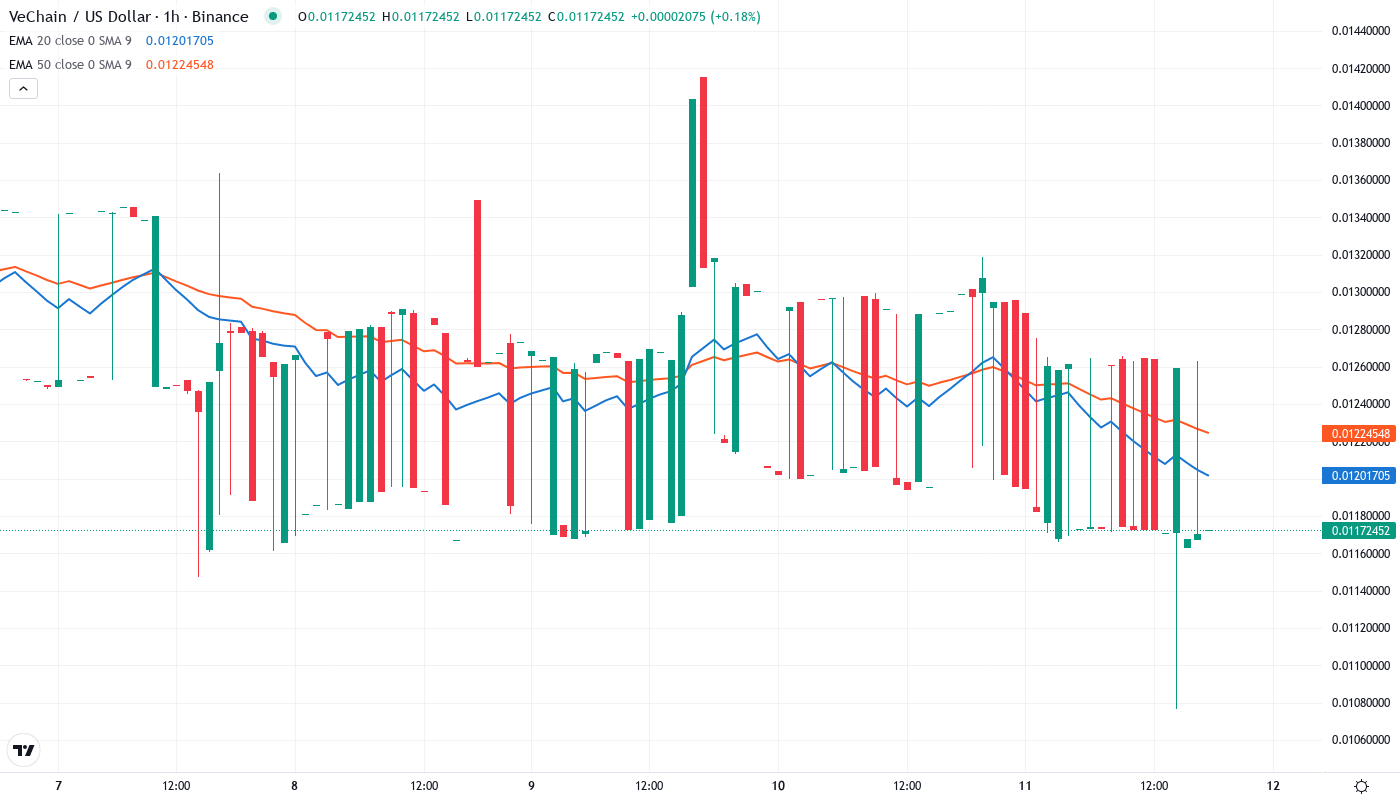

VeChain Tests Critical Support at $0.0117 as Hayabusa Mainnet Sparks Staking Revolution

Market Structure Shifts Lower

- VET plunges 35% monthly despite launching game-changing Hayabusa upgrade

- Coinbase COIN50 inclusion fails to arrest bearish momentum engulfing price

- Bulls defend $0.0117 support for sixth consecutive test since December

VeChain’s price action tells a story of two competing forces – revolutionary network upgrades colliding with devastating market weakness. The token shed 35% over the past month to $0.0117, erasing nearly 10% in just the last week alone, even as the Hayabusa mainnet went live with its complete overhaul of VET’s consensus mechanism and staking rewards. What’s particularly revealing is how the Coinbase COIN50 Index inclusion – typically a bullish catalyst – couldn’t stem the bleeding, suggesting sellers remain firmly in control despite fundamental improvements. The main question for traders is: can the $0.0117 support level hold through this perfect storm of positive developments meeting negative price action?

| Metric | Value |

|---|---|

| Asset | VECHAIN (VET) |

| Current Price | $0.01 |

| Weekly Performance | -9.97% |

| Monthly Performance | -34.93% |

| RSI (Relative Strength Index) | 34.9 |

| ADX (Average Directional Index) | 37.9 |

| MACD (MACD Level) | 0.00 |

| CCI (Commodity Channel Index, 20-period) | -173.70 |

RSI at 34.90 Signals Deep Oversold Territory – Matches November Capitulation

Reading the oscillator at 34.90, traders see VET entering oversold conditions not witnessed since November’s market-wide washout. The momentum exhaustion arrives precisely as the Hayabusa upgrade transforms VET from passive VTHO generation to an active staking model – a fundamental shift that typically attracts long-term holders but hasn’t sparked immediate buying pressure. Similar RSI configurations below 35 marked significant bottoms in August and November, both preceding 15-20% relief bounces within days.

