance as the price consolidation drags on. Bulls will have to be patient and wait for a more defined basing formation to appear on the charts. This $1.12 range can be played by range traders.