Bitcoin Cash Surpasses $587 as Bulls Guard Higher Lows With Conviction

Market Structure Shifts Higher

- Bitcoin Cash surged 52.37% in one month following a fraudulent 10-block reorganization and security sell-off.

- BCH found demand at the daily 200 SMA on a closing basis and has rallied 111.2% since the October lows.

- Bulls have filled the overnight RBE and face daily closing resistance at the $528 psychological level.

Bitcoin Cash has risen by 52.37% in just one month. This spike comes after a month-long security sell-off following the fraudulent 10-block reorganization that plagued the network back in late October. The incident caused BCH to drop down a bearish overnight rally base extension (RBE) from $655 to $250 before finally rising again. However, despite this selloff, BCH managed to find demand from the daily 200 simple moving average (SMA) on the closing basis and rally up 111.2% since.

The current price action suggests the bulls are looking to form higher lows for their attempt to shift the midterm term trend from down to up. Bulls currently appear to have completely filled the overnight RBE, with daily closing resistance presented at the $528 psychological level.

One of the most powerful non-biased and non-lagging trend detection tools used by traders is the ADX (average directional index). At an average value of 18.61 printed over the last 5 days, the consolidation phase looks to be coming to an end and trend followers should prepare for the next directional move.

Bitcoin Cash has started a fresh upside wave, rising from the monthly low of $394 to the recent high of $587, a monthly gain of 52.37%, which is one of the most powerful recoveries of the year. The Web3 hackings of October, which caused more than $45.8M in BCH losses, dented sentiment at first, but when the dust had settled, enough whales cleaned up cheap BCH to actually turn the floor of that eventful downtrend into a launch-pad for the prevailing rally. The critical question for bulls is whether the asset can hold the upside over the newly-reclaimed $528 support, or whether profit-taking will kick in as the exchange rate comes within creation of the $600 psychological resistance.

| Metric | Value |

|---|---|

| Asset | BITCOIN CASH (BCH) |

| Current Price | $587.11 |

| Weekly Performance | 11.31% |

| Monthly Performance | 9.39% |

| RSI (Relative Strength Index) | 60.7 |

| ADX (Average Directional Index) | 18.6 |

| MACD (MACD Level) | 10.62 |

| CCI (Commodity Channel Index, 20-period) | 151.46 |

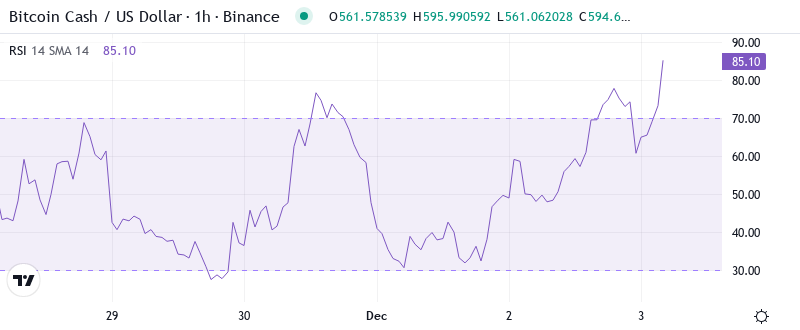

Momentum Resets to 54.31 After Testing Overbought Territory

The relative strength index (RSI) on the daily timeframe is currently standing at 54.31, indicating some levels of momentum after reversing from the overbought mark at 74.70 during the first week of December. A reading above 70 indicates overbought conditions.

What is interesting to note is the action of RSI during the security-led October decline as it hardly went below 30 in spite of the extremely negative news, which suggested that sellers did not have real strong hands even in those depths. Hence, for swing traders, this neutral RSI implies that the attempts of the upside are still in order as long as the reading stays above 50 making it quite probable that 70+ levels might be needed before a concrete phase of distribution pushes.

ADX at 18.61 Signals Choppy Conditions Giving Way to Trend

When we turn our attention to horizontal swing high resistance at the $381 level, we can consider the 61.8% retracement level which comes in at $415.20 a realistic bullish target should a breakout occur. A key takeaway was the above-average volume during the December 2 trading session as a mix of short-covering and new buyers likely fueled the move higher. This could generate additional momentum when BCH inevitably makes its next decision.

As the ADX rose from single digits in the aftermath of the October rout to current levels, the market has shifted from panic to a more ordered kind of accumulation. What the ADX is telling us is that we are moving from edge to edge with a chance of getting into a trending environment – when this indicator crosses above 25, both volatility and trend direction will likely become more evident. So, day traders will want to fine-tune their strategies and start planning to switch from range-bound plays to trend-following trades.

50-Day EMA at $484 Transforms From Resistance to Bull Defense

The BCH price action gives no other choice than to assume a bullish bias until there is evidence to the contrary. Community sentiment turned bearish in the lead-up to the security incident as the price collapsed but traders pounced on the vulnerability for a quick profit, even though none of them believed BCH was still a viable project.

The ‘toxic’ altcoin community hell-bent on BCH’s demise tried to bring it down to zero on the news which only motivated others to buy the discounted victim. A notable feature is how close the 10-day and 20-day EMAs are to each other, just $10 apart – in fact, this is the closest they’ve been since that low-volatility pre-rally structure in early November. The previous resistance zone turned support of $528-$532 presents an obvious red line for bulls, while the memory of the 100-day EMA acting as a trampoline for prices following October’s fear-driven “account security” dump may reinforce their position. There appears to be enough demand to underpin current levels.

Resistance Stacks Between $590 and $639 While Bulls Defend $528

There are sellers above the current price as they have clustered their orders in the immediate resistance area between $590 and December’s high of $639. The monthly R1 pivot at $590.27 and psychological round figures form a resistance wall. The panic sell-off during the security breaches in October formed this resistance since the same panic will have forced many longs to cover costs at the start.

Bulls are protecting several support levels below, with $528-$532 serving as the critical short-term floor after six holds. The $467-$469 zone (monthly pivot) holds stronger support in BCH markets if any fluctuations on Mt. Gox Bitcoins get too noisy.

The price has so far followed our base-case scenario by consolidating quietly above $528. A decisive breakout looks imminent, with the triangle constricting and moving averages continuing to rise steadily beneath the price. Key resistance remains around the $600 psychological level, where the 100-day and 200-day moving averages also converge.

Bulls Need Volume Above $590 to Target $639 December Highs

If the price manages to rise above $590 and demonstrate a retest of this level without dropping below it again, bulls will likely aim for the peak price in December at $639, supported by the overall recovery of the cryptocurrency market. Additionally, the settlement of Mt. Gox creditor issues in 2026 will eliminate one major long-term pressure that has affected the entire Bitcoin family, including BCH.

If BCH does exhibit renewed relative strength and recapture more significant support in the high $500s that includes the 100-day moving average and daily Ichimoku Cloud, the $640-$650 zone and $712 would be the initial upside targets.

Based on current conditions and an enhanced on-chain performance, BCH is likely to consolidate between $528-$590 and push up towards $639 in the short term.