Bitcoin Tests Critical Support at $90K as Whales Accumulate 47,584 BTC

Market Structure Shifts Higher

- Bitcoin’s price fell early on Thursday, dropping 2.8% over the past 24 hours to about $88,229 as of 8:30am UTC.

- It tested the psychological support at the $90K level on the 4-hour chart.

- The RSI flashed oversold conditions, suggesting the retreat may be overdone.

The steady ascent from the mid-December low of $47,278 remains intact.

Bitcoin has had a rough time since reaching its all-time high of $69,000 in November. The minutes of the Federal Reserve’s November policy meeting showed that officials were likely to hike rates in a more aggressive manner amid inflation concerns, which are usually bad news for risk-on assets like cryptocurrencies. Fast forward to last week and Bitcoin finally rallied above $60,000 after news that US senators had reached a deal on crypto tax language as part of a broad infrastructure bill. Does this mean Bitcoin has finally broken out of the $51-60k range, or are technical indicators hinting at another retest of support?

| Metric | Value |

|---|---|

| Asset | BITCOIN (BTC) |

| Current Price | $89808.02 |

| Weekly Performance | -1.26% |

| Monthly Performance | -13.55% |

| RSI (Relative Strength Index) | 43.2 |

| ADX (Average Directional Index) | 31.6 |

| MACD (MACD Level) | -2399.48 |

| CCI (Commodity Channel Index, 20-period) | 4.09 |

RSI Cools to 43.17 Without Hitting Oversold – Room for Bears to Push

The relative strength index (RSI) was sitting at 43.17 on the daily timeframe, having dropped from overbought readings above 70 in early December but notably managed to avoid the sub-30 capitulation zone. This measured retreat was indicative of profit-taking rather than panic selling, with the oscillator settling in the lower-neutral territory where both the up- or downtrend are still possible.

If we compare this RSI setup with previous examples, the late September dip into the low 40s allowed further downside before the indicator bottomed and XRP ripped to the upside. Presently, the RSI has room to the downside before reaching oversold territory. However, the fact that we haven’t seen extreme bearish momentum in light of a 16% pullback suggests that the XRP accumulated by whales during December acts as a buffer. For swing traders, this balanced yet slightly to the downside RSI suggests going short with a break of 40 and covering longs with a reclaim of 50.

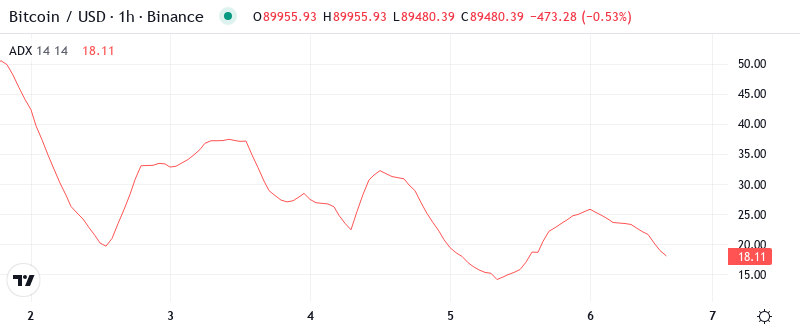

ADX at 31.6 Shows Bears Control Direction but Trend Losing Steam

With an ADX reading of 31.6, it confirms trending conditions, despite recent volatility. That said, the indicator has cooled off from its earlier over-40 readings. At current levels, the strength of the trend is such that directional plays are to be favored over range-bound ones, and at the moment bears are in the driver’s seat with price below all the important moving averages.

What is interesting to note is that ADX has held up through the multi-week pullback which implies this is not just random whipsaw but a methodical pullback within the context of a broader trend. Bitcoin is now in a post-QT world and with the recent announcement of Portal’s atomic OTC desk, institutions are now able to gobble up coins on the cheap without immediately marking down the markets. As such, day traders should adjust to this trend-some-but-getting-stronger environment by reducing their positional size and letting the bearish trend be the boss until ADX goes sub 25 or we recapture the 50-day exponential.

50-Day EMA at $97,778 Becomes Key Resistance After Support Failure

Price action essentially shows what is happening in the market and what has already happened. In the current scenario, Bitcoin is indicating a negative sentiment overall.

The most important point for the bears is the cross of the 100 and 200 EMAs, which has never failed to produce a substantial burst of volatility. This time, the 200-day is giving way above $100,000 for the first time in BTC’s history. So, it’s still kind of “bearish flippening” in the sense that the trend is down while the price action is below each of those supports. In addition to the two daily EMAs/ MAs, there’s plenty of reference for the bulls to carry over the bearish momentum.

Resistance Wall Builds From $93K to $98K as Former Support Flips

There are several resistance levels positioned above the present price. The first hurdle is the daily pivot $93,983, followed by the 20-day EMA at $91,721 and the weekly pivot $93,961. The significant resistance is at $97,778 where the 50-day EMA meets the weekly R1 at $97,657. This resistance blocked the recovery attempts in late December.

Buyers are stepping in to defend the weekly pivot at $92,206, and below that, the weekly S1 is at $85,365. A daily close below $90K suggests short-term trend exhaustion, with $81,694 and $74,781 as the next levels down. A close above the weekly pivot at $103,864 sees $120,000.

This market structure is the textbook correction within an uptrend. Painful enough to shake out the leveraged longs yet not deep enough to invalidate the greater bull market thesis. The 47,584 BTC added by whales during December’s downtrend while retail was capitulating says it all re: SM’s view on these levels.

Bulls Need Convincing Close Above $94K to Reclaim Near-Term Control

If price reclaims the daily pivot at $93,983 and maintains above it on a daily closing basis, bulls can look to the 20-day EMA at $91,721 as the subsequent inflection point en route to the vital $97,778 resistance zone. The atomic OTC desk going live on Portal, along with ongoing post-QT liquidity injection, represents fundamental drivers that may support an upside revival should technical setup warrant one.

If prices breach that key moving average around $86K to the $87K zone, the most obvious target would become the monthly S2 at $71,526. To avoid this scenario, price simply holds the $89,808 support and turns $90K into support on the lower timeframes too.

Based on the current setup and whale holdings plus bad news exhaustion, the probable medium-term outcome is for Bitcoin to oscillate in a higher range with an $85K-$110K midpoint until late-1Q. This range won’t tighten for a few more weeks as volatility only slowly decreases on price upswings.