Bitcoin Darts Past $89K as Paraguay Registration Rules Meet Oversold Bounce

Market Structure Shifts Higher

- Bitcoin’s price recovery momentum is gearing up for a solid charge towards reclaiming $100,000 with the short-term trend reversing yesterday’s minor losses.

- Paraguay’s new guidelines requiring mining firms to seek an operating license are seen as adding the kind of regulatory clarity the industry has wanted for some time.

- Bitcoin proved to be a strong asset as any weekly close above $89,540 will further validate the robust support.

The price of Bitcoin this week bounced back above $89,540 after falling to around $80,522 on the month. This recovery happened at the same time that Paraguay announced it shall require all Bitcoin miners to register, a move that could quash speculation while increase confidence in regulated markets. The big question for you: do you believe this over-sold bounce can turn into a real overall trend change or will sellers be triggered at the first significant resistance area of $100k?

| Metric | Value |

|---|---|

| Asset | BITCOIN (BTC) |

| Current Price | $89540.75 |

| Weekly Performance | -1.56% |

| Monthly Performance | -13.80% |

| RSI (Relative Strength Index) | 42.6 |

| ADX (Average Directional Index) | 31.6 |

| MACD (MACD Level) | -2420.80 |

| CCI (Commodity Channel Index, 20-period) | -2.29 |

RSI Climbs From 42.59 Oversold Reading – First Time Since October

The oscillator is about to cross above its second standard deviation band while threatening to break the seven-month falling trendline. A weekly close above October’s high would also mark a weekly key reversal, putting more technical traders on alert. Additionally, the position among near-term CBOT call writers positions Alcoa as the sixth least loved stock in the options market, which should continue to provide a solid support buffer.

Therefore, swing traders can seek confirmation by demanding a break of Friday’s high to establish that a short-term bottom is in place. A close above the two-hour 10-period moving average (10 MA) would also be encouraging. Relatively low volume indicates a potential test of these lows so be prepared… The discount-to-NET ratio started at 14.3% but after the significant loss of value, Bitcoin ended the week at 14.6%. This implies the discount is widening which should definitely be on your radar.

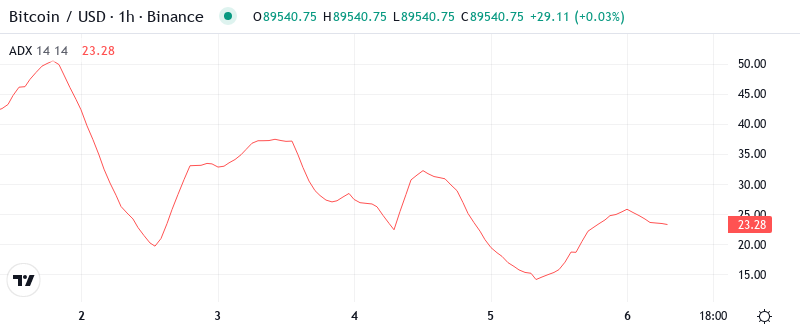

ADX at 31.63 Signals Mature Downtrend Losing Steam

Trend strength indicators show an interesting situation, as ADX has dropped to 31.63 from levels above 35 last week. We have a mature downtrend that is starting to lose its directional determination. The higher ADX showed that the recent selloff was a real force – it was not just profit taking but a real trend that saw almost 14% sliced off the December top.

What is interesting to note is how ADX has stayed above 30 even after the oversold rally. In simple words, we haven’t moved into a choppy market yet, but we are in a transition stage where the downtrend is losing its power but hasn’t let go completely. So day trading folks, be ready for some action as the battle of tired sellers and new buyers emerges around the key moving average clusters.

20-Day EMA at $91,696 Becomes First Major Resistance Test

If the bears step in again and push Bitcoin lower, solid support can be expected at the $88,525 level. This is followed by the 200-day EMA at $86,263. The RSI has managed to climb back into bullish territory above 60, indicating that buyers are still interested. However, the failure of the RSI to follow through and reach overbought territories is a worrying sign. Buyers need to maintain the initiative to prevent a potential turn lower.

The price movement in December indicates that these averages changed their roles from support to resistance as Bitcoin failed to hold onto the critical $95K level. The previously mentioned support zone of $93,827-$97,768 now turns into a red zone that bears will defend. The 200-day EMA presents as a solid support at $65,529, or some 27% beneath the current price level, underlining how overextended this bull cycle was before capitulating. Bulls will have to recapture the 50-day EMA.

Resistance Clusters Between $97,577 Monthly Pivot and $103,142 Prior Support

Sellers have placed numerous resistance levels above the current price, which are also important from a technical and a sentiment perspective. First, the monthly pivot is at $97,577, slightly above the 100-day EMA. Second, and more importantly, will be the breakdown level from December at $103,142. This level was support for two months and then turned into resistance after the Christmas week dump.

Importantly, the market structure resemgests a coiled spring between $81,694 support and $97,577 resistance. This $15,883 range (about 18%) gives traders clear walls to work with while the market consolidates December’s 20% correction. nervestrading off an important structural area that is likely to induce volatility signals the end of accumulation and the beginning of distribution. Compression between falling resistance and rising support generally resolves in a 15%- to 20% directional move which would put targets around $75,000 on the downside or $108,000 on the upside.

Bulls Require Daily Close Above $93,827 to Confirm Trend Reversal

If Bitcoin can recover the 50-day EMA at $93,827, the door opens to a retest of the psychological $100,000 region. Bulls need to establish a daily close above this EMA as well as alleviate recession concerns in light of The Kobeissi Letter indicators, else risk-off flows could limit the upside. A reclaim of $97,577 on a daily closing basis would turn the focus to the December breakdown level at $103,142.

If the price of bitcoin is unable to find support at the 20-day EMA ($91,696) and instead dips below this week’s low of $81,694, the bearish case will come into play. In that case, long liquidation could gather pace, pushing the digital currency towards the monthly S3 support at $76,947, down 14%.

If fears of a recession gain ground, an even deeper fall could unfold as investors exit risky assets.

The oversold bounce we expected played out last week, and the strength of the bounce implies the market is not through consolidating yet. The bounce reached resistance exactly where we expected it would, at the 20-week and 21-week moving averages, which caught the top of the price action in the recent consolidation.