APT Plunges 28% as Token Unlock Fears Overshadow Ecosystem Wins

Market Pulse

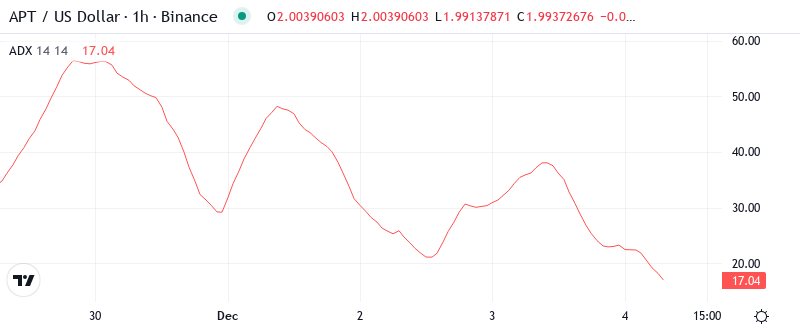

- APT tumbles to $1.99, erasing over a quarter of its value in just one week

- Stablecoin launches fail to offset anxiety around $1.8B December token unlock

- Technical structure deteriorates with price trapped below entire EMA cloud

Aptos (APT) has been hammered this week, shedding 28.2% to trade at $1.99 as the looming December token unlock casts a long shadow over the ecosystem’s positive developments. The devastating drop comes despite bullish catalysts like Paxos launching USDG0 on the platform and CreatorFi securing $2M in strategic backing – clear evidence that when supply fears dominate, even strong fundamentals can’t hold the line. The main question for traders is: will the technical carnage continue as December approaches, or can oversold conditions spark a relief bounce?

| Metric | Value |

|---|---|

| Asset | APTOS (APT) |

| Current Price | $1.99 |

| Weekly Performance | -11.99% |

| Monthly Performance | -28.23% |

| RSI (Relative Strength Index) | 29.8 |

| ADX (Average Directional Index) | 46.9 |

| MACD (MACD Level) | -0.29 |

| CCI (Commodity Channel Index, 20-period) | -82.14 |

RSI at 29.77 Signals First Capitulation Since Spring

Reading the oscillator at 29.77, traders see APT in deeply oversold territory for the first time in months. This capitulation-level reading typically marks emotional exhaustion among sellers, though it doesn’t guarantee an immediate reversal. Similar RSI configurations in March and August preceded sharp bounces of 15-20%, but those occurred without the headwind of a massive token unlock hanging over the market.

What’s revealing is how rapidly momentum collapsed – RSI plunged from neutral readings above 50 just two weeks ago straight into oversold conditions. So for swing traders, this extreme reading suggests a technical bounce could emerge, but any rally will likely face heavy resistance from investors looking to exit before the December supply shock. The unlock timeline essentially caps upside potential until that overhang clears.

ADX Climbs to 46.94 – Sellers Control With Conviction

Trend strength exploded higher with ADX surging to 46.94, marking one of the strongest directional moves in APT’s recent history. At these levels, the indicator screams that this isn’t just profit-taking – it’s a full-blown trending market with sellers in complete control. The move from sub-20 readings to nearly 47 happened in less than two weeks, matching the velocity seen during previous major washouts.

Basically, when ADX reads above 40, it tells day traders to abandon mean-reversion strategies and ride the prevailing trend. The combination of extreme trend strength and oversold momentum creates a paradox – powerful selling pressure meeting exhausted conditions. To clarify, this setup often leads to violent snapback rallies followed by continuation lower, making tight stop-losses essential for anyone attempting to catch a bounce.

Price Trapped Below Entire EMA Ribbon Since Break

The moving average structure paints a grim picture with APT trading below every significant EMA. Price sits beneath the 10-day ($2.11), 20-day ($2.33), 50-day ($2.52), and 100-day ($2.85) exponential moving averages, forming a descending staircase of resistance overhead. Most telling is how the 20-day EMA at $2.33 rejected recovery attempts twice this week – that level changed from being a launchpad to a ceiling.

This complete breakdown of the EMA structure mirrors the configuration seen before APT’s previous 40% declines. The 50-day EMA at $2.52 now represents the critical level bulls must reclaim to even begin discussing trend reversal. Until then, every bounce into the EMA cloud between $2.11-2.33 offers short sellers a low-risk entry point, especially with the token unlock narrative providing fundamental justification for continued pressure.

Resistance Stacks Heavy From $2.11 to Former Support at $2.52

Above current levels, sellers have fortified multiple resistance zones that coincide with both technical levels and psychological barriers. The immediate resistance sits at $2.11 where the 10-day EMA converges with intraday pivot points, followed by the more substantial barrier at $2.33 (20-day EMA and former support). The weekly pivot at $2.46 adds another layer before reaching the crucial $2.52 zone where the 50-day EMA meets December’s breakdown point.

Bulls now guard the $1.82 support level where APT found buyers during August’s washout – this represents the final defense before opening an air pocket toward $1.50. The monthly low at $1.82 has been tested once already, with buyers stepping in aggressively enough to spark a 10% intraday bounce. However, volume on that bounce remained below average, suggesting more of a technical oversold bounce than genuine accumulation.

The market structure signals that sellers remain in control as long as price stays below $2.33. Each resistance level above represents trapped longs from the past two weeks who will likely sell any rally attempts. This creates a self-reinforcing dynamic where technical resistance aligns with fundamental concerns about the token unlock, making sustained recoveries extremely difficult until December’s supply event passes.

Token Unlock Shadow Demands Patience From Bulls

Bulls require a decisive daily close above $2.33 to neutralize immediate selling pressure and open a path toward $2.52. Even then, the looming December unlock of $1.8B in tokens acts as a ceiling on any rally attempts – institutional buyers will likely wait for that supply to hit the market before accumulating. The introduction of USDG0 and CreatorFi’s launch provide long-term catalysts but can’t overcome near-term supply dynamics.

The bearish scenario accelerates if APT loses $1.82 support on volume, which would trigger stop-losses from this week’s knife-catchers and open a direct path to $1.50. That psychological level represents a 25% additional decline from current prices and would likely mark maximum panic before the token unlock. Any rejection at $2.11-2.33 resistance that pushes price back below $1.95 confirms sellers remain firmly in control.

Given the technical damage and fundamental overhang, the most probable path sees APT chopping between $1.82-2.11 over the coming weeks as traders position ahead of December’s unlock. Sharp oversold bounces will meet equally sharp selling at resistance levels, creating a volatile but ultimately range-bound environment until the supply shock either materializes or proves less severe than feared.