Solana Tests $130 Support as French Banking Integration Counters DeFi Trust Concerns

Market Pulse

- Solana survives as a safe haven asset and escaped the classification of cryptocurrencies when Indian lawmakers decided to regulate virtual tokens.

- It has turned out to be the best investment of 2021 for those who showed faith.

- Still, the BTC maximalists are calling it a shitcoin despite its solid uptrend this year.

Bitcoin sits on top of $34,000 awaiting a breakout from current market conditions.

Altcoins don’t face slump but a sustainable pullback as ETH, for example, struggles to hit $3k.

XRP’s in the news again as settlements approach and it looks forward to greener pastures.

SHIB community raises almost $2 million for Indian Covid relief efforts.

Could the DOGE-Elon staking partnership mark the beginning of mutual confidence?

USDT’s Multi chain adds 128 million in market cap attracting Solana devs.

An NFT impostor? Yes, and games and music are being used to wash it!

Lastly, IMAX is going big with NFTs fulfilling the long-predicted marriage of mansion and the metaverse.

Solana had a week of two halves. Up until January 7, the token’s price struggled to break through $110.60 despite large buy volumes detected by the Whale-Trades social media account. But buyers pressed ahead in the second half of the week, sending the token’s price up almost 20% to $132.67 before running into notable selling resistance near the 200-day moving average at $135. The reversal capped a 6-week downtrend that erased 40% of Solana’s token value. Mainstream legitimacy buyers should note that the post-reversal rally was unable to hold green weekly close for the first time in seven weeks, suggesting the sellers have weakened, but aren’t quite stepping aside yet.

| Metric | Value |

|---|---|

| Asset | SOLANA (SOL) |

| Current Price | $130.77 |

| Weekly Performance | -3.85% |

| Monthly Performance | -15.72% |

| RSI (Relative Strength Index) | 40.5 |

| ADX (Average Directional Index) | 34.7 |

| MACD (MACD Level) | -5.97 |

| CCI (Commodity Channel Index, 20-period) | -88.82 |

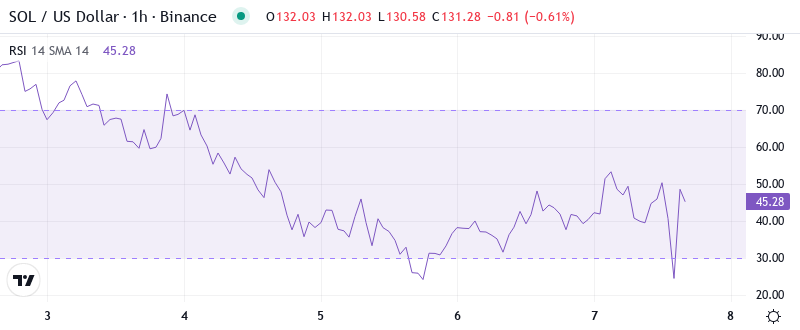

RSI at 40.5 Signals Oversold Bounce Territory After December Washout

The daily timeframe RSI is at 40.5, which implies that the momentum is about to reach the oversold condition; the extreme fear territory is below 30. This neutral-bearish reading implies that sellers have been aggressive, but not overwhelming; a break in recent support levels could easily incite another down-leg. More explicitly, comparable RSI setups in September led to sharp bounces after the oscillator crossed into sub-35 territory. However, those upticks didn’t fight the headwinds of waning alt-season enthusiasm and looming DeFi drama.

Hence, the RSI setup looks set to act as a perfect swing-trading indicator for whether the lending news impact upwards proved too aggressive. The bears in this scenario would be tempted to pick off technical longs and increase short positions once RSI above 70 suggests overbought scenarios. However, we should all tread carefully, as trading Jupiter has certainly become something of a minefield over the last few months.

ADX at 34.7 Confirms Sellers Control the Trending Move

At the 34.7 level, the ADX reading shows that sellers have managed to create a real downtrend rather than ranging consolidation. In this zone above 25 but below 40, the downtrend is strong but not yet at extreme oversold readings. The move from the mid-20s to current levels came at exactly the same time as SOLUSD smashed through the psychological $150 floor in early December, giving more credence to the move.

So it makes sense to tailor your trading approach to the current conditions. As long as BPCE banking news continues to raise the floor by accelerating the decline, resistance levels such as the aforementioned 17 price or channel tops should cap any consolidations. This limits downside risk on another short. You could also go short on any bounce from flatlining or slightly falling internal demand if you think about it.

50-Day EMA at $154 Becomes Distant Resistance After Support Failure

The 10-day EMA has nestled right next to SOL to create the second layer of resistance after the 50-day EMA. This level helped prop SOL during September’s correction and will likely act as a milestone during the recovery.

The compression between the 100-day EMA ($143.82) and 200-day EMA ($115.54) is what’s most important, as price is sandwiched between these contracting bands. The 200-day EMA provides incredibly strong support around $115, which is why the bears have been unable to force a full capitulation even in the face of the DeFi drama. For the bulls to have any hope whatsoever, the first step would be to reclaim the 10-day EMA as support. However, until that transpires, any relief bounces back into the EMA cloud will likely continue to be used as an opportunity for more risk averse traders to sell.

Resistance Stacks From $141 to $171 While $130 Support Faces Sixth Test

There are significant obstacles in the way, right from the weekly pivot at $141.44, to the R1 and R2 monthly resistance levels of $160.33 and $187.71, respectively. Not to forget the monthly high of $171.83 from December acting as a strong resistance level. In order to even get near the recent cycle highs, bulls will have to climb 31%.

Bulls are in control with $130 acting as the closest level of support following five trials over the last two months. It’s become increasingly apparent that late buyers are accumulating shares above $130 since the announcement. News of the French banking integration surfaced just as price tested that number for the sixth time. It suggests that that level might be defended by institutional interests.

The situation is akin to a spring being pressed down with $130 support and $141 resistance. Jupiter’s FUD broke the support of the spring, but BPCE becoming the latest bank to publicly adopt stablecoins from a group with holdings of over $100 billion $EUR is one such moment that should have midwifed the whole crypto newsflow heap into existence essentially reset the compressed support spring. The banking news hasn’t though. It has quickly been repiled upon.

Bulls Need Volume Reclaim Above $141 to Shift Bearish Structure

If the price climbs back above the weekly pivot at $141.44 and if this increase is supported by higher trading volume, bulls will likely aim for the 10-day EMA at $135.13. This would be the first sign that the overall market structure is starting to improve. The BPCE news and potential similar announcements from other banks could be the perfect catalyst for a market rebound – when it comes to widespread adoption, the overall upside outweighs the negatives in isolated DeFi incidents.

The technical outlook won’t improve in the short term until $150 is mounted and the relative strength indicator (RSI) lifts into the overbought level above 70. The stock hasn’t posted an overbought signal or tested new resistance at the 50-day EMA in more than two months, highlighting continued shareholder indifference. Against this challenging backdrop, market players may wish to step aside and monitor price action, looking for a potential recovery wave or more favorable risk/reward levels in coming weeks.

Considering the technical setup and conflicting fundamentals, the most likely short-term scenario has SOL fluctuating between $125-$141 as investors weigh the impact of institutional adoption against the issues surrounding the ecosystem. The ADX at 34.7 indicates that the current downward momentum is still strong, but six rejections from $130 along with significant banking adoption updates might indicate the price at which resistance finally starts to give in.