So for swing traders, this oversold reading combined with major protocol changes creates a high-probability bounce setup, though the broader downtrend remains intact. The transition to staking-only rewards through Hayabusa essentially forces a supply shock as passive holders must now actively stake to earn – yet this bullish dynamic hasn’t reflected in price action, suggesting capitulation selling overrides fundamental improvements for now.

ADX Climbs to 37.93 – Trend Conviction Behind Bearish Move Intensifies

Trend strength readings paint a sobering picture with ADX surging to 37.93, confirming sellers aren’t just nudging price lower – they’re driving it down with conviction. Basically, when ADX crosses above 30 and approaches 40, it signals we’re in a mature trending phase where counter-trend trades become increasingly risky. The Hayabusa mainnet launch, which replaces authority nodes with a DPoS system, ironically coincided with this acceleration in selling pressure rather than providing the expected support.

To clarify, the ADX is indicating that despite game-changing network upgrades and Coinbase index inclusion, the bearish trend carries serious momentum that won’t reverse on fundamentals alone. Therefore, day traders should align with the trend rather than fight it – the combination of high ADX and oversold RSI often produces violent bear market rallies, but the primary trend remains down until ADX drops below 25 and price reclaims key moving averages.

20-Day EMA at $0.0132 Becomes First Major Resistance After Support Failure

Moving average structure reveals the depth of VET’s breakdown, with price now trapped below the entire EMA ribbon for the first time since October’s accumulation phase. The 10-day EMA at $0.0126 rejected recovery attempts twice this week, while the 20-day at $0.0132 looms as the first major resistance bulls must conquer. Most concerning for bulls – the 50-day EMA sits way up at $0.0150, representing a 28% climb just to reach intermediate-term trend resistance. What’s significant is how the Hayabusa upgrade’s shift to staking-only rewards hasn’t provided buying support at these moving averages. The 200-day EMA at $0.0207 remains distant at 76% above current levels, emphasizing how far VET has fallen from its longer-term trend. Bulls need to reclaim the 20-day EMA on volume to even begin discussing trend reversal – until then, each EMA above acts as resistance likely to cap rallies.

$0.0117 Support Holds Through Six Tests as Hayabusa Changes Game Rules

Support architecture shows surprising resilience at $0.0117, where buyers emerged six times since mid-December despite the overwhelming bearish pressure.

This level gains additional significance as it coincides with the Hayabusa mainnet activation – essentially marking where the market values VET under its new staking-only economic model versus the old passive generation system.

Above current levels, resistance stacks heavy between $0.0126 (10-day EMA) and $0.0138 (January’s breakdown point), with the psychological $0.015 level representing a 28% climb that would likely attract heavy selling. The monthly pivot at $0.0179 sits even further out of reach, requiring a 53% surge to challenge – illustrating how deeply oversold VET has become.

Market structure suggests accumulation beginning at these levels, particularly as Hayabusa forces passive holders to either stake or sell. The elimination of passive VTHO generation creates a binary choice that could reduce floating supply significantly once the initial selling wave exhausts. However, until price convincingly breaks above $0.0132 on volume, the bear trend technically remains intact despite this fundamental supply shock building beneath the surface.

Bulls Require Decisive Close Above $0.0132 to Shift Momentum

Bulls must engineer a daily close above the 20-day EMA at $0.0132 to signal even a basic trend shift, with follow-through above $0.0138 needed to confirm buyers regained control. The combination of Coinbase COIN50 inclusion and Hayabusa’s staking revolution provides fundamental catalysts, but price needs to reflect this bullish divergence between news and technicals.

Bearish continuation triggers if VET loses $0.0117 support on volume, opening an air pocket down to $0.0106 (December low) with little to halt the slide. A breakdown here would trap recent bottom-fishers betting on the Hayabusa upgrade, likely accelerating selling toward the psychological $0.01 level where serious accumulation historically occurs.

Given the extreme oversold conditions, high ADX reading, and game-changing fundamental shifts, the most probable near-term path sees VET mounting a relief rally toward $0.0126-$0.0132 resistance before sellers reassert control. The Hayabusa transition period creates unique volatility as the market reprices VET under its new economic model – patient accumulation at these levels offers the best risk-reward for investors believing in the protocol’s long-term vision.