Aave Tests Critical Support as MegaETH Deployment Sparks Hope for Recovery

Market Structure Shifts Lower

- Implementation proposal for MegaETH hasn’t turned the tide on Aave’s fortunes

- Aave’s price dropped approximately 14.7% over the past week

- The $195 technical support level has held since November

The implementation proposal for MegaETH has been making headlines, but it hasn’t managed to turn the tide on Aave’s fortunes, as it dropped approximately 14.7% over the past week. As its center of technical support is being tested, the $195 level has kept the market afloat since November.

Aave continued to implement its deployment on chains that have shown consistent activity and long-term community engagement while its scaling solution will expand the protocol to the MegaETH ecosystem. The proposed V3 implementation is intended to upgrade the protocol with a series of cool new features designed to improve cost efficiency for users. As awaiting increased exposure by a Layer 2 scaling solution in the coming weeks, the next iteration from the most popular DeFi lending platform on Layer 1 will surprisingly revisit the newly-released Layer 1 games. It appears obvious from the Leaning Into stables report that Aave never anticipated the weakness seen in Layer 1 competition over the past year.

| Metric | Value |

|---|---|

| Asset | AAVE (AAVE) |

| Current Price | $195.07 |

| Weekly Performance | -1.43% |

| Monthly Performance | -14.68% |

| RSI (Relative Strength Index) | 52.9 |

| ADX (Average Directional Index) | 18.1 |

| MACD (MACD Level) | 0.73 |

| CCI (Commodity Channel Index, 20-period) | 75.90 |

RSI Hovers at Neutral 50 – Room for Movement in Either Direction

The slow stochastics continue to flash caution, notably as the last three breakdowns from the cross of the bull range have culminated in local price tops. Encouragingly, any pullbacks for bullish breakeven trades are now in the money, which often reduces selling pressure on rallies. The 12 and 26 RSI on the daily MACD is also catching back down to the 9, which may form a new bull cross next week if prices stabilize. Awaiting this confirmation is often the safer route for bulls, although waiting for the 5- and 10-day moving averages to depart is often too late to board the next rally.

What is interesting is how RSI has reacted during comparable neutral crossings in September and October – on both occasions, it was trailed by a 20-30% directional move over two weeks. Fundamentally, this time around things are different: Aave Labs’ proposal to deploy V3 onto MegaETH is a first-mover opportunity that could serve as rocket fuel to jump start DeFi lending on an entirely new chain. For swing traders, this neutral momentum reading with positive drivers indicates patience over urgency – let RSI resolve directionally over 55 or under 45 before putting some risk to work.

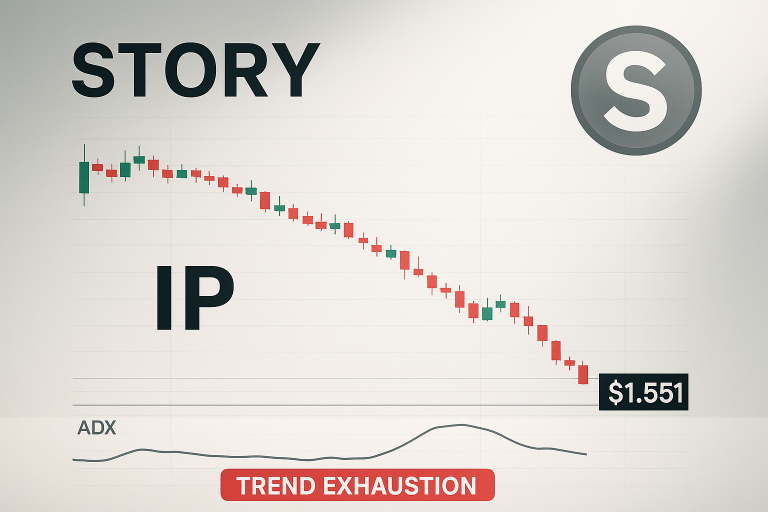

ADX at 18.13 Confirms Choppy Conditions Dominate

The strength of the trend continues to be significantly weak with the ADX reading just 18.13 which is well below the 25 level that would generally suggest conviction in the direction of the trend. This merely reflects the sideways grinding price action of the last three weeks as AAVE essentially oscillated between $195 support and $220 resistance failing to develop a trend. The reported strategy adjustment of focusing on the core chains over the past week hasn’t yet resulted in a trending market, so we must assume we are in the process of accumulation or distribution.

Simply put, the average directional index (ADX) measures the strength of a trend and above 25 is where a trend is usually considered to be strong, no matter if it is an uptrend or downtrend. When below 20 or ranging for a long period it shows a lack of a solid trend. If there’s no clear trend then the direction becomes irrelevant, you just trade the price action combined with areas of support and resistance.

20-Day EMA at $204 Becomes First Resistance Target

The moving average setup indicates a recent breakdown. The current price is below the entire short-term EMA ribbon. The 10-day stands at $191.68 has turned lower and the 20-day stands at $204.39 will be the first obstacle. However, the most important is the 50-day EMA at $229.89, which was lost during the last decline in December and now presents itself as resistance.

Bulls probably felt a bit relieved to see price rebound directly from the 200-day EMA around $187 during this week’s pullback, indicating that more entrenched owners continue to support this project. The organic driver necessary to test those overlying EMAs may come from the MegaETH injection that aims to “turbocharge” DeFi lending, although, from a technical standpoint, the 20-day EMA at $204 is the initial barrier that needs to be overcome. A reversal that lasts will require a close above this mark on the daily to flip momentum bullish again.

Support at $187 Meets 200-Day EMA in Crucial Confluence

There are multiple levels of resistance that the price needs to surpass in order to reach the recent highs. The first barrier is the weekly high of $208.36, followed by the December peak of $219.37 where a lot of sellers started selling. In between, we have the monthly pivot of $203.17, which blocked the increase in price twice last week before the price drop.

The good news is that the existing uptrend remains intact with no effective breaches of the higher lows, so this should merely be considered a pullback until proven otherwise. The solid recovery back above $200 now depends mostly on Bitcoin avoiding a dip under $6.5k and the stock market heading into a potential panic as well, with geopolitical tensions in Hong Kong and the Middle East weighing on investor sentiment.

The MegaETH creating new demand for AAVE will likely only expedite the decision process, and trading above the previous shoulder high in November. Should AAVE grind its way above $50, it faces very little resistance north of there and we would guess will see the long-overdue acceleration of its bull run.

Bulls Need Daily Close Above $204 to Shift Momentum

For the bears, a daily close below the November 22 low at $186 would be a decent signal to begin legging in more aggressively below $180. Since I don’t believe Meta is going back to $170 anytime soon (if ever), I will continue to operate within the $180-$170 trading range given the constructive framework on risk asset markets.

If the $187 level holds during any pullback, bulls remain in charge, raising odds for a rally back to resistance in the low $200s. A buying surge could finally yield a rally up to range resistance above $238 and into the mid-$200s.

With relative strength currently neutral, AAVE is at an inflection point for whether the consolidation results in a final drippy orgasm we entry or the proposal euphoria keeps the price well supported … and potentially even higher into the end of the year